Smartphone sales plummet 10 per cent globally; Apple’s Australian market share drops

Smartphone sales have dropped 10 per cent globally; in Australia, Apple’s market share has taken a hit.

Smartphone sales have plugged dramatically around the world on the back of component shortages, inflation and declining consumer confidence.

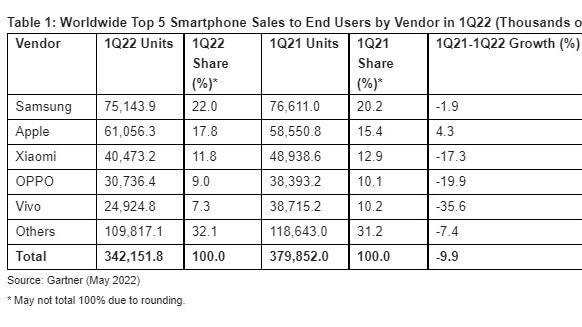

Figures released by technology market analyst firm Gartner show a massive 10 per cent drop in unit sales in the first three months of this year compared to Q1 2021.

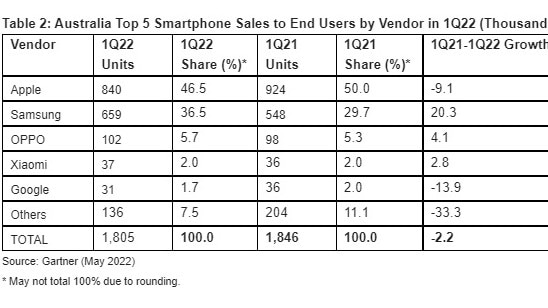

However the figures, released by Garner, show a milder 2 per cent decline with Australia.

“A number of factors including delayed product launches due to ongoing component shortages, rising inflation and poor consumer confidence led to a market decline in the first quarter of 2022, senior director analyst at Gartner Anshul Gupta said.

Gartner found that 5G adoption is yet to pick up pace in many emerging markets with 5G phone sales building from 547 million in 2021 with projected sales this year of 805 million.

Regionally, the US smartphone market fared better than other countries, owing to a larger Apple iOS user base who opted for device upgrades.

South Korea and greater China recorded a sharp decline in smartphone sales in 1Q22 as buyers delayed upgrades amid a saturating 5G user base.

In Australia, Samsung has clawed back substantial ground from Apple, increasing its market share from 29.7 per cent in the first three months of 2021 to 36.5 per cent, thanks to an increase of 20 per cent in phone sales.

Gartner found that Apple’s smartphone sales were 9 per cent lower in Q1 2022 compared to the same quarter last year.

It’s a reversal of fortunes for Apple which had managed to snare more than half the local market share, a major success at the time.

Nevertheless, Apple 5G iPhones continue to drive upgrades thanks to its large iOS user base.

Overall Australian smartphone sales dropped from 1.846 million handsets in Q1 2021 to 1.805 million in Q1 2022.

Oppo was third with a mild increase from 5.3 per cent to 5.7 per cent. Xiaomi, Google, and a swag of small selling brands made up the remaining 11 per cent.

Globally both Samsung and Apple increased their market shares – Apple by 2.4 per cent to 17.8 per cent and Samsung by 1.8 per cent to 22.0 per cent.

Xiaomi and Vivo were more prominent in sales success internationally than in Australia.

However, Xiaomi, Oppo and Vivo suffered smartphone sales decline due to slowing demand in China and, more significantly, disrupted manufacturing capabilities.

Huawei, once a major player in Australia and other countries, couldn’t muster a top five spot in either Australian or global rankings.

Gartner said foldable phones have started to emerge as a strong replacement factor, driving up foldable phone sales for Samsung and leading Chinese vendors. That’s good news for the vendors given these phones cost $1500 or more.

There are reports emerging that Apple has been testing foldable phones; Apple has registered several patents for foldable phones since at least 2016.

Telsyte managing director Foad Fadaghi said he wasn’t too concerned about the drop in global and Australian smartphone sales.

He said the smartphone market had enjoyed “phenomenal performance” in the previous two years with many people bringing their handset purchases forward during the pandemic.

Apple too had enjoyed exceptionally strong performance in Australia previously “so there has to be an inevitable slowdown at some stage”, Mr Fadaghi said.

Apple’s drop in market share was “just part of a long-term trend between the two, a product cycle with Samsung”.

However he said Samsung would be pleased at its 20 per cent rise in sales. Some of this would be from their low and mid range phones.

He said Samsung had spent big promoting its A-series mid range phones and had performed well in the mid range market.

In contrast, Apple’s (competing) iPhone SE “was unlikely to move the needle for Apple”, he said.

Mr Fadaghi said 5G phone sales would continue to thrive, as 5G components became available as an integrated part of cheaper phones.