Review: Cheap platforms make it easy to trade stocks, but beware of pitfalls

It’s easy to trade stocks using online platforms. Some are amazing sources of information, but others present dangers. We look at five.

Cheap online trading platforms let Australians buy and sell stocks effortlessly for next-to-no brokerage. Some trade in just Australian and US shares and ETFs, others offer access to international markets, foreign exchanges, cryptocurrencies and more. Here are five that offer access through mobile apps and browsers.

–

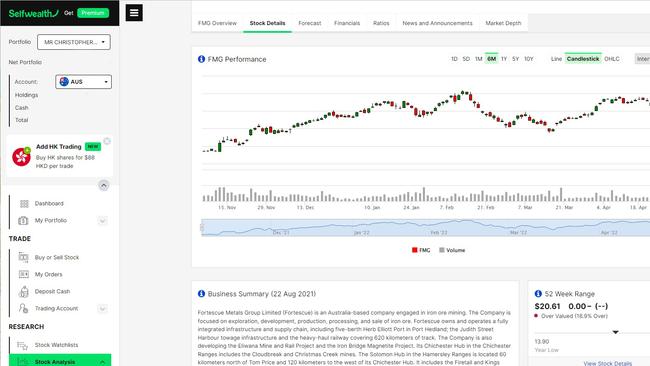

SelfWealth (brokerage $9.50)

SelfWealth is ideal for new traders and people squirrelling away long term trades. You can access Australian, US and Hong Kong stocks and ETFs. The flat $9.50 fee applies no matter the size of the trade.

The interface isn’t beautiful, but is functional. You can swap between a stock’s profile, forecasts, detailed financials and chart when assessing prospects. You can view live trading prices of a selected stock for free.

However, SelfWealth doesn’t provide event or market notifications.

The platform is free but for $20 per month you can access SelfWealth Premium, which includes viewing the stock selections of ‘leading’ SelfWealth members. While this is instructive, be warned. You can lose money buying other people’s stocks at your rather than their timing.

–

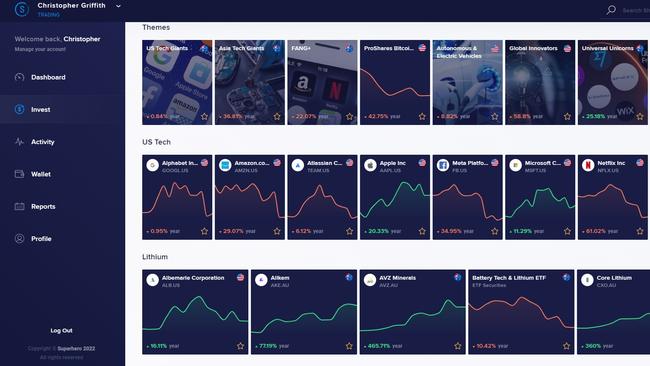

Superhero ($5 ASX,$0 US stocks)

Superhero offers an attractive and uncluttered interface and helps you zero in on stock selections.

The ‘invest’ menu promotes ETFs such as ‘US Tech Giants’ and ‘Autonomous & Electric Vehicles’ along with selections of US tech, Lithium, US brands, Healthcare stock options and more.

It’s easy to build a balanced albeit guided portfolio of Superhero’s recommended stocks and ETFs. You can trade other stocks, but you’ll need to look elsewhere for deeper research.

Superhero offers a long list of reports covering your Australian and US trading activities.

While it was easy to deposit cash, approving my bank account for withdrawals took time. Two of my accounts apparently didn’t match my account name at Superhero. I had to access chat multiple times for a fix.

Be aware that Superhero doesn’t allocate your shares through the ASX’s CHESS system. Your shares are held in trust should the company fall over, but it’s not the same thing.

Also there is no ‘stop loss’ option for Australian stocks so they won’t automatically sell before their price plummets dramatically into free fall if there’s a crash.

–

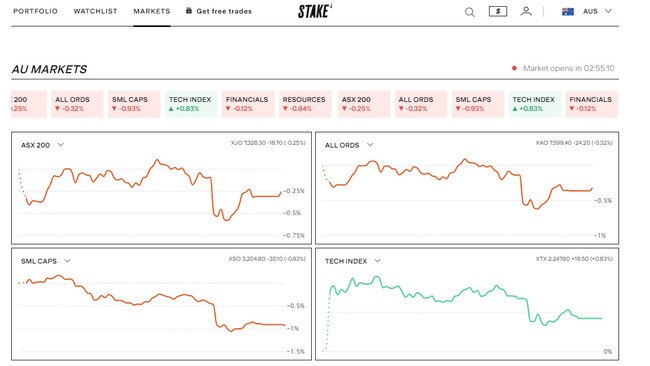

Stake ($3 for ASX trades, $0 for US trades & ETFs)

Stake is the most basic platform I tried. You can trade Australian and Wall Street shares and ETFs, and crypto trading is on the way.

Click on a stock and you’re taken to a single page comprising a colourful chart with candlestick charting, market announcements, and basic stock details. But there are no financials or deeper analysis. You’ll need to enrol in another platform for that – which you can do for free.

While it’s sparse on features, I do like the live day trading chart comprising a little worm that wriggles its way across the screen showing the direction of trades.

The cheap $3 buying and selling fee is alluring, but Stake has a mechanism to keep out day traders taking advantage of this should they repeatedly buy and sell one stock.

Again, there is no ‘stop loss’ feature for Australian stocks. You’ll need to be online should a stock crash, not diving off a beach in Fiji. Stake is promising a fix for this.

–

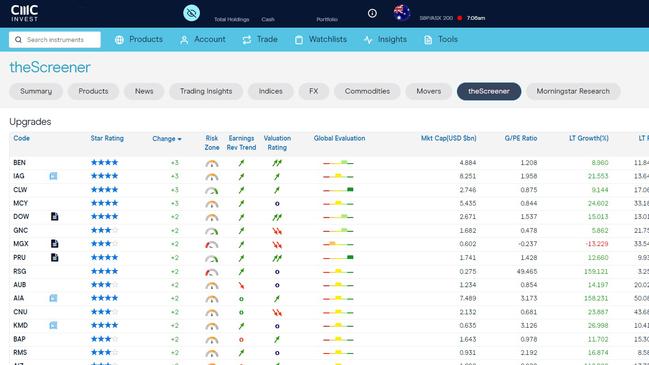

CMC Markets ($11 up to $5000)

This comprehensive platform lets you trade equities, indices, currencies, bonds, ETFs and CFDs (contract for differences) – up to 10,000 instruments. It’s targeted at experienced traders but isn’t beyond everyday investors who enjoy its features, and isn’t too costly.

Brokerage in several countries is free; in Australia your first buy of the day is free up to $1000, after that you pay $11 or 0.1 per cent. Live ASX data is free.

CMC Markets offers comprehensive news information on stocks, movers and shakers, a screener for stocks to buy with a risk assessment, Morningstar quantitative ratings, and the best comprehensive charting display of stocks I’ve seen. It includes pattern recognition of candlestick formations and trend lines.

I like the filtering feature that lets you build personalised stock queries against your criteria.

One of its best feature is the range of options when you trade. Not only can you set limit prices and stop losses when buying and selling, you can also create conditional orders such as trailing stop losses. You can set up these orders when you buy.

It’s a masterful platform once you can learn how to use it.

You can invoke Demo mode to practice trading with fake finance.

–

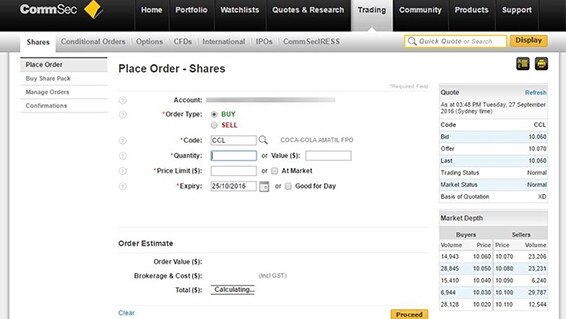

CommSec ($10 up to $1000, pricey above that)

You get what you pay for with CommSec including research and education, live market news, videos, reports, trends and broker analysis. It’s a good platform both for experienced traders and newcomers who can benefit from the extensive online education.

To get going, you open a Commonwealth Direct Investment Account and deposit funds. You can trade from outside accounts, but it incurs another fee. You can trade shares, ETFs, options, warrants and securities.

An international share trading account offers additional access to markets across the US, Canada, Asia Pacific, Europe and the Middle East, but again be aware of international brokerage fees.

For beginners there’s CommSec Pocket with $2 trades limited to a choice of 7 ETFs.

My one beef was a long stint of waiting on the phone for customer support.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout