Why the US is opening its doors to China’s bitcoin industry

China is cracking down — and this time it’s serious — so where next for the lucrative cryptocurrency?

An Australian investor recalls a trip to China four years ago for a bitcoin conference.

During his 10 hour flight from Sydney to Shanghai, the price of bitcoin plunged 30 per cent. “They’ve just banned bitcoin in China,” a colleague informed him on arrival.

The conference went ahead anyway. It opened with a Chinese regulator. “He gave this speech about how blockchain had good potential, but bitcoin was bad. Everyone clapped, he walked off and it just went on as planned,” he says, laughing. “It was – off we go! It was all quite bullish and bitcoin rallied back.”

That was September 2017, the month Beijing banned the operation of crypto exchanges in mainland China.

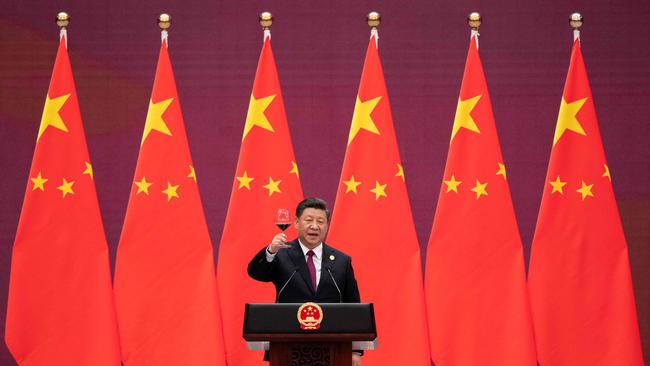

It was, however, a very different story this year when Xi Jinping’s economic tsar, Liu He, uttered eight words that upended the cryptocurrency universe.

“Crack down on Bitcoin mining and trading behaviour,” Comrade Liu instructed China’s most senior regulators on May 21.

Today, the industry, worth more than $1 trillion, is still roiling.

The anarchic digital currency has a huge following among Chinese investors. Beijing’s regulators have long been uneasy with bitcoin, clamping down as it surged to record highs in 2013 and again in 2017. At first, investors did not know how seriously to take Vice-Premier Liu’s warning in May.

“This has been almost a joke in the industry,” says Henrik Andersson, chief investment officer at Melbourne-based crypto fund Apollo Capital. “How many times can China ban bitcoin?”

There is a lot more clarity now.

Liu, with the full authority of his childhood friend President Xi, is overseeing the biggest regulatory crack down in the currency’s history. From China’s capital to its most western provinces, crypto businesses are being purged.

Investors quickly got the message. More than $400bn of the total value of bitcoin was wiped out as it dawned on them: Beijing is not joking.

Bitcoin ‘Mecca’

For years, the People’s Republic of China has dominated the world’s most disruptive cryptocurrency.

Farms of computers around the world “mine” for bitcoin by solving the cryptographic puzzles that validate the currency’s transactions. Every day, more than 900 new bitcoins are released – each worth more than $60,000 on the market today. The miners compete for the daily loot.

In mid-May, more than half of those energy-hungry machines were in China, plugged into the cheap energy supply in the country’s west.

Many of the machines migrated internally. Workers would carry the machines to Sichuan for the summer, as heavy rains motored the province’s hydropower stations. In the drier months, they were carried to neighbouring coal-powered stations in Xinjiang and Inner Mongolia.

The whole operation had the blessing of local authorities, eager for the opportunity to transform gluts of power into local jobs and to boost their provincial gross domestic product numbers.

Not any more.

In June, the farms of China’s last bitcoin haven were shuttered as the Sichuan government demanded the closure of more than 20 cryptocurrency mining projects in the province.

“The proof is in the hash rate,” explains Alex Brammer, the Seattle-based vice-president of the cryptocurrency mining and data firm Luxor Technologies.

Bitcoin’s hash rate measures the amount of computing power mining new coins. The helpfully transparent indicator reveals this crackdown is real. Indeed as, one by one, China’s provincial governments followed instructions from Beijing to outlaw large-scale bitcoin mining, bitcoin’s hash rate halved. That was great news for the world’s non-Chinese miners, whose profit margins ballooned as more than half of their international competition suddenly went offline.

Now a great international migration of bitcoin machinery is under way – to the former Soviet Bloc and, intriguingly, to the US.

“It’s unlike anything we’ve ever seen before,” says Brammer, who is advising partners in China as they relocate. Some of the older Chinese hardware is heading west into Kazakhstan and Russia.

Much of the newer equipment is off to destinations the industry dubs “tier 1”, such as the US and Canada. The Republican Governor of Texas, Greg Abbott, has boasted that his state is becoming a “Mecca’’ for bitcoin miners — although his ambitions could yet be undermined by energy infrastructure woes.

China’s miners had been using 83 Terawatt-hours a year, according to the Cambridge Bitcoin Electricity Consumption Index. That was more than Chile’s entire annual power consumption. Beijing’s economic planners made it clear to the provinces the industry had no future in the world’s second-biggest economy.

Every little bit helps as China’s planners strain to fulfil President Xi’s pledge to be carbon-neutral by 2060.

Bitcoin’s reliance on China’s mostly coal-powered grid had also become a reputational problem for investors, including, most notoriously, Tesla billionaire Elon Musk – after Xi, the most market-moving person in the crypto universe.

Days before Liu’s instruction, Musk triggered a $150bn Bitcoin sell-off with a tweet scolding its sooty underbelly.

“Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment,” he wrote.

The outlawing of bitcoin mining in China – for decades heralded as “the world’s factory” – underlines a historic shift in its economic development.

Environmental standards are forcing heavily polluting, non-strategic industries out of China.

Jobs are going too.

Before the ban, bitcoin machines were in such demand that they were sold in the country’s biggest electronic shopping centres.

Last June, just over a year before this crackdown was announced, The Australian visited a store at the giant SEG Plaza in Shenzhen, just over the border from Hong Kong.

One of the 20-something staff spoke enthusiastically about the future of the bitcoin mining industry, which he admitted his father – a Guangdong peasant – could not understand at all.

His is one of thousands, perhaps hundreds of thousands, of bitcoin-related jobs that now look imperilled.

Already gone is the labouring work in China’s far west, hauling the machines between Sichuan and Xinjiang as seasonal power prices varied.

The ban follows an earlier one on the importing of waste that upended the world’s garbage and recycling industries.

Many investors believe the migration from China will help make the cryptocurrency cleaner.

“China shutting down mining means the renewable part of mining has gone up,” says Apollo Capital’s Henrik Andersson. “It’s probably close to 50 per cent now.”

China’s mining giants are alert to the trend as they migrate off the mainland.

Clean and low-carbon energy will power at least 85 per cent of the $US25.74m ($35m) farm the Shenzhen-headquartered BIT Mining is building in Texas.

There is also relief that the bitcoin network will be less vulnerable to a “51 per cent attack” – where a group of miners gains control of more than half of its computing power and messes with the currency.

Richard Galvin, co-founder and chief executive of crypto fund Digital Asset Capital Management, says investors have often raised concerns about the high concentration of bitcoin in China.

“There was always the risk scenario that if the Chinese government wanted to, they could effectively take over bitcoin by nationalising all the mining power,” says Galvin, a former JP Morgan investment banker.

“That’s clearly not going to happen now.”

‘Cryptocalypse’

The Chinese Communist Party is far from alone in worrying about bitcoin.

Gary Gensler, the head of America’s Securities and Exchange Commission, last week said cryptocurrency markets were “rife with fraud, scams and abuse”.

“We just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West,” Mr Gensler told the Aspen Security Forum.

Banking regulators around the world share Beijing’s concerns about the systemic risk posed by bitcoin and other burgeoning cryptocurrencies. The Economist has even coined a term – “cryptocalypse” – for what might happen if the price of bitcoin plunged to near zero.

Some of Beijing’s concerns are unique, as are their enforcement mechanisms.

Last October, Xu Mingxing, the 34-year-old founder of bitcoin exchange OKEx, was detained by China’s security authorities.

It wasn’t the first time. Police had previously nabbed him in 2018 after an investor complained about huge losses incurred trading bitcoin on OKEx.

Investor disputes are a source of huge anxiety to China’s stability-obsessed leaders.

Bitcoin joins a long list of products – following beans, garlic and tea – that have worried them, argues Winston Ma, author of The Digital War: How China’s Tech Power Shapes the Future of AI, Blockchain and Cyberspace.

“China has a clear record of cracking down on all kinds of products for fear that bubbles will eventually burst and lead to riots of disgruntled retail investors,” Ma wrote in a recent piece in the International Financial Law Review.

Beijing officially outlawed crypto trading platforms in China in 2017, back when the Australian investor was flying over the South China Sea on his way to Shanghai.

The platforms responded by registering their businesses overseas – in the Seychelles, the Cayman Islands and other lightly regulated pockets of the world.

Chinese investors kept pouring money into the volatile digital asset.

Another concern for Liu and Xi’s other top economic advisers is the ability of bitcoin to evade their strict capital control restrictions.

An investor explains how the mining farms gave people in mainland China a currency control bypass. “You could take a million US dollars worth of RMB, or yuan, and buy mining equipment. And that produces bitcoin, which you can then sell for US dollars,” says the investor. “In a way, you’re basically converting your yuan into US dollars.”

Beijing has another great motivator for its step up in enforcement.

China is determined to lead the world with the rollout of its digital currency – the e-CNY, or digital yuan. It is a currency built in the image of China’s controlling one-party state: the anti-bitcoin.

Where bitcoin roams free of central bank control, the digital yuan is under Beijing’s thumb.

While the value of bitcoin oscillates wildly on Elon Musk’s Twitter feed, the digital yuan is fixed by China’s leaders. And, as bitcoin gives anonymity for transactions, the digital yuan will give Xi unprecedented powers of surveillance.

It is not far away now.

Trials of the digital yuan have been under way for more than a year.

The Beijing 2022 Winter Olympics, only six months away, has been chosen as a flagship event to show it off to delegations visiting from around the world.

That gives Beijing a powerful reason to attack the cryptos, says Ma, the former head of the North American arm of the China Investment Corporation, China’s sovereign wealth fund.

“They are trying to make it crystal clear – there is only one digital currency that is legitimate for financial transactions,” he tells The Australian.

‘Changing my life’

Quashing the animal spirits attracting investors to bitcoin is going to be a formidable challenge – even for the world’s most powerful political party.

Many individual investors in China still think they will be able to keep trading cryptocurrency in a grey zone beyond Beijing’s reach.

“To completely ban individuals from investing in cryptocurrency is like fighting the whole internet,” says a 28-year-old freelance graphic artist in China’s capital.

“The cost is unimaginable,” he tells The Australian.

He made his first bitcoin investment in 2017 after reading about Li Xiaolai, one of China’s most famous bitcoin billionaires. Now his entire savings are in the cryptocurrency. His investment of 240,000 yuan ($50,000) has grown to 3 million yuan ($600,000).

“If I didn’t invest in bitcoin, in what other market could I have made an over 10 times return?”

Over the years, he has had to change the platforms he uses to trade as various platforms have been banned.

New platforms have always popped up, just as fast.

The investment has brought the graphic artist closer to something he could never afford with the income from his work – owning his own Beijing apartment. With that, he could move out of his parents’ place.

He would also greatly improve his chances of getting a wife. An apartment is almost a precondition for marriage in China.

Beijing’s new crackdown has not changed his investment strategy.

He intends to keep holding bitcoin until his portfolio hits 20 million yuan, or $4.2m.

“Then I can think of changing my life.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout