Policy path transitioning to a new world poses the make-or-break for Labor

Treasury secretary Steven Kennedy has detonated a convenient bipartisan fantasy.

The character of this new Labor government is going to be formed much faster than usual. Its test is managing an inflation surge that will cause much pain across the community and drive policy changes in relation to prices, wages, tax and energy regulation.

Political management will be a supreme task. While the government will stick by its election promises, the shift in economic policy is pivotal yet a work in progress. Central to this job will be retaining the new government’s authority and optimism as it heads towards a policy recalibration and an explanation to the public.

The first message from new Treasurer Jim Chalmers, confronting an unpredictable and high-risk outlook, has been essential – a pledge to be “upfront and honest and not mince our words” about the task. He sees the challenge as “incredibly serious”. His instinct is to be blunt, not to “tiptoe” around. Indeed, the worse mistake would be to pretend there aren’t bad things happening.

The government is simply unable to deliver any time soon on many of its election pledges on cost of living, cheaper energy, budget policy and wage improvements. Chalmers pledges a stronger economy in the medium term, but Labor must create the policy path to get there.

Australia has undergone two decisive events – it has changed governments after nine years and it sees the most serious inflation challenge for more than 30 years. That’s tough, but it’s an opportunity for Labor to prove its worth in managing adversity.

Chalmers has laid down three markers. First, inflation is the new defining challenge for the government. Second, it “will get worse before it gets better” – meaning higher prices and higher interest rates given this week’s lift in the cash rate to 0.85 per cent, affecting 3.5 million families with mortgages. And third, Chalmers concedes the budget is under “significant” more pressure. In truth, budget policy must change.

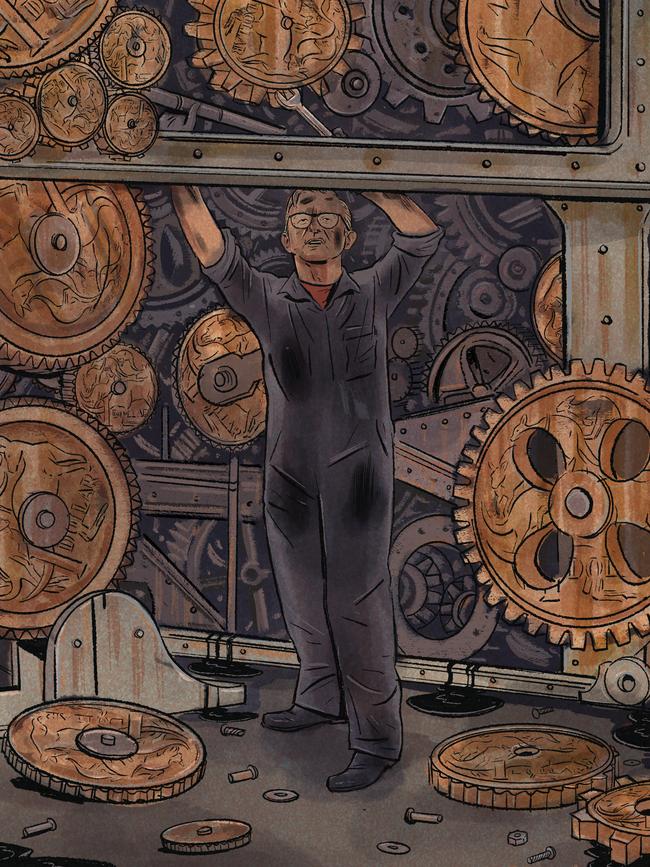

The crisis will lead to enduring changes. This week Treasury secretary Steven Kennedy detonated the convenient bipartisan Labor-Coalition assumption that record budget debt can be repaired just by economic growth. That fantasy is gone. Kennedy was polite, saying a “more prudent course” is for the budget to play its role – meaning spending cuts or tax rises. The dawn of high-inflation realism is about to hit the budget. What does that mean? Probably higher taxation levels and an attack on tax concessions.

Former Reserve Bank governor Ian Macfarlane tells Inquirer: “I think inflation will increase over the next two quarters. It will more likely be around 7 or 8 per cent and then come down. But I doubt when it falls it will go back to the 2 to 3 per cent levels. It is more likely to settle higher, around 3, 4 or 5 per cent.”

What does that mean? It will mean higher interest rates for longer to keep inflation down. What is the risk? As private sector economists are warning, higher interest rates come with a price: lower demand, slower growth, probably higher unemployment. Getting the balance right is exacting.

On energy, the government is trapped between global price rises, domestic policy blunders for 15 years and immediate coal shortages – but the focus will shift to delivering more gas and the issue of intervention in the gas market in the cause of greater local supply. What does this mean? Nothing can stop the hefty escalation in power bills this winter with deep consumer aggravation. The political conflict between Labor and the gas-hating Greens will escalate.

The world is changing. The deflationary, globalised, cheap energy, low interest rate world of the past 30 years is dying. Labor’s inheritance is the management of this transition. This task will make or break the Albanese government. It is the conflict between financial reality and compassion politics. Anthony Albanese needs to cultivate a dual image – as the compassionate prime minister he promised to be and as the manager of economic adversity he must prove to be.

High inflation is a threat anywhere and everywhere to caring politics. It is hard to imagine a more lethal cocktail of inflationary items – petrol, gas, electricity, food and building materials. How much tolerance will the public display towards the new government? A fair amount probably in the Australian way but that depends on Labor’s performance.

The Reserve Bank has travelled its road to Damascus. This week’s 0.5 per cent increase in the cash rate was a declaration of anti-inflationary war. Has there ever been a more dramatic bank switch from dove to hawk on monetary policy? Its message to government, unions and business is: we will do whatever is needed. That’s good. But overreacting in the opposite direction is bad.

More interest rates increases will follow during the year. Governor Philip Lowe said inflation has “increased significantly” driven by global factors but also domestic forces. It is worse than he anticipated just a month ago. The bank has its finger on the trigger. Having spent two years pushing for higher wages the bank is now worried about a possible wage-price spiral. Don’t expect the public not to be confused. Our best advisers misjudged the inflation eruption.

In the near term, Albanese and Chalmers are complete hostages to the Reserve Bank. It badly misread the previous cycle. Will the bank have the judgment to curb inflation without driving an excessive Australian downturn?

Economist Chris Richardson, tells Inquirer: “The Reserve Bank has never been more important to Australia because we have never before had these levels of debt. It is stunningly important for the bank not just to get it right but to explain itself and keep explaining itself. We now have five minutes of inflation but we need to ensure we don’t lose the lowest level of unemployment in 50 years. These are rare and precious gains and you don’t want to lose them.”

This concern will focus Labor’s mind. The economy is far more sensitive these days to interest rate shifts. Chalmers dismisses any talk of recession. He’s right. But this depends on the bank’s judgment. Yet the two certainties from higher inflation are harm to living standards and damage to the government’s declared election goals.

Rising inflation means real wages will be lower than previously forecast, a crucial setback for the government’s aspirations. This poses issues of economics and equity for Labor. “For the next year or 18 months real wages are going to fall,” Macfarlane says. Chalmers says that after “almost a decade of wage stagnation we’ve got real wages going backwards”.

EQ Economics managing director and Judo Bank adviser Warren Hogan tells Inquirer: “The question becomes: how much of the cost shock will be borne by workers in a real wage hit and how much by business in lower profits? At present it looks like the workers are bearing the most through lower real wages. I think that will start to shift. But the big issue will become: how do we share this?”

It’s another crucial question for Labor. For Albanese and Chalmers, seeking consensus deals with business and unions, this dilemma will become intense.

Chalmers talks up the public sense of collaboration, what he calls a “big national conversation about our economic outlook”. His message is: let’s keep our nerve for the medium term, Australia still has lots of positives going for it.

Australia’s woes occur against an even more serious global predicament. Inflation in many countries is running higher than in Australia – witness 8.3 per cent in the US – along with massive rises in oil, food and energy prices driven by the war in Ukraine and compounded by China’s zero-tolerance Covid strategy sure to cut its growth. The world faces slower growth and higher inflation, maybe a mild version of 1970s stagflation, but hopefully not a global recession.

In his speech Kennedy warned inflation could rise “well above” 6 per cent. Higher electricity prices – a “new upside risk” – are yet to appear in the data. Inflation will dominate this year and into next year in an Australian economy operating near full capacity with unemployment now at 3.9 per cent.

Kennedy outlined the budget dilemma. New structural spending is embedded from the National Disability Insurance Scheme, aged care, defence, health and infrastructure, much of this deeply cherished by Labor. Don’t think Labor will swing the spending axe in a decisive way. The word Chalmers uses is “trim” – and that’s not structural surgery.

Bigger government is here to stay with Kennedy saying spending as a proportion of gross domestic product will average 26.4 per cent across the coming decade compared with 24.8 per cent in the decade before the pandemic. That’s a huge shift and a Morrison government legacy. The Liberals need to be careful in opposition advocating what they refused to do in office.

This leads to the second option identified by Kennedy – higher taxation. He sent strong signals on this front. “The effects of a larger tax take can be minimised by ensuring the design of the tax system is optimal,” Kennedy said. It is obvious what Treasury wants and what it sees as inevitable. Welcome to the new debate on tax. Kennedy says inflation will mean higher average personal tax rates – but budget pressures will make it hard to ease what looms as the personal tax burden increasing “towards record levels”.

What are the implications? Forget any further cuts to company tax. Kennedy says banks and miners are making hefty profits. He wants “ongoing review” of the tax base and tax concessions “to ensure the tax system remains adequate to fund spending commitments” along with a commitment to equity.

Kennedy doesn’t say this but debate about tax concessions surely leads direct to superannuation and housing tax breaks, typically protected by political red lines. As for his reference to the tax base, Hogan says: “I don’t think there’s any way we can get our budget back to balance without an increase in the GST. There are not enough other levers to pull.” But don’t expect Labor to tackle this necessity. You see, however, the ugly political tests coming down the line.

Chalmers says his aim is “growth without adding to inflation” but Australia is heading towards rising inflation and slower growth. His goal is to “get Australians to the other side” of the “quite serious inflation problem”. But navigating the way through is extremely tricky. It involves honouring election promises, shifting the objective of policy from promoting economic recovery to managing an inflation breakout and energy crisis – yet ensuring the basis is preserved for a medium-term recovery.

Chalmers admits “striking the right balance in wages” will be critical. He says wage rises can be affordable and sustained but he knows the risks of seeing wages chase inflation. Nobody much mentions the Hawke-Keating framework these days – yet it constituted a political compact that delivered real wage cuts sustained by social wage gains from government.

Hogan says: “I don’t think this has to be the start of a wages-price spiral. There will be wages growth but we also need wage restraint of some sort. All the evidence shows that businesses just pass the costs through. Some of the data I see suggests that about 75 per cent of Australian businesses are able to pass to consumers the impact of higher wages. On the other side of the equation you need enough wage increases to ensure you don’t have a detrimental effect on consumer spending. These are the two extremes you need to avoid.”

In the end, as Chalmers knows, all roads lead back to productivity. It is productivity that must underpin real wage gains. His budget aims to put in place a series of productivity objectives while also trying to mitigate cost-of-living pressures. Again, that will be a difficult balance to get right.

Kennedy addressed the productivity issue with alarming data. The budget assumes productivity gains

of around 1.5 per cent yet the average over the past 20 years is only 1.2 per cent. The difference is substantial.

If our lower productivity performance is maintained then GDP growth is lower with living standards diminished.

Summarising the framework facing the new government, Kennedy said global settings were the “most complex” in 70 years: “There are no upsides to global growth from the war in Ukraine, Covid-19 crisis in China and persistent supply-chain challenges. Commitments to structural spending in areas including disability support and aged care are putting sustained pressure on the budget. The tax system is under pressure. And productivity and real wage growth has been weak for more than a decade.”

Chalmers believes there is a spirit of collaboration in the country to confront these issues. Let’s hope he’s right. The nation needs it. The mantra from ministers at present is that “everything is on the table”.

That’s fine as an opening move. But decisions will be needed – and soon. And matching those decisions the government needs a new political narrative to explain itself, our more difficult circumstances and its policy responses to the people.

The Albanese government confronts a global and domestic inflation trauma that will demand a new political narrative and transformed economic policies from the recent election with the public facing higher costs, rising interest rates and prolonged real wage cuts.