PNG’s debt overture to Beijing rings alarm bells

Port Moresby may be playing a dangerous game with Beijing.

On a cold Canberra morning 18 days ago, Scott Morrison stood alongside Prime Minister James Marape at Parliament House, declaring Australia had “no truer friend” than Papua New Guinea.

Marape, on an official visit with full red carpet treatment, said he came to Australia as “friend and family”, and that for PNG there was no relationship “more important than our relationship with Canberra”.

But back on home soil this week, Marape indicated PNG’s relationship with China could soon rival its ties with Australia, in crude financial terms at least.

After a meeting with Chinese ambassador Xue Bing in Port Moresby on Wednesday, Marape made a series of announcements that would have set heads spinning in the Australian government’s new Office of the Pacific.

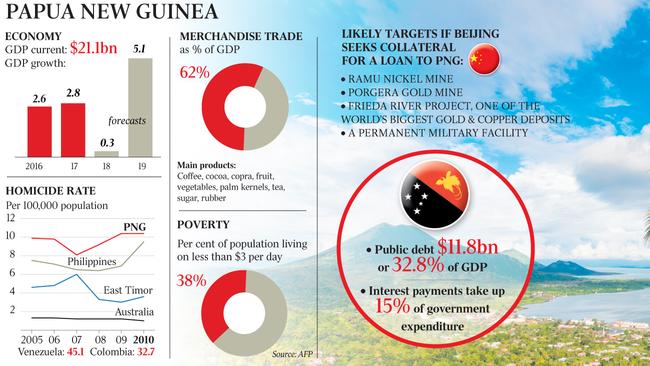

Most alarming for Australia was a request — publicised in an official statement from Marape’s office — by PNG for Chinese help to refinance its entire $11.8 billion government debt.

In a statement, Marape said he had asked the ambassador formally to convey the request to Beijing, and for PNG’s central bank to work directly with the People’s Bank of China “in ensuring that consultations are under way”.

Also concerning was the foreshadowing of new deals with China to build ports and airfields, to be discussed on Marape’s imminent state visit to Beijing.

Wider play

The idea that PNG could consolidate its government borrowings under a single Chinese loan would seem to be a bizarre move for a leader who pledged to “take back” PNG’s economy from foreigners, leading some to see a wider play.

As one long-time PNG observer says: “It looks like a massive China-sanctioned shit-stir for Australia.”

Marape back-pedalled on his statement yesterday, saying his government also would look to the World Bank, the Asian Development Bank and “some other possible non-traditional partners”, to secure low-cost and concessional loans to restructure his country’s debt. He says there will be “no more unnecessary loans except to refinance our expensive loans and for key enabling economic infrastructure”.

But strategic experts say the prospect of PNG becoming ensnared in a Chinese debt trap is not one that can be taken lightly.

Australian Strategic Policy Institute executive director Peter Jennings says there is now a familiar pattern of China luring developing nations to accept loans they cannot afford, forcing them to make political commitments to Beijing or hand over key assets.

He cites Sri Lanka’s experience, where it was forced to surrender the southern port of Hambantota to Beijing on a 99-year lease after defaulting on a Belt and Road Initiative loan, as well as surging Chinese debt in Africa.

“Given our geography, this is something we have to pay very close attention to,” Jennings says. “Frankly, PNG is of immense strategic importance to us. We saw that in World War II. It is the first buffer of any big strategic threat that might develop for Australia.

“And for that country to find itself under the thumb of Chinese financiers I think would be extremely dangerous.

“I just don’t think we can be sanguine about it and dismiss it simply because it might obligate us to do something. Yes, it does, because this is our region, our strategic front yard, and we have got to be mindful of looking after it by helping our neighbours to look after themselves.”

Warnings ignored

Former minister for the Pacific Concetta Fierravanti-Wells sounded a warning about Chinese lending in the Pacific 18 months ago, arguing Australia’s neighbours were taking on debts they could not afford to build “roads to nowhere” and “useless buildings”.

Now a Coalition backbencher, Fierravanti-Wells tells The Australian that successive governments have been asleep at the wheel as China up-ended the traditional regional order.

“Those responsible for foreign issues in DFAT and in cabinet have ignored the warning signs over the past decade, preferring complacency and acquiescence,” she says.

“If donor countries like China truly wanted to assist developing Pacific countries, they should be considering debt forgiveness rather than embarking on adding to the debt levels through more loans.”

Australia and the US prevented China from gaining a strategic foothold in PNG last year with a deal to redevelop Manus Island’s Lombrum base as a joint naval facility. China had been eyeing the deepwater port, after a deal to upgrade the nearby airport, along with ports at Wewak, Kikori and Vanimo.

PNG also has huge natural resources deposits that could be lost if a Chinese loan goes sour.

Two Chinese-developed projects — the Ramu nickel mine and the Porgera goldmine — will be at the top of the list for Beijing if it is seeking collateral for a major new Chinese loan. The proposed Frieda River project, one of the world’s biggest gold and copper deposits, also is slated for development by the majority Chinese-owned PanAust. It would be a rich prize for Beijing in the event of a loan default.

The Marape government’s debt consolidation play follows a bid for a $446 million budget support loan from Beijing, agreed in-principle at last year’s Asia-Pacific Economic Co-operation conference in Port Moresby.

But negotiations on that loan stalled because the China Development Bank wanted to provide project support rather than a straight loan.

Not just a debt problem

PNG also has been seeking direct budget support from Australia, potentially through a redirection of some of the $600m a year Australian taxpayers pump into the country in foreign aid.

However, Canberra has refused, knowing PNG’s reluctance — or inability — to put in place deep structural reforms to get its budget back on track.

“There is a very strong awareness within the Australian government about PNG’s fiscal situation,” former diplomat James Batley tells The Australian.

“It’s not just a debt problem, it’s an ongoing issue — their outgoings don’t match their incomings. That is a matter of real consternation on the part of the Australian government.”

Rather than budget support, Australia has offered PNG assistance to put together a restructuring plan to take to the International Monetary Fund, which will itself require a commitment to budget reform.

The Morrison government is also anxious not to create a precedent for PNG and other nations that increases their dependence on Australian cash.

But as growing strategic competition in the region turbocharges the Morrison government’s Pacific step-up, regional leaders know they have much greater leverage in their dealings with Canberra.

“Countries in the region are not really making much of a secret about the fact that they are in a strong bargaining position,” Batley says. “Pacific countries have become more assertive in their own foreign policies.”

Morrison, who will meet regional leaders in Tuvalu next week at the Pacific Island Forum, avoids directly addressing the question of Chinese influence in the Pacific.

But he has a simple message for Pacific leaders that succinctly sums up the problem, without antagonising Beijing.

Australia, he says, wants to ensure “each and every one of those nations are as independent and as sovereign and as much in charge of their future as they possibly can be”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout