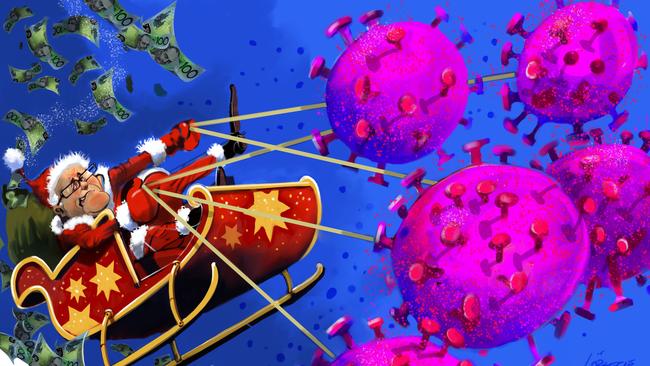

How we slayed the threat of coronavirus

The inside story of how we were saved from an economic crisis.

The economic response of $257bn off the budget, equivalent to 13 per cent of GDP, revealed the deepest and broadest commitment in Liberal Party history to put a floor under much of the nation’s social and economic life — a decision that defines the Morrison government.

On display has been the nation’s belief in a social contract — tangible though never precisely defined — a philosophy represented by the ideas as diverse as compulsory voting and an inclusive Medicare but given a fresh interpretation by the wage subsidy innovation of JobKeeper, the centrepiece of the crisis response authorised by Scott Morrison and Josh Frydenberg.

Critical to the response has been the conceptual outlook of the official family, notably the Treasury under Steven Kennedy with financial system support from Reserve Bank governor Philip Lowe. But 2020 constitutes a turning point in Liberal history not just because it went full throttle Keynesian but because it embraced a wage subsidy with two separate but closely tied aims — to maintain the social order, and sustain the economic lifelines when fighting COVID-19.

Last April, Treasury told Frydenberg the unemployment rate could have peaked at 15 per cent without the JobKeeper intervention. That rate today is 7 per cent, with Treasury estimating it will peak below 8 per cent, more likely around 7.5 per cent, a degree of relief almost inconceivable nine months ago when the pandemic looked its bleakest.

Former ANZ chief economist and UTS professor Warren Hogan told Inquirer: “Two features stand out for me. One is the speed with which they adapted to the evolving economic and health threat. The pace at which they kept moving was breathtaking. I’ve never seen anything like it. The other element was co-ordination — between the financial regulators, including the RBA, and the government, and between the regulators, the banks and the RBA. It was a level of co-ordination we haven’t seen before.”

‘We landed the plane on the Hudson’

Deloitte Access Economics partner Chris Richardson said: “In terms of economic policy, we landed the plane on the Hudson. If you think of the twin battles for lives and livelihoods, Australia did well on both. The better we did on one, the better that allowed us to do on the other. I judge our response to be not perfect but still magnificent.

“You will have seen the research; poverty went down in Australia in the crisis. It’s remarkable. It’s a proud year to be an Australian. The virus has travelled through the weakest link in any nation — in the US it travelled through the political system; in Singapore it travelled through the migrant workforce.

“If I was identifying our weakest link, it would have been the unemployment benefit because it looked like many more people would depend upon it.

“It is to the government’s credit that it asked ‘where are the risks?’ and introduced the coronavirus supplement.”

This goes to the shared outlook of Morrison, Frydenberg and Treasury. It was a social and economic response that superseded the previously justified budget surplus goal. The $550-a-fortnight JobSeeker supplement almost doubled the existing unemployment benefit and sat next to the $1500-a-fortnight JobKeeper payment to support job retention and keep the link between employers and employees, at a likely full cost of $101bn.

This year’s budget documented the story: a 2020-21 budget deficit of 11 per cent of GDP and total deficits across the next four years of $480bn. Hogan asked: “Where to from here? It looks like they may have overdone the stimulus, I think by a quantum of 20 to 25 per cent in terms of the JobKeeper program, but that was the side they were intending to err on.”

JobKeeper critical

In a year of critical meetings, the most critical came on the evening of Thursday March 26 in the PM’s office over dinner when Morrison, Frydenberg and then finance minister Mathias Cormann agreed on the principles of what became the $130bn JobKeeper scheme, later scaled back.

Joining the meeting that evening via screen were Kennedy and Treasury deputy Jenny Wilkinson, in an engine room event that responded to a crisis in Australia’s homes and streets where unemployment queues resurrected nightmare images from the Great Depression.

On March 15, the first social distancing rules had been announced, authorised by the newly formed national cabinet, helping to trigger a frightening fallout. The next day the sharemarket plunged 9.7 per cent, its worst day since the GFC. School closures followed.

Lowe said the country was in a “very serious situation”. The Reserve Bank met urgently to approve a $90bn injection to boost the liquidity of the financial system. The Treasurer invoked “Team Australia” — the need to pull together. Non-urgent surgery was suspended and the border closures had begun.

“The situation was shocking,” Frydenberg told Inquirer. “Employers were saying ‘we just can’t afford to keep you, goodbye’. People in their thousands were lining up outside Centrelink. The fear in the community was palpable. We had to stop that. We had to seize the moment. That’s what JobKeeper was about. The task was to keep people formally connected with their employer.”

Kennedy later told a Senate committee that Australia had “never seen an economic shock of this speed, magnitude and shape”.

Two days earlier, on Match 24, Treasury delivered Frydenberg a scenario in which GDP could fall 10-12 per cent in the June quarter and, if COVID-19 required further restrictions, then GDP could fall 24 per cent — the equivalent of $120bn — in that quarter. As a consequence, that would have put dire pressures on the financial system. Such chilling scenarios had not been heard since the Great Depression.

The call to John Howard

Two days after the dinner with the three ministers, on the morning of Saturday March 28 when Frydenberg was walking outside Parliament House, he rang John Howard.

“I told him what we were thinking of doing on JobKeeper,” Frydenberg said. “I told him the size of the program.

“I said ‘as a Liberal, this is not the type of intervention I ever thought I would be announcing’.

“And John Howard said that during crises such as these, there are no ideological constraints. That call was very important.”

It helped steel Frydenberg to the decision he was already taking — to seal the greatest fiscal policy reversal for a government that had worked for six years towards a budget surplus by authorising deficits and debts on a scale previously beyond the imagination.

“We had no real choice,” Frydenberg said. “The economy, globally, was cratering.”

Treasury gave Frydenberg three options for the JobKeeper rate — $1000, $1200 and $1500 — and he sensibly took the highest rate. “I said this was a break glass moment,” Frydenberg said. But the design of the Australian scheme was critical. Kennedy and Treasury didn’t want the Boris Johnson UK scheme — being demanded by the ACTU — because, as designed, it would have a limited impact on economic activity.

On March 21, the day before the $66bn second fiscal package was announced, Treasury gave Frydenberg a brief that critiqued the UK model. Kennedy wanted a wage subsidy that used existing payment systems and also encouraged firms to keep operating.

After the Thursday night meeting, Frydenberg spoke to four senior business figures: the chief executive of JB Hi-Fi, Richard Murray; the chief executive of Wesfarmers, Rob Scott; Justin Hemmes, who runs the Merivale group; and Solomon Lew. They were separate conversations but the collective message was powerful — while they wanted to keep their staff, the signal they gave Frydenberg was, as he says, “they would have to let thousands of people go and that assessment further locked in our intervention”.

On Friday March 27, Frydenberg told Kennedy they needed to provide Morrison with a wage subsidy scheme offering hefty support. That night, Frydenberg took the proposal to the PM. It was further refined on the Saturday. The expenditure review committee of cabinet met on the Sunday and again on the Monday.

‘Can you deliver this?’

Critical to the entire concept was smooth delivery. Treasury had probed the Australian Taxation Office on this point. But ministers had to know directly. Frydenberg said: “We called the head of the ATO, Chris Jordan, and the deputy commissioner as well. They were asked point blank: can you deliver this? And they said ‘yes’. That gave us the confidence to press the button. This assurance was vital, given all the delivery problems that had plagued Labor during the earlier GFC.”

The Morrison/Frydenberg announcement on Monday March 30 said the wage subsidy would apply to six million workers, a figure later reduced to 3.5 million — if not universal, then still a sizeable section of the workforce constituting an unprecedented step for Australia. The approach of Treasury had largely been to “put an entire floor under the economy”, and the government acted on this premise.

The philosophy on which Morrison insisted was an “equality of outcomes” model — everybody eligible got $1500 a fortnight, sold by the PM as being the “Australian way”. The flat payment was essential for quick ATO delivery. It applied to full-time, part-time, casuals, the self-employed and not-for-profits. The payment had sufficiency, at 70 per cent of the median wage and 100 per cent of the median wage in hospitality. It was a form of temporary de facto nationalisation of the workforce.

“If you think about it, we have already delivered $130bn to households and businesses, of which $70bn has gone through JobKeeper, and it has gone remarkably smoothly,” Frydenberg said this week. “It is the program that helped us get through the crisis and save the nation.”

The Morrison/Frydenberg aim was to ensure the Australian economy neither collapsed nor was fatally hollowed out by the crisis. Given Treasury’s 15 per cent unemployment warning on April 13, it is fair to say JobKeeper averted a depression-type scenario for the country. But in his ministerial statement of May 5, the Treasurer was still warning the economy would contract by 10 per cent and that unemployment would reach 10 per cent in the June quarter.

These figures are a stark contrast to Treasury’s current view that unemployment will peak around 7.5 per cent. Moreover, the contraction in the June quarter was only 7 per cent — a shocking number and the largest since records began, but significantly below what had been forecast.

Bank loan repayment deferrals

Reflecting on this situation, Hogan said: “I believe that without the bank loan repayment deferrals and without JobKeeper, the unemployment rate would have easily surpassed 12 per cent. In my view, economists underestimated how effective those policies would prove to be.”

But this is also related to Hogan’s assessment that when the dust settles, the judgment will be the government overspent by about a fifth in its fiscal support.

Richardson said: “There’s a different yardstick to use. You need to ask the policy makers, if Australia had a deep crisis in the future, would we do a version of JobKeeper again? I believe the answer is ‘yes’. I mean, you wouldn’t use it for any old crisis. But JobKeeper has been a notable success, and one measure of success is ‘would we repeat this again?’”

Despite its mistake in the initial JobKeeper estimates, policy making during the crisis has been one of Treasury’s finest hours. Pivotal to Australia’s better-than-expected economic outcomes is that health outcomes have also been better than expected. Everything depends on containing the virus. If something goes wrong on that front, all the economic success will be undermined.

This highlights the utility of the Morrison government suppression strategy in the teeth of the two polarising critiques — that it should have opted either for elimination (the de facto position of some premiers), or that it should have run a more socially relaxed herd immunity stance (a view the Australian public would never have tolerated). The government got the balance right, and the state where this was best exemplified was NSW, where the outbreaks have been contained with a still functioning economy.

Frydenberg explained his modus operandi during the crisis: contact with Morrison was constant and the critical factor.

“I would discuss options with Treasury but before I took detailed submissions to the ERC, I would talk with the PM and talk through the issues and options,” he said. “Often I had a good sense of where he was before I walked into the ERC room.” You can assume this is an understatement.

A little known aspect of the operation was the role of former Macquarie Group chief executive, Nicholas Moore, who took charge within Treasury of a unit dealing with critical requests for funding assistance coming to government from corporates and provided the assessments that Frydenberg then took to the ERC.

Response and resilience

The Australian story during 2020 has been response and resilience. But there is a troubling conclusion — it is politically easier to offer huge fiscal support during a deep recession than it is to drive unpopular, productivity-enhancing reforms during a time of prosperity. The ludicrous hysteria surrounding the government’s IR reform package this week is a warning sign about the possible return of old politics.

Morrison’s chief operating mode is activism, the ideal disposition to combat the crisis. John Howard has said Frydenberg kept a “steady head” throughout and, indeed, this was essential given the rapidity of decision-making.

Morrison and Frydenberg took no prisoners. The 2020 year belongs to them. It will long be analysed in the annals of public policy and economic decision-making. But the seduction of fiscal stimulus has never been more apparent — for the public, and for the government.

In 2021, the test for Morrison and Frydenberg will be their capacity to remove the life supports and shift towards reforms based on enterprise and productivity, the question being: will they have the courage, or have they been seduced by the politics of cash handouts, emergency relief and debt tolerance?

We await the next chapter.

The year 2020 has been unprecedented in many ways, but the transformation of economic policy to check the coronavirus pandemic has no parallel in the post-war period and testifies to the entrenched Australian model of universal government support during crisis periods.