Blurring the bottom line

Activist groups push for companies’ position on issues from gender diversity to coalmining.

The ANZ bank is still reeling from being unexpectedly dragged into the battle between Rugby Australia and Wallaby star Israel Folau.

Last week a reporter contacted a corporate spokesman for the bank in New Zealand, asking for a comment on the activities of Folau’s wife, Maria, who had retweeted a tweet by her husband. ANZ is a sponsor of New Zealand’s national netball team the Silver Ferns, in which Maria Folau plays.

“We do not support the views of Silver Fern Maria Folau and have made our views known to her employer, Netball New Zealand,” spokesman Stefan Herrick told the New Zealand press.

But when the comments were picked up by the media in Australia, ANZ’s Melbourne head office was pulled into the raging rugby controversy over the dispute between Israel Folau and Rugby Australia, and was soon forced to issue a clarifying statement.

As it came under heavy fire on social media, the bank scrambled to deny it had any plans at all to review its sponsorship of the Ferns, rejecting reports it was threatening to pull its sponsorship.

“We value our partnership with Netball New Zealand and any suggestion we tried to pressure them is absolutely incorrect,” the bank said. “We do not support any views or actions that can be interpreted as supporting homophobia.”

A spokesman told The Australian the bank supported “freedom of religion and freedom of speech” and had no views on Maria Folau’s views.

MORE: Sponsors may pay if Folau wins | Editorial: Corporate activism fine until mob has its say | Janet Albrechtsen: Qantas boss can’t be happy

Other people’s business

The debate over Israel Folau and the role that Rugby Australia’s sponsors may have had in his dismissal for saying gay people were destined for hell is the latest example of corporate Australia and business leaders being drawn into a wide range of issues beyond their core role of running a company.

Corporate leaders are under pressure as a combination of media-savvy activist groups, investor and superannuation fund groups, employees and customers insist that companies state their position on a broad range of issues, from gender diversity to climate change and coalmining.

In some cases, corporate leaders decide to take a public stand, such as on same-sex marriage in 2017, but in other cases, like that of the ANZ, a company is dragged into a social issue for no other reason than it has decided to be a good corporate citizen and sponsor a national sporting team.

Company director and former Business Council of Australia president Graham Bradley says the debate over Folau’s comments and the role of firms in commenting on broader social issues was “complex and nuanced”.

But he adds: “Boards and company management should tread carefully when purporting to speak for their company on politically divisive issues only tangentially relevant to their business.

“It’s particularly important to respect minority sensitivities among employees, customers and shareholders, especially for companies with international businesses.”

Sponsoring strife

AMP chairman and former Commonwealth Bank chief executive David Murray says companies need to think carefully when considering sponsorship. “It is up to each business to figure it out. If a business wants to sponsor something, they have to be very clear what it is that they are sponsoring and that it fits in with their values,” he tells The Australian. “Otherwise they could be forced to withdraw from the sponsorship or get caught up in a debate which might have little to do with their business.

“My personal view is that companies should seek to run a good business and other matters are matters for the law. When you are an employer you don’t get involved in the personal views of your employees, including their religious views.”

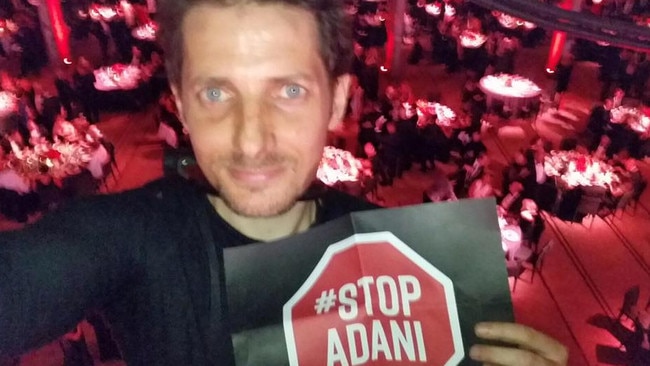

In April 2017, Westpac chief executive Brian Hartzer found himself almost face to face with anti-Adani mine activists at Sydney’s Carriageworks, where his bank was hosting an event to mark its 200th anniversary. While guests were dressing up for the black-tie event, social media was pushing out a call for people to target Westpac over the Adani coalmine in Queensland.

Westpac was not a banker to Adani but activists were pressuring Hartzer to follow the lead of some other financial institutions in publicly stating it would not lend to the company.

As police worked to bring down an activist who chained himself to the roof of Carriageworks late into the evening, Hartzer was forced to call a halt to the function, while declaring the bank would not discuss individual customers.

As groups continued to target some Westpac branches, the bank later put out a statement about its lending to the coalmining industry that effectively ruled out lending to Adani.

Anti-Adani activists later targeted branches of the Commonwealth Bank, part of an effective campaign to stop the big four banks lending for Adani’s proposed Carmichael mine in the Galilee Basin.

South Australian beer company Coopers found itself drawn into the same-sex marriage debate two years ago as a sponsor of the Bible Society, which hosted a video debate on the issue in the run-up to the postal survey.

When the video was criticised by groups supporting same-sex marriage for making light of the issue, Coopers beer was hit by a consumer boycott in key inner-city markets.

The company was forced to distance itself from the Bible Society’s video and put out its own video declaring it was committed to “embracing all Australians”.

Share of responsibility

Shareholders are also increasingly proposing special resolutions at annual general meetings on a range of issues — from executive pay, to climate change and gender equity.

The Australian Council of Superannuation Investors, which controls about 10 per cent of the ASX 200, is pushing hard for companies to incorporate environmental, social and governance principles into corporate strategy.

At Origin Energy, 46 per cent of shareholders supported a resolution last year calling for better reporting on Origin’s direct and indirect policy advocacy via industry associations.

At Whitehaven Coal, 40 per cent of investors called for the company to adopt the international Task Force on Climate-related Financial Disclosures’ framework. Whitehaven has since become the world’s first pure-play coalminer to commit to TCFD.

In April, chocolate brand Cadbury took a public stand against online racism and intolerance, unveiling a “Symbol for All” designed to respond to hate-filled comments on its social-media platforms. The brand also encouraged any person, organisation or company to adopt the symbol by downloading, customising and sharing it on their own channels.

“Every single day Cadbury’s Australian Facebook page is flooded with hateful messages and comments that have nothing to do with chocolate and everything to do with racist sentiment,” Paul Chatfield, the director of marketing for chocolate for Cadbury’s owner, Mondelez International, said at the time.

“As an iconic brand in Australia we have a voice and a responsibility to lead by example, which has been the impetus for the creation of this symbol.”

Diane Smith-Gander, a director of AGL Energy and Wesfarmers and the former chairwoman of ASDA and Basketball Australia, says good companies base their stance on environmental, social and governance issues on a clear understanding of their stakeholder needs. “That makes for a coherent voice and a believable voice,” she says.

Companies could also suffer if they did not take a stand on certain issues. “If a topic is important to your stakeholders and you don’t speak up, that will be damaging,’’ she says. “The Israel Folau matter is not one for business in general. Businesses directly involved, say sponsors, need to act in accordance with their brand values. That’s happening with sponsors dropping Folau.

“Everyone else should leave it to the player, the sport and the sponsors. Their stakeholders will then judge the outcomes, which will impact on their engagement with the sport and the brands associated with it.”

Directors split

KPMG’s global head of human rights and social impact services, Richard Boele — who is conducting a series of seminars across the country for company directors on the federal government’s new laws requiring them to ensure there is no slavery in their supply chain — says directors are divided.

“Some directors were asking: How much more is society expecting the business community to sort out?” he says. “Others were saying that the new legislation was a great opportunity to put a different lens on their business and understand where they might inadvertently be causing harm.

“The new legislation requiring companies to look into their supply chains for instances of modern slavery is part of a growing trend of expectations being put on business to address a whole range of social challenges.”

Boele says the business community now has to deal with “an explosion of requirements around sustainable reporting”.

“We are also seeing an increasing growth in investor requirements of business,” he adds.

While companies have to respond to pressure from activist groups, shareholders and customers on social issues, they also have to be aware of the views of employees, particularly younger staff members.

“Employees these days are asking questions about the purpose of the companies they work for,” he says. “They want to know about the values of the company they work for and whether its values align with their values.

“For companies with relatively young workforces like KPMG this can be critical in attracting the best talent.”

Major investors including superannuation funds can be an important force for pressuring boards of listed companies. The head of advocacy for the Australian Institute of Superannuation Trustees, Ailsa Goodwin, says the superannuation regulator, the Australian Prudential Regulation Authority, has “made it clear that super funds need to consider environmental, social and governance issues as part of their investment decision-making process”.

“Financial returns always come first,” she says. “But if there is evidence to suggest that an ESG issue, such as climate change or labour practices, could impact negatively on the financial returns of an investment, then trustee directors need to consider this.”

This could mean a superannuation fund could sell its shares in a company whose policies it did not agree with, or it could seek to engage with a company on ways to improve practices, Goodwin says.

While the super funds can put pressure on companies, Goodwin says superannuation funds can also face “pressure from a plethora of interest groups to adopt a certain position”.

For major corporations, dealing with pressure to become involved in social and environmental concerns is part of doing business — including part of the reporting requirement for companies listed on the ASX, which has its own corporate governance council setting out guidelines on a wide range of issues.

The line between issues of the boardroom and issues of the society in which it operates is set to become increasingly blurred.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout