Wealthy tipped to ignore discount loss on fees

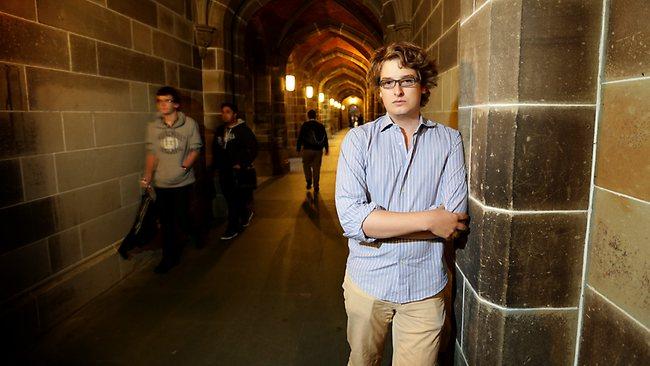

RICHARD Willder says the "affluent groups" won't be deterred by the scrapping of a 10 per cent discount on fees paid in advance.

RICHARD Willder says the "affluent groups" who pay university fees upfront probably won't be deterred by the scrapping of a 10 per cent discount on fees paid in advance.

"They're going to keep paying upfront anyway," says the University of Melbourne student, who has always done so himself.

But Mr Willder says the move will reinforce the intention of many students to avoid repaying their interest-free HECS loans for as long as possible.

"If someone wants to pay upfront, why shouldn't they get an incentive to do so? It benefits everyone," he said.

The 24-year-old, who also volunteers as an intern in the office of a Liberal MP, says the move smacks of class warfare.

"But as far as class warfare goes, it's more reasonable than some of Labor's other policies," he said.

The federal government says 16 per cent of students pay their fees upfront, attracting discounts worth $65 million a year.

It estimates that scrapping the discount, as well as a 5 per cent early HECS payment bonus, will save $230m over four years, with 10 per cent of students continuing to pay in advance.

Grattan Institute higher education expert Andrew Norton suspects the government is right that some will still pay upfront, even though it would make more sense for people to pay off interest-incurring loans such as mortgages.

"Parents want their kids to start their lives free of debt," Mr Norton said. "If you have spare cash,

that seems a reasonable way to spend it."

Former Sydney journalism student Karina Darling worked at a pub to earn money to pay her fees upfront. Her debt-free status helped her obtain a home loan two years after completing her degree.

She said HECS encouraged students into debt. "It's another $30,000 around your neck which people don't think about. Some of these HECS deals can come back to bite you," she said.

Southern Cross University vice-chancellor Peter Lee said the change would deprive the government of upfront cash needed for initiatives such as disability insurance and the National Broadband Network.

Professor Lee said the government would now have to wait for the money to be repaid through the tax system.

"It has improved its balance sheet but made its cash position worse," he said.

Additional reporting: Andrew Trounson, Rosie Lewis