Federal budget 2018: low-paid Aussies the real winners, says Morrison

Scott Morrison says lower income earners will enjoy the biggest percentage reductions in their tax bill.

Scott Morrison has slammed claims high-income earners will reap the bulk of the government’s proposed income tax cuts, suggesting its seven-year tax plan “ran a sword through bracket creep” and lower income earners will enjoy the biggest percentage reductions in their tax bill.

His comments came amid a looming political battle, with Malcolm Turnbull saying the government would not split its two-part tax relief package after Labor only offered to support the first stage for low and middle-income earners, leaving the flattening of tax brackets slated for 2024-25 in doubt. Several Senate crossbenchers, including Pauline Hanson, are also withholding support for the 2024-25 cuts.

In a post-budget lunch address in the Great Hall of Parliament yesterday, the Treasurer said workers earning $30,000 would receive an 8.3 per cent reduction in their tax bill over the course of the seven-year plan, compared with 2.5 per cent of those on $200,000.

“For those on $160,000: 2.4 per cent reduction. For those on $120,000: 2.9 per cent reduction … those on $50,000: 6.3 per cent reduction,” Mr Morrison added, pointing out that the top 1 per cent of taxpayers paid 17 per cent of all income tax.

The government’s tax plan, worth $140 billion over a decade, would provide a tax cut of up to $10 a week for all taxpayers from next year and the abolition of the second-top 37 per cent bracket by 2024 when the top income tax rate threshold would rise from $180,000 to $200,000. Mr Morrison said 94 per cent of all taxpayers would be paying the 32.5 per cent marginal income tax rate by 2027, up from 63 per cent without the reform.

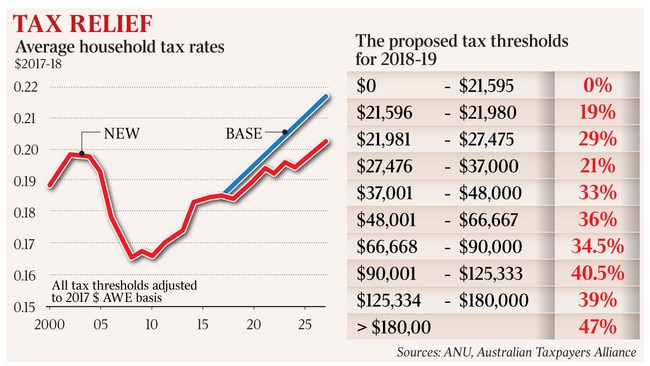

Ben Phillips, an economist at the ANU, said while the government’s proposals provided “significant tax cuts”, they wouldn’t fix bracket creep. “It remains the case that bracket creep will mean that all households will be paying a higher average rate of tax in 2027 compared to 2017 rates,” he said, projecting the average rate for all households would lift from 18.6 per cent now to 20.2 per cent over that time. “Effectively, the tax cuts are not significant enough to overcome bracket creep.”

Mr Phillips’s analysis also showed the reduction in average tax rates by 2027 would be greatest for the top fifth of earners and lowest for the bottom fifth, 1.7 percentage points compared to 0.2.

Separately, the Australian Taxpayers Alliance said the proposed changes would make an already complex system more so.

John Humphreys, its deputy director and an economist at University of Queensland, said the combination of new and existing tax offsets, the Medicare levy and changed income tax schedules would increase the number of effective tax brackets from eight to 10. “These changes are better than nothing. But god-damn, they are far more complicated than necessary, hard to clearly explain, and the marginal tax rates and therefore incentives jump around like a frog on meth,” he said. The interaction of the proposed tax offsets and levy, which includes increasing the low-income tax offset from $445 to $645 from 2022 and introducing a middle income tax offset valued at $530 a year, would cause marginal tax rates to drop from 29 per cent to 21 per cent for incomes between $27,000 and $28,000.

“Even after all these improvements, we are still left with a messy (and sometimes regressive) tax system,” he added.

Mr Morrison also indicated the government wouldn’t let the opposition pick and choose its support for stages of the package, slated to go to parliament next month. “It’s time for Labor to giddy up and support lower, simpler fairer taxes,” he said, suggesting the government’s reform ambitions had been constrained by the Senate, which had failed for two years to pass the company tax cut.

“You’ve got to play the field you’re on,” he said, hinting the government wouldn’t pursue more ambitious reform without a fresh electoral mandate.

Mr Morrison said the progressivity of the tax system was assured, noting the proportion of taxpayers earning above $200,000 a year and paying the top 45 per cent rate of income tax in 2027 would be higher than it is now.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout