Federal budget 2018: Labor sets new rich line at $95,000

Bill Shorten’s budget reply speech revealed a plan to make all workers earning more than $95,450 worse off by 2022.

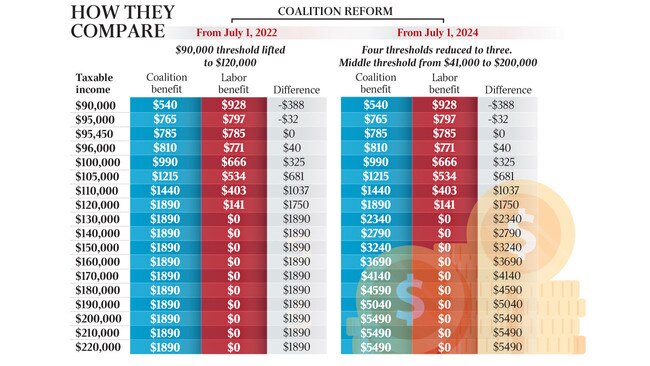

Labor has set a new benchmark for the definition of “rich” after Bill Shorten’s budget reply speech revealed a plan to make all workers earning more than $95,450 worse off by 2022 when compared with the government’s seven-year strategy to slash taxes.

The Opposition Leader’s income tax proposal, centred on a new refund worth up to $928, includes barely any change to the decade-old income tax thresholds faced by middle and higher-income earners.

The Labor plan would leave almost three million taxpayers up to $5490 a year worse off compared with the Coalition plan.

Analysis by The Weekend Australian shows the benefits of Mr Shorten’s $928 proposed offset, withdrawn at a rate of about 2.6c for every dollar earned above $90,000, would be overtaken by the government’s rival plan once an individual’s income exceeded $95,450, making that the pivot point for undecided voters making a choice based on the competing tax policies.

John Humphreys, an economist at the University of Queensland, yesterday warned of a “political class war in the making” following Mr Shorten’s budget reply speech. He singled out the stark difference in Labor’s proposed tax treatment of workers earning between $90,000 and $200,000 a year.

Battlelines for the next election are being drawn around the contrasting tax policies, with Malcolm Turnbull and Mr Shorten locked in a political stand-off that leaves immediate relief for low to middle-income earners in limbo.

The Prime Minister yesterday branded the Opposition Leader “unbelieva-Bill Shorten” for promising in the budget reply address to deliver the policy trifecta of deeper tax relief, greater health and education spending, and a healthier budget bottom line.

“What you saw from the Labor Party was unfunded, uncosted, and unbelieva-Bill Shorten,” Mr Turnbull said. “You can’t believe a word he says … This is the guy who said he gave a gold-plated guarantee that his members of parliament were eligible to sit in the parliament.”

Labor argues the government is holding low-income earners hostage by using legislation to link immediate tax relief for those earning up to $90,000 to a proposed flattening of the tax system from 2024.

Mr Shorten said yesterday the five pending by-elections — four of them triggered by Wednesday’s High Court decision that forced Labor MPs to resign for being dual citizens — would double as a referendum on the competing budget visions. “If you want to see 10 million working Australians get better tax cuts — $928 per year for many of those Australians — if you want to get a better deal for working and middle-class Australians, vote for us,” Mr Shorten said.

The government legislation proposes three stages of tax reform. Labor supports the first phase, which would introduce an annual tax offset worth up to $530 and lift the ceiling on the 32.5 per cent tax bracket from $87,000 to $90,000. Both measures are due to take effect in July.

In his budget reply address, Mr Shorten proposed expanding the government’s tax offset but launched an in-principle assault on phase three of the government’s tax package, which includes a flat 32.5 per cent rate for those on incomes between $41,000 and $200,000 by 2024.

Phase two of the government’s package would take effect in July 2022 and lift the ceiling on the 32.5 per cent tax bracket from $90,000 to $120,000. By 2024, under Labor’s plan, workers earning between $120,000 and $200,000 would be between $36 and $106 a week worse off compared with the government’s plan.

Labor Treasury spokesman Chris Bowen yesterday suggested the government should split its tax package into separate bills to ensure phase one of the tax package could take effect in July and deliver tax relief for low to middle-income earners.

“Is Scott Morrison seriously saying he won’t give low and middle-income earners a tax cut from July 1, 2018, if the parliament doesn’t sign off on massive tax cuts for high-income earners in 2024?”

The government has repeatedly dismissed claims its seven-year tax plan, worth $140 billion over a decade, is tilted towards the rich, pointing out the share of taxpayers in the top tax bracket would increase from 4 per cent in 2016 to 6 per cent by 2024, an increase of almost 400,000 workers.

Former Labor treasurer Wayne Swan in 2011 announced a freeze in indexation of family tax benefits for families earning above $150,000, prompting a debate about who was “rich”.

Under Mr Shorten’s current plan, a tax rate of 49 per cent would apply to those earning more than $180,000. The Coalition’s top rate of 47 per cent, including the Medicare levy, would eventually apply to those earning more than $200,000. “Those on the top rate are now paying 30 per cent of all personal income tax,” Mr Morrison said. “Under our plan, their share will actually rise to 36 per cent, so there is no danger of our system losing its progressivity here.”

Mr Bowen said Labor would reserve its support for the later stages of the government’s plan until a Senate committee report, due next month. “$127bn of the $140bn income tax package occurs outside the forward estimates,” he said. “There’s a major ramp in cost over the medium term, especially after 2024-25 when high-income earners get further tax relief.”

Ben Phillips, at the ANU Centre for Social Research and Methods, said Labor’s plan addressed bracket creep to a “limited extent and certainly much less so than the tax plan of the Coalition”.

The top two income tax thresholds, set at $80,000 and $180,000 in 2008, would have needed to increase to $98,400 and $221,400 had they been indexed to the consumer price index since then.

KPMG chief economist Brendan Rynne said yesterday: “It’s worthwhile recognising that taxable income of $200,000 from July 2024 is equivalent to $162,600 in today’s dollars if average wages growth is 3 per cent per annum between now and then.”

The number of taxpayers earning more than $95,000 will increase from two million this year to 2.96 million by 2022, according the Parliamentary Budget Office.

John Wanna, professor of public administration at the Australian National University, questioned yesterday whether either party’s proposals were genuine tax cuts.

“Offsets, rebates, low-income supplements, concessionary measures, call them what you will … they are also a form of welfare payment,” he told The Weekend Australian.

“The only difference between these repayments and normal welfare is that most welfare recipients are dependent upon welfare benefits, whereas these are for people earning some income and then being made slightly wealthier by government,” he said.

Labor’s offset would lift the effective marginal tax rate to 41.6 per cent for incomes between $90,000 and $125,400.

The combination of the 2 per cent Medicare Levy and Labor’s offset, which would be withdrawn at the rate of 2.6c for every dollar of income between $90,000 and $125,400, complicates the effective tax schedule.

“The government wants to charge workers earning between $90k and $200k a 34.5 per cent marginal tax rate, while Labor has proposed marginal rates of 41.6 per cent, 39 per cent, and 47 per cent (not including the deficit levy) for the same cohort,” Dr Humphreys said.

“Under Labor, the confusion and complexity of the Low to Middle Income Earner Tax Offset would be permanent, resulting in 10 tax brackets and three moments of regressive tax ... compared to the government’s final proposal of eight tax brackets and two moments of regressive tax,” Dr Humphreys said.

“Sadly, neither side of politics shows the slightest awareness that these regressive moments even exist.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout