Federal budget 2018: Bill Shorten’s old plan: three tiers, top rate of 30c

A three-tier tax plan with a top rate of just 30c in the dollar was Bill Shorten’s economic pitch 13 years ago when he was AWU boss.

A three-tier tax plan with a top rate of just 30c in the dollar for those earning more than $100,000 was Bill Shorten’s central economic pitch to the ALP when he was campaigning to enter parliament.

The Opposition Leader’s trenchant opposition to the Coalition’s $140 billion, 10-year, three-tier, personal income tax cut plan is the new battleground for the next election.

Labor has accused the government of creating an “unfair” system that gives the biggest tax breaks to the highest income earners — those over $200,000 — and big business.

But in 2005, as then AWU national secretary, Mr Shorten strongly advocated “fair dinkum reform” that would leave just three tax rates to provide incentive for workers.

In a series of speeches and interviews from April to November 2005, Mr Shorten advocated three tax rates: 10c in the dollar for those earning below $50,000, 20c for incomes between $50,000 and $100,000 and 30c for those on the highest incomes above $100,000.

Under Mr Shorten’s current plan, top income earners would pay 49c in the dollar.

Mr Shorten is opposing Malcolm Turnbull’s budget plans to effectively eliminate tax bracket creep, with a three-tier tax system in which those earning more than $200,000 will pay 47c in the dollar by 2024-25.

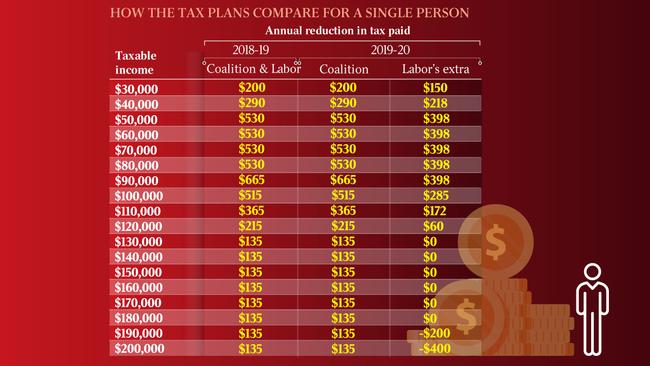

Labor and crossbench senators are supporting the first steps of the Coalition’s budget plan to offer tax relief to those earning less than $90,000 but is demanding costings and justification for tax cuts of about $125bn for all taxpayers, including those earning more than $200,000.

Mr Shorten said yesterday he had previously supported flatter tax rates and still did but “I also do so on the basis of fairness”.

In 2005, Mr Shorten said he agreed with Mr Turnbull, then a Liberal backbencher, putting pressure on treasurer Peter Costello by “highlighting the special injustice of the current tax system in giving breaks to the better off (like Malcolm) while hitting the worse off hardest”.

Mr Shorten also supported an increase in the annual immigration rate to 200,000 people to help “regional growth” and fill the skills shortage at the time.

In recent months there has been a furious debate within the Coalition about cutting the current immigration from 190,000 people a year by at least 20,000.

Mr Turnbull’s proposal in 2005 was to have a three-tiered system of 15c in the dollar, 30c and 35c, with the top rate cutting in at an income of $125,000.

“A large gap between the top personal income tax rate and the company tax rate creates an incentive to redefine personal income as company income,” Mr Shorten said in a 2005 speech to the Fabian Society in Melbourne. “The maximum marginal income tax rate cuts in at a relatively low-income level, which harms work incentives and skill acquisition. As a union, the AWU is doing what it can for members to combat the worst impacts of this rotten tax system by negotiating higher wages, but radical surgery is required. All this tinkering about, offering people $6-a-week tax cuts, is just putting lipstick on the tax system.”

Mr Shorten said that “the promised benefits of the GST are not materialising for middle-class workers”. “Despite becoming the highest-taxing government in Australian history, the Coalition has created a tax system that is unfair and eroding incentives for saving, productivity and participation in the labour market,” he said in the 2005 speech.

“Since the introduction of the GST, total income tax collections increased by 31 per cent to $101.2bn in 2003-04 — up from $77.2bn in 2000-01.”

In November 2005 Mr Shorten told The Age he was willing to have his scheme “subjected to rigorous economic modelling” but it would be funded by “cutting all the business rorts and business welfare”.

The Coalition’s proposed $140bn personal income tax cut plan over 10 years includes a flat rate tax of 32.5 per cent for those on incomes of between $41,000 and $200,000 by 2024-25 by abolishing the existing second-top 37 per cent bracket.

From July 1, the first steps of the plan provide a new non-refundable tax offset of $530 for those earning between $48,000 and $90,000 and to raise the threshold for the 32.5 per cent tax rate from $87,000 to $90,000.