Federal budget 2018: Bill Shorten ups ante in tax cuts battle

Bill Shorten has pledged to almost double the annual cash handouts for low to middle income workers to $928.

Bill Shorten has intensified his class-war attack on the Turnbull government, pledging to almost double the annual cash handouts for low to middle income workers to $928 while leaving those he claims to be rich on what will be the highest top tax rate in more than 25 years.

The Labor leader has also promised a $2.8 billion “better hospitals fund” for more beds, nurses and doctors and a $470 million plan for 100,000 fee-free TAFE places, as well as vowing to launch an industrial relations crusade on wages while setting up a special prosecutor to go after the banks.

Mr Shorten also promised a “better NBN” without specifying how it would be funded.

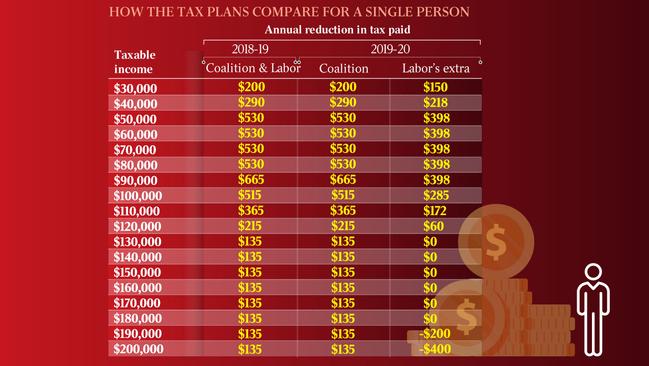

Moving to outbid Scott Morrison on tax cuts in his budget reply speech last night, the Labor leader committed to give workers an extra $398 in tax offsets on top of the $530 a year announced by the Treasurer in Tuesday’s budget.

But they would not apply until a year later, in 2019-20.

The opposition’s alternative tax plan would cost the budget a further $5.8bn over three years. The total costed promises announced amounted to new spending of more than $7bn over the forward estimates, raising questions about Mr Shorten’s claim he would match the government’s commitment to an early return to surplus by next year.

The Opposition Leader also signalled that Labor would reverse the government’s already legislated company tax cuts by claiming savings of “$80bn”.

But Mr Shorten was embarrassed later when he tweeted a summary of his speech with the dot points incorrectly numbered. “Bill Shorten’s numbers don’t add up. He can’t even count to five properly,’’ Finance Minister Mathias Cormann tweeted in response.

Bill Shorten’s numbers don’t add up. He can’t even count to five properly. He can’t be trusted with our economy or our Budget. #canttrustbill #cantaddup #shiftybill #budgetreply18 pic.twitter.com/sdnSpQysuX

— Mathias Cormann (@MathiasCormann) May 10, 2018

Mr Shorten, positioning for a potential early election, used his speech to take up the Coalition’s challenge for a battle over tax, claiming Labor would help lower-income workers over those on higher incomes.

Accusing the government of a “mates’ rates” tax plan, Mr Shorten offered handouts limited to tax offsets that would see those on wages of $50,000 to $90,000 receive the full $928 before tapering off to $140 for someone on $120,000. “We will support the government’s tax cut this year — and in our first budget, we will deliver a bigger and better tax cut for 10 million working Australians,” Mr Shorten said.

“At the next election there will be a very clear choice on tax. How can it be fair for a carer on $40,000 to pay the same tax rate as a doctor on $200,000? For a cleaner to pay the same tax rate as a CEO.”

The “Working Australians Tax Refund” plan leaves tax brackets unchanged beyond the first phase of the government’s changes due on July 1. Workers on wages of more than $180,000 a year would also have to pay a top tax rate of 49 per cent because of Labor’s promise to reimpose the 2 per cent debt and deficit levy that had been abolished by Mr Morrison. This would return the top rate to levels last seen in the late 1980s.

Mr Shorten claimed his scheme would offer a larger tax benefit to 10 million Australians — more than what was on offer from the government, with more than four million workers getting the full $928 benefit.

Malcolm Turnbull said yesterday there had never been a starker policy difference between Labor and the Coalition.

“They are for higher taxes, massively higher taxes on everybody, we are for lower taxes, we are for a stronger economy, they are for a weaker economy, we are for more jobs they are for fewer jobs,” the Prime Minister said.

Mr Shorten’s speech did not include any detail on when Labor would pledge to bring the budget back to surplus nor by how much. Despite boasting to pay off debt faster, there was no detail on how this would be achieved.

“We can pay down national debt faster because we’re not giving $80bn away to multinationals and because we’ve made the tough decisions to reform our taxation system,” he said. He pledged $25 million for a special taskforce in the Officer of the Commonwealth Director of Public Prosecutions to work with the financial services royal commission.

A Labor government would waive upfront fees for 100,000 students to attend TAFE in courses in a skills drive that would cost $473m over the forward estimates and $708m over the medium term.

It would also boost health services to the regions with $80m for MRI machines and 500,000 more scans funded by Medicare.

Finance Minister Mathias Cormann claimed Mr Shorten’s tax plan would cost jobs and hurt families. He said the last time Labor delivered a surplus was in 1989.

Mr Morrison said Labor’s tax alternative would keep low and middle-income earners from ever aspiring to earn more. “He is also spending money he doesn’t have,” the Treasurer said.

Additional reporting: Rachel Baxendale