Federal budget 2018: Almost back in black as $126bn sliced off debt

Booming revenues and a fresh push to get spending under control have lopped $126bn off the future debt burden.

Booming tax revenues and a fresh push to get spending under control have lopped $126 billion off the government’s future debt burden, helping shield the budget from a looming rise in global interest rates.

For the first time since the financial crisis more than a decade ago, the government has pencilled in a fall in the actual dollar value of the federal government’s total debt, which is now expected to stand at $558bn by 2028 rather than the $684bn projected as recently as December.

“It has been a long road back from where we started in 2013,” Scott Morrison said in his budget speech last night. “With the budget returning to balance, we will start paying down debt.”

The budget deficit is expected to shrink from $18.2bn this year to a surplus — the first since 2008 — of $2.2bn in 2019-20, a year earlier than expected.

“This year, government is no longer borrowing to meet recurrent spending — the first time in a decade,” the budget papers state in a document unusually bereft of new, vote-buying spending proposals in what could be an election year.

Booming company tax collections on the back of elevated iron ore and coal prices, combined with strong jobs growth, are propelling the government back into the black earlier than envisaged, sharply reducing its future outstanding debts.

“As a government, we have put constraints on how much we spend and how much we tax, to grow our economy and responsibly repair the budget,” the Treasurer said.

“Real expenditure growth remains below 2 per cent, the most restrained of any government in more than 50 years.”

Closely watched growth in total government payments, expected to hit $484bn next financial year, has accelerated from 1.3 per cent three years ago to 3.1 per cent next year before dropping sharply to 0.2 per cent in 2020. Under Labor, spending growth had surged to 12.7 per cent in 2009 during the financial crisis and its aftermath.

The stock of federal government debt, only a year ago projected to burst through $720bn by 2027, is now expected to peak at about $600bn from 2021 before steadily falling after 2026.

Just less than 60 per cent of the government’s debt is held by foreigners, down from almost 80 per cent in 2012.

The improvements will help scupper claims the Coalition has not been fulfilling its promise to pay down debt and bring about a “clear path to surplus” of at least 1 per cent of GDP “as soon as possible”.

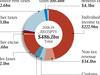

Government receipts, which include tax and income from government-owned corporations, are on track to swell from $445bn, or 24.3 per cent of national income this year, to 25.3 per cent by 2020, which would be the highest share since 2006.

Government payments as a share of GDP are forecast to rise from 25.1 per cent of GDP to 25.4 per cent next year before dropping to 24.7 per cent by 2022, down from a record high since the 1970s of 25.9 per cent in the wake of the financial crisis.

Next year, the government will pay about $18.5bn in interest before falling to $17.2bn by 2022. The government is expecting its 10-year borrowing costs to rise from just under 3 per cent to about 5 per cent over the next decade.

“We have retained Australia’s international AAA credit rating from all agencies, one of only 10 countries in the world to do so,” Mr Morrison said.

Standard and Poor’s has placed the government on “negative outlook”, which means it has considered stripping the government of its coveted AAA rating.

Net debt, which cordons off a portion of the $141bn Future Fund and other financial assets, will peak at 18.6 per cent of GDP this year, falling to 3.8 per cent by 2029.

Improved economic circumstances have added more than $35bn to government coffers over this and the next four years, about $20bn of which the government is putting towards paying down debt more quickly.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout