This week’s move by the US Treasury, Federal Reserve and US bank regulator FDIC, to reassure depositors in failed Silicon Valley Bank they will get their cash back and stop the contagion spreading to other lenders, is now spreading through global markets.

Bank stocks from Australia, Japan and into Europe have been hammered as the world also resets expectations for the path of interest rate hikes.

Australian banks have also been hit with heavy share losses this week, although all have so-far contained the selldown to mid-to-high single digits. It’s going to be a precarious few days for banks.

The worry is the prospect of the domino effect as other countries may seek to insulate their respective banking systems, given US deposits – no matter the size — are now being given reassurances of protection from Washington. The first country to buckle could set off a massive chain reaction. Thankfully none have yet.

It would be tempting for big corporates across the world and pension funds to take on currency risk and park their spare cash with a US bank. Chief financial officers would be well aware this is a fragile time and the aim of the game is to minimise risk.

Here Treasurer Jim Chalmers would be acutely aware former treasurer Wayne Swan and former treasury secretary Ken Henry were architects of the Australian guarantee scheme. Swan and Henry introduced a universal guarantee in late 2008 for hundreds of billions of bank deposits shortly after the collapse of Lehman Brothers to sandbag the Australian banking sector.

The Australian guarantee came about in response to other countries, led by Ireland, following one another in quick succession in introducing guarantees to support their own domestic banks. When this happens other governments have little option but to follow given it makes it untenable for banks without a generous guarantee to secure funding and deposits.

Canberra’s program filled the gap where no formal guarantee existed. It was eventually wound back to a $1m deposit protection and then pared back to $250,000 which exists today. Remember it was up to $US250,000 of deposits that were insured in SVB, but that didn’t stop failure. Indeed a staggering 96 per cent of the California-based bank’s deposits were above the cap.

Ironically it was the universal guarantee that undercut ANZ’s need to buy out Suncorp’s banking arm at the time with the regional lender struggling under rising bad debts. Fast forward today and ANZ and Suncorp agreed last year to a buyout deal which is now waiting for the green light from competition regulators.

This week the US regulators have said all depositors will have access to all of their savings in the failed SVB. This means cashed-up Silicon Valley venture capitalists to Australian tech companies with funds in SVB can get their deposits. They extended the same guarantee for crypto-focused lender New York’s Signature Bank, which was also shut down by regulators on Sunday. Expect similar explicit guarantees for the next struggling bank and the next one.

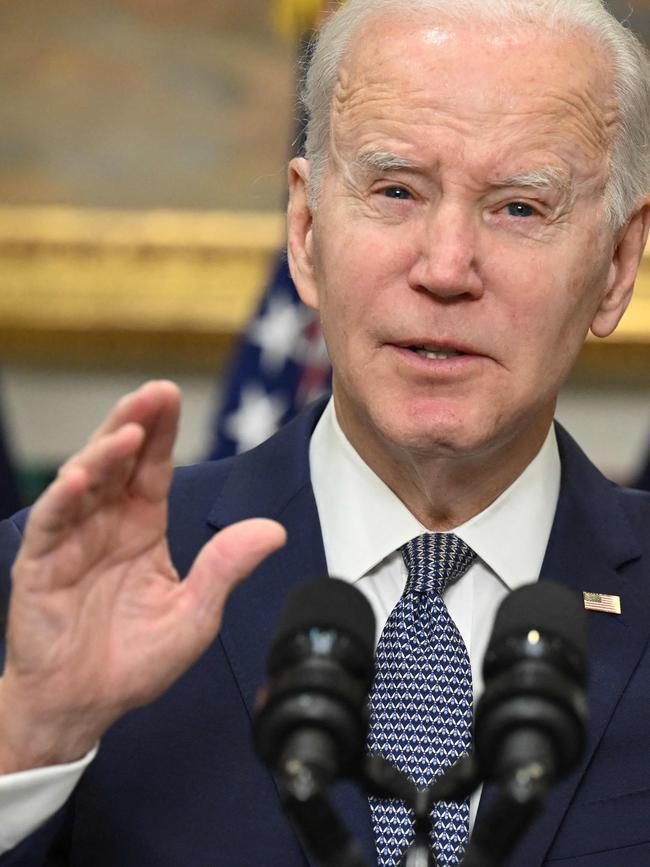

Going a step further, the US Fed has opened a liquidity facility for all US banks to pay out all demands of deposit holders. This is as close as you can get to a guarantee without saying it. (US President Biden calls it a reassurance.)

This will add a distortion on top of a distortion. Already financial markets are being twisted in new ways as central banks unleash fast-paced interest rate rises in order to deliberately slow economies to control inflation.

Clearly US financial regulators have been caught in a dilemma. They need to draw a line at banks that have stumbled on their bad mistakes — including funding cryptocurrency. But they also know a collapse at one bank can suck in the entire sector. Regulators in the US clearly were worried enough that SVB’s woes would expose issues across the entire mid-tier rump of the US banking system, including the expected fallout from fast-rising interest rates.

Wayne Byres, the former boss of Australian bank regulator APRA, at his retirement speech last October said there is often a bigger cost when a government’s first reaction is to provide a backstop to cover failure. It creates “a moral hazard in which the downside from risk-taking is underestimated at best, and ignored at worst”.

SVB’s woes were unique. It wasn’t groaning under bad debts or access to funding markets. Its problems come down to too many deposits sitting in unhedged low risk US government bonds and mortgage securities – instruments that come with slightly higher risk. With unemployment incredibly low across most developed economies, including the US the balance of bank balance sheets have never been stronger. Since the GFC, banks have been forced to improve their liquidity and hold more capital to act as a cushion to economic shocks.

Significantly for money markets SVB’s woes are not a result of a funding squeeze which sucked in most Wall Street banks when Lehman Brothers collapsed.

More of a case, SVB had too much funds — more than $US100bn ($149bn) — sitting in the wrong place which wiped out its capital as interest rates moved against it. It had to realise these losses as its VC customers and tech companies began drawing on deposits to meet their own funding squeeze as sharemarkets collapsed last year.

In short, it was a Silicon Valley bet on interest rates staying lower for longer that was clumsy and went badly wrong. Questions will surely be asked how SVB’s glaring balance sheet mismatch could go unchecked by bank regulators in a fast-rising interest rate environment.

Regulators such as the Bank of International Settlements have talked about their biggest fear is the trillions of dollars in interest rate risk sitting hidden in private markets such as pension funds and investment funds. The risks at SVB were in plain sight.

johnstone@theaustralian.com.au

The effective guarantee of unlimited funds across the entire American banking system is a new financial distortion that dramatically raises pressure on other governments to make their own promise of a financial backstop to stop funds rushing out of the doors and into the US.