It’s a long time since I have read an article in Time. In fact, I’m with Donald Trump on this issue, unaware that the magazine was even still going.

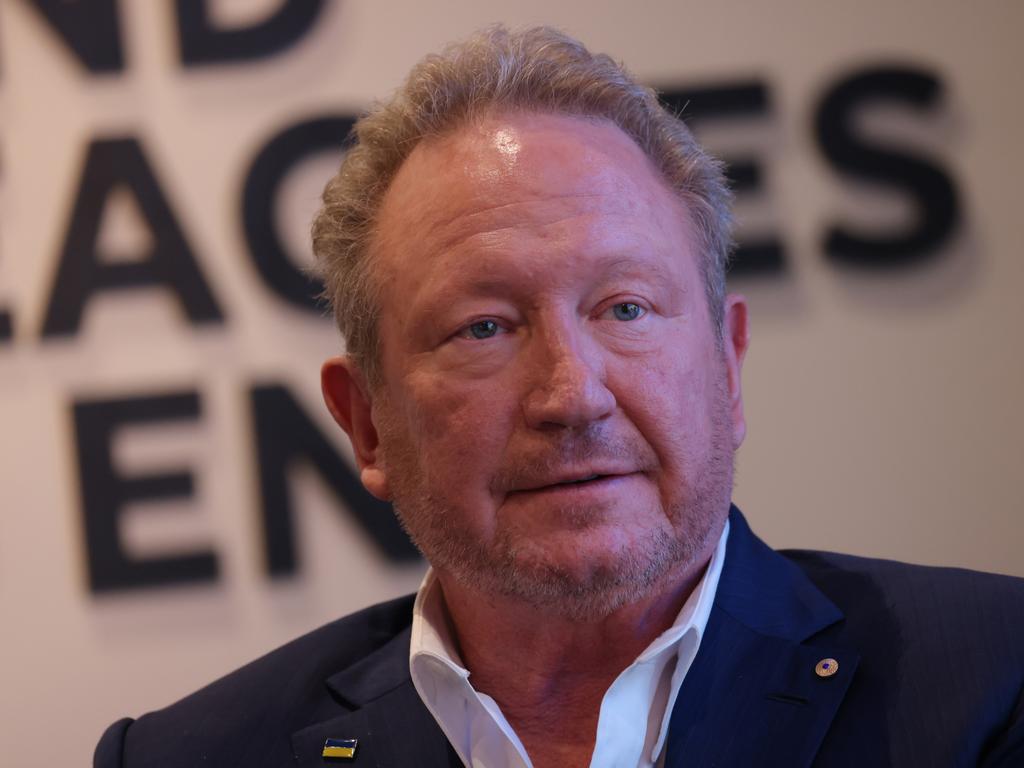

But I was alerted to a long essay about our very own Andrew “Twiggy” Forrest, published late last month in Time, under the title, A Mining Billionaire’s Case for Ditching Fossil Fuels.

It’s worth starting at the end, where the reader is informed that Time receives support for climate coverage from the Outrider Foundation. Evidently, this foundation “is an environmentalist advocacy organisation based in Madison, Wisconsin, that promotes climate change advocacy and criticises nuclear weapons, mainly through financial support for reporting in mainstream journalistic outlets”.

Well-known climate academic Michael Mann, of the hockey stick graph fame, is on the advisory board. By rights, this article should have had SPONSORED stamped on every page. There is more than a touch of irony about the basis of the article: the journalist jetting around the world with Twiggy in Forrest’s personal jet. It’s Las Vegas one day, Davos another, the outback in Western Australia on yet another. There is a slap-up lunch at a “luxurious Paris brasserie”. At one stage, Twiggy makes a quick side-trip to Munich to meet the Ukrainian President Volodymyr Zelensky. For those with the travel bug, it was a journalist’s dream assignment.

To give you a flavour of this longwinded hagiographic piece, while also allowing you to give it a miss, take this bit of vacuous bilge: “His soup turning cold, he grabs my lapels and rattles off the facts as he sees them: fossil-fuel industry executives are ‘culprits’, doing all they can to resist a transition to a cleaner economy.

“It’s time for businesses to stop talking about long-term targets … and completely ditch fossil fuels in the coming years rather than in the coming decades.

“ ‘If you think you can’t go green, then you’re right,’ he says of his industry colleagues. ‘It’s time for you to get off the stage and learn from someone with more talent, more conviction, or initiative …’.” What? Someone like Twiggy, perhaps?

Of course, he is well-known for his climate zealotry as well as his penchant for publicity-seeking stunts. He is also a man in a hurry. He doesn’t like the term net zero, preferring real zero. He puts a timeframe of five years on his ambitions.

Who can forget the green-painted London cabs, underground carriages and billboards emblazoned with the message “Green hydrogen can save us. But waiting for it won’t”, along with the Fortescue Future Industries logo? This was done to coincide with the COP climate conference held in Glasgow in 2021. Then there was Twiggy’s hydrogen-powered ship docked at the Dubai COP in 2023.

You need to get to page 10 of the 14-page article for green hydrogen to be mentioned. There we learn that climate-related investments are not philanthropy but a highway to superior financial returns: “For his electrification drive – think of the mining trucks or mining-site operations – the promise is savings as the upfront costs reduce fuel usage. It also brings with it knock-on financial benefits: creating ‘green iron ore’ and ‘green steel’, as its customers look to decarbonise their own products.”

It’s at this point we are told “the most significant of the new technologies is green hydrogen; this green fuel can replace fossil fuels in heavy industry and transportation. The company is spending hundreds of millions of dollars a year to build out green-hydrogen production facilities, in Australia, the US, Norway and Brazil.”

For anyone following the developments in green hydrogen, this journalist is way off the pace.

Not only has Twiggy himself shelved most of his green hydrogen projects – the cost of electricity generated from renewable energy is too high and unavailable, there are no offtake customers, among other things – but the nascent industry worldwide has been experiencing a major downturn.

It is now widely accepted that hydrogen won’t be used much in road transport or as a source of home heating, at least in the coming decades. It will have limited use in some industries but it’s most likely that the hydrogen will be sourced from natural gas.

Of course, sponsored journalism can still be high quality; this piece in Time is not a case in point. The author, Justin Worland, fails to mention the problems that FFI encountered, including the substantial turnover of staff, loss of jobs and the shelving of various projects.

Twiggy’s words are one thing – “we’re staying the course”, “real zero is completely bankable” – but his actions tell another more nuanced story. The shareholders of the parent company are becoming impatient as the share price of Fortescue Limited suffers a significant fall. It has declined by more than 20 per cent since May 2024 while the share prices of other iron ore stocks have barely moved.

After Twiggy’s catastrophic Anaconda corporate experiment involving nickel, Fortescue has been able to ride the commodity price cycle with inferior ore bodies and the booming Chinese steel producers happy to take the output. It has been a substantial achievement by any measure.

But when it comes to Twiggy’s venture into green investments, it’s a different story.

To be sure, there are a number of subsidised investments bedded down, including wind farms and solar installations. But the future of many of its planned projects and initiatives are up in the air.

This is all occurring against the backdrop of the election of the Trump administration and that country’s withdrawal from the Paris Agreement. At the same time, large British oil and gas company BP has had to walk back its green ambitions and ramp up its investment in oil and gas. The current chief executive now maintains the company moved “too far, too fast” in seeking to reach net zero by 2030. Investments in renewable energy projects have been significantly scaled back, with several green assets up for sale.

One of the drivers in this change of direction is the share price underperformance of BP relative to other large oil and gas companies. BP failed to take advantage of the surging price of oil and gas from 2022.

There is a message there for other companies whose leaders think that going green is a guaranteed highway to superior shareholder returns and a rising share price. Recent experience points in the other direction completely.

When thinking about the great figures of Australian mining, it’s hard to go past some of the committed geologists and company executives who turned dreams into profitable reality. You can go back to Charles Rasp who discovered Broken Hill, Lewis Weeks who discovered oil and gas in Bass Strait, Roy Woodall who got Olympic Dam going, Morrie Mawby, George Fisher, Essington Lewis, Arvi Parbo, Lang Hancock, Hugh Morgan, Rod Carnegie and others.

But the key here is that Twiggy Forrest would not make either the first or second XI.