Stop pumping cash down the Snowy 2.0 drain

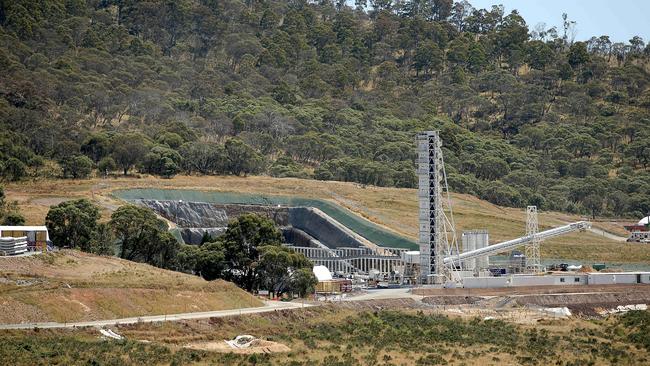

With further multi-year delays, skyrocketing costs, billions of dollars’ worth of contractor claims, the scrapping of the fixed-price contract, the 15-month “pausing” (so far) of the tunnel boring machine and mounting environmental damage to Kosciuszko National Park, the list of problems keeps snowballing.

But an overlooked consequence of this debacle is that it is the taxpayer shareholders, through the Australian government, who are footing the bill.

Initially we were assured that Snowy Hydro would take on the risks and costs of Snowy 2.0, with absolutely no need for public funding. That was never really the case, but the assurance finally has been dashed by a single-sentence revelation in the depths of the 2023-24 budget papers: “The Australian government has committed to provide additional equity to Snowy Hydro Limited to support the delivery of the Snowy 2.0 pumped hydro project and the Hunter Power Project.” Astoundingly – despite the tight budgetary situation – the government quietly has committed additional, unlimited, taxpayer funds to build the two mega-projects without any review and regardless of their cost or viability.

Apparently the amount is to be determined after the completion of “cost and schedule reviews currently under way on both projects”, and will be on top of the $2bn provided previously, $1.4bn for Snowy 2.0 and $600m for the HPP.

When Snowy 2.0 was announced, Snowy Hydro and the Turnbull government gave repeated assurances that no taxpayer support was required: “Snowy 2.0 won’t be a cost to taxpayers, we will be paying for this out of the balance sheet of Snowy Hydro,” said its former chief executive, Paul Broad, back in 2017.

This view was reiterated later that year by prime minister Malcolm Turnbull: “Snowy Hydro can finance the project itself using retained earnings and borrowing; Snowy 2.0 will start operations from 2024.”

However, a year after the feasibility study concluded no taxpayer funds were required, Snowy Hydro requested $1.4bn so Snowy 2.0 could be built without triggering a credit rating downgrade.

The Morrison government acquiesced, announcing its approval of Snowy 2.0 in February 2019 and dutifully providing $1.4bn. But Snowy Hydro underestimated the quantum required, as its credit rating was downgraded anyway 18 months later from A- to BBB+.

S&P Ratings also warned of “a high likelihood of extraordinary government support” needed to avoid another downgrade. It further cautioned that Snowy Hydro’s balance sheet could not fund another major project, such as the Kurri Kurri gas power station being mooted at the time (now called HPP), without the government paying the full cost.

Accordingly, the announcement of the HPP in June 2021 came with $600m of government funding for the project’s then estimated cost.

Snowy Hydro resumed another round of assurances that no more public funding would be required, until as recently as three months before the budget in May: “At this stage there are no current plans for any additional shareholder equity beyond the current arrangements for Snowy 2.0 and Hunter Power Project”.

That assurance has been broken again, with the budget effectively giving Snowy Hydro an open cheque, committing whatever it takes to complete both projects – “extraordinary government support” indeed.

No doubt this commitment – now seemingly unlimited – came at Snowy Hydro’s request, despite assurances otherwise.

The certainty of additional government support has resulted in S&P restoring Snowy Hydro’s credit outlook to stable in June. But it also came with a downgrading of the stand-alone credit profile from BB+ to BB, meaning without government support Snowy Hydro debt would be regarded as junk.

The immediate concern is how much public funding is needed this time. Last time $1.4bn was insufficient to avoid a credit rating downgrade when the estimated cost of Snowy 2.0 almost doubled from $2bn to $3.8bn.

Much more will be required this time as the cost for Snowy 2.0 and HPP continue to skyrocket. Snowy Hydro confirmed at Senate estimates in May the cost of Snowy 2.0 would be higher than the current estimate of $5.9bn, which of itself does not include all project costs.

Industry experts have been predicting for some time that Snowy 2.0 will cost more than 10bn, plus another $10bn for transmission connections, and that HPP will cost more than $1bn, including its gas connection and storage system. At such eye-watering costs, for an inefficient 2000-megawatt battery and a 10-hour duration 660MW gas power station, neither project is economic nor could ever recoup the public funding.

But the financial impact on the taxpayer is actually worse. As well as having to finance every extra dollar outlaid on these projects, the dividends paid to the government by Snowy Hydro are declining, partly due to Snowy 2.0’s financing costs – a double whammy.

Dividends have halved across the past four years to as low as $123m in FY2021 and are unlikely to pick up for many years, if ever. Current dividends constitute a meagre 2 per cent return on Snowy Hydro’s market value ($7.8bn in 2018).

We soon will know how many more billions of public funds are needed on top of the $2bn provided so far. Depressingly – going on previous estimates and assurances by Snowy Hydro – the additional funding is unlikely to be enough.

There’s no end in sight for Snowy 2.0’s woes, with seven or more years of construction to go.

With additional public money about to be sunk and environmental destruction yet to be wreaked on Kosciuszko National Park, it would be irresponsible for the government to not review the project, thinking that Snowy 2.0 is too far gone and there is no alternative but to stumble on.

At the very least a comprehensive independent review of Snowy 2.0 (and HPP) must be commissioned. Experts have been urging such a review for years to provide a thorough, objective assessment from which the government can make the best possible decision for all Australians – regrettably now a question of choosing the least-worst option.

Surely we are well beyond the point where enough is enough.

Blindly pumping many more billions down the Snowy Hydro drain is not the answer. There are far better ways to support our nation’s energy transition.

Ted Woodley is former managing director of PowerNet, GasNet, EnergyAustralia, China Light & Power Systems (Hong Kong) and is a board member of NSW National Parks Association.

The Snowy 2.0 project keeps making headlines for all the wrong reasons.