And the key issue in any appointment to this role is the maintenance of independence.

The markets may not react well.

For the simple reason that the job of the central bank in an inflationary environment is that it meets the community expectations and economic imperatives to get prices under control.

It should be impervious to the government’s political objectives or political pressure.

Some may argue that public servants are trained to serve the government. And in installing a public servant to this role without a sufficient gap in tenure could risk undermining the bank’s independence.

But these are different times.

It may be now irrelevant that it hasn’t happened since Peter Costello established the formal independence of the bank in 1996 with the statement of monetary policy that set out clear objectives for the bank and the processes for achieving those objectives.

But then it may be.

Costello wanted to legislate it.

The last treasury secretary to be appointed to the role was Bernie Fraser in 1989 – appointed by the Hawke government. His tenure was ended by Costello in 1996 before Fraser fired off some parting shots about the character of politicians.

Fraser would protest the bank was independent. Keating would argue he had them in his pockets.

Now the two names have been thrown about in the speculation over who the new Labor government may appoint to replace Lowe – if indeed it is to not be Lowe himself – without any apparent care to the implications of what is being suggested.

They are Treasury secretary Steven Kennedy – who is close to Chalmers but was also close to Josh Frydenberg – and Finance secretary Jenny Wilkinson who is highly rated by the Albanese government.

They are indeed two very fine public servants. But the fundamental question remains.

How would the markets react? And what advice would the head of prime minister and cabinet be providing in terms of the perception of the maintenance of central bank independence?

In weighing all this up, Treasurer Jim Chalmers should be at least considering casting the net wider for candidates. And overseas if necessary.

He would be well served to look to the example of Jerome Powell, the chair of the US federal reserve in seeking to guide monetary policy and public confidence into the future – considering the latter has been trashed.

Powell comes from a business background – he is not an economist – although he is formally literate in economics.

He went hard early on interest rates and has now got the US to a point that inflation is now running below the cash rate which is where you want to get to in the inflation fight.

Australia is not near this point yet.

Powell is a credible figure in the US despite the pain he has inflicted. Unlike Lowe, and perhaps unfairly.

He is also well served by being a good communicator, bearing in mind the guardrails around public communications from a central bank.

A few words in the wrong place can shift markets and uproot lives.

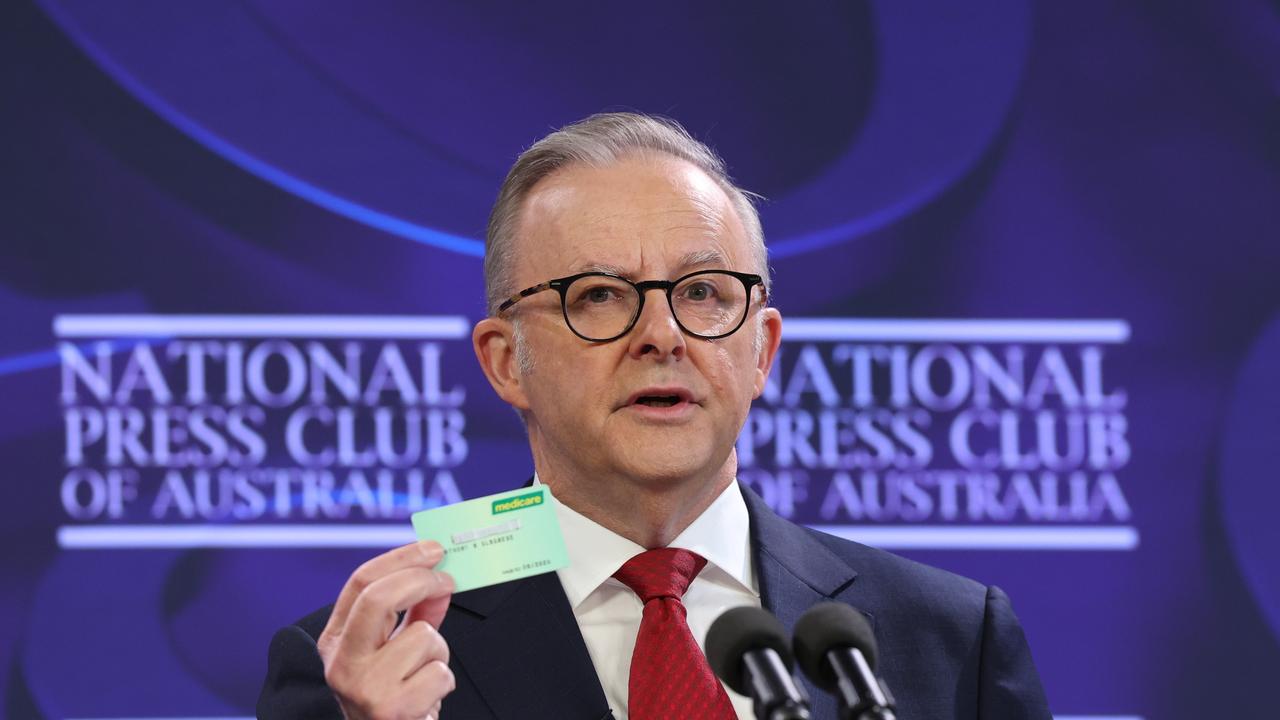

If Jim Chalmers is seriously contemplating appointing a serving public servant to replace Phil Lowe as the next central bank boss, he risks setting back the nation to an era before the formal operational independence of the central bank.