For this reason alone, household consumption numbers in the latest quarterly accounts are perhaps the most politically potent.

The GDP growth of 0.2 per cent for the quarter was as expected.

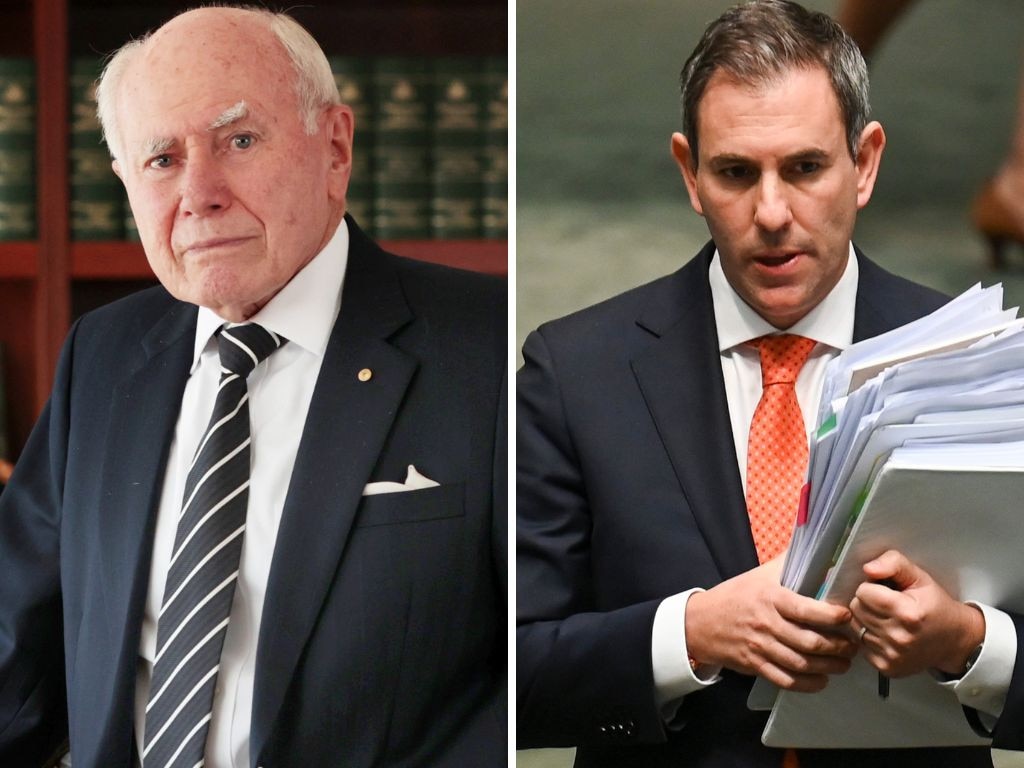

While growth is now the weakest outside the pandemic since the 1990s recession, Chalmers makes a virtue of government spending to keep the economy out of recession.

Yet this just gives more weight to the argument that public demand is also keeping inflation higher for longer. If we didn’t have the spending Chalmers boasts of, we would probably have negative GDP growth, which might have brought down aggregate demand and inflation may have been lower, hence the chance of an earlier interest rate cut may have been higher.

Chalmers has taken a different path than Australia’s peers. This was a choice he settled on earlier this year.

The main reason inflation hasn’t come down as fast as other countries may have less to do with government spending than the RBA’s decision to not push rates as high as other countries.

Yet Chalmers’s focus shifted in February when he started to see other country’s economies falter.

He saw greater political risk in a recession than in prolonged inflation. And this is the source of the political contest at the moment – between Chalmers and the Reserve Bank and the government and the opposition.

In Britain, Canada and the US, rates were higher, inflation came down quicker but all three experienced recession and unemployment rates higher than Australia.

As economist Saul Eslake says, it has been a trade-off by both the RBA and the government. And he says while you could argue that population growth has helped keep Australia out of technical recession, all three of the comparable countries mentioned all had higher population growth than Australia.

Eslake says the odd thing about Chalmers veiled attack on the RBA that it was smashing the economy with high interest rates was that it hadn’t been smashed and the whole point of monetary policy in fighting inflation anyway was to cool the economy in order to bring it down.

Again, this raise doubts about the Albanese government and the RBA being on the same page when it comes to inflation.

The national accounts numbers suggest they are working at cross-purposes.

The negative view of the national account numbers is that they confirm that Australia has been in a GDP per capita recession for seven out of the past eight quarters.

If you take real GDP, it has fallen 1.6 per cent since it peaked in the fourth quarter of 2022.

Coming back to household consumption, however, this is the part of the economy – almost two thirds of it to be precise – that has actually been smashed.

But this is not entirely the result of high inflation and high interest rates.

Eslake points out that real per capita household disposable income has fallen 9.8 per cent since it peaked in the third quarter of 2021.

Over the same period, consumer spending has fallen 2.4 per cent.

That is reconciled by the fact that household savings have fallen from around 6 per cent to close enough to 0 – the lowest in 17 years.

The buffer that the RBA took comfort from 18 months ago to weather the rate rises has evaporated.

What this means from here for households is obvious. There are less savings now to draw from to keep households out of trouble as prices continue to rise.

Yet it is not all down to interest rates. Inflation and rates are a big part of it but so is the decline in real incomes, with wages not matching prices, and the unprecedented tax take from Canberra.

The proportion of household income paid in taxes is up to 23.4 per cent in June, which is the highest since 1959.

And this part of the equation is definitely not the RBA’s fault.

While Chalmers will be happy with the growth numbers remaining in positive territory – if only just – what should be most trouble the government is the household recession.

The level of grumpiness is only going to grow this side of Christmas, and possibly beyond as it heads towards an election if some relief doesn’t start to arrive soon.

Jim Chalmers may be spending Australia out of technical recession but the same can’t said of households. And its households that vote, not economies.