Businesses must prepare for more global turbulence

Against a deteriorating geopolitical backdrop, some of Australia’s companies and business leaders are tottering towards disaster, sleepwalking through a new era of polycrisis and upheaval, with little provision or plan for the changing global future.

In Australia, many business leaders can’t see or fully comprehend the profound changes effected by a second Trump presidency. Instead they occupy a strange unreality; they avert their eyes hoping nothing will change when they should be focused on preparing for all sorts of complex and unanticipated scenarios.

Hope is not a strategy nor a plan for resilience. In short, companies that want to survive this challenging period need to be ready and resilient. They need to ask how they can “Trump-proof” their businesses to navigate the geopolitical shockwaves ahead.

To guide businesses through the second Donald Trump era it helps to understand that much of his thinking borrows from a longer tradition in US history that stretches back to presidents including Herbert Hoover, William McKinley and Andrew Jackson, as well as founding father Alexander Hamilton. The Trump approach is not without precedent.

Equally, our era can be seen as an example of two distinct patterns of historical evolution.

First, relatively long periods of stability and prosperity, where nations compete within an accepted body of rules and norms.

(The most common examples include the decades between the Crimean War and World War I and the decades following the fall of the Berlin Wall).

Second, the generally shorter periods when nations are aggressively contesting the rules that underpin the order. These transitional periods are often punctuated by intense turbulence, nationalism, economic crisis, political instability, and an increased risk of miscalculation.

These forces play out until a new world order emerges. The only thing these periods tend to have in common is their volatility and unpredictability. The peaceful transition from the Cold War to US hegemony following the collapse of the Soviet Union was an exception. Fast-forward to the present century and the picture has changed.

In the past decade China has emerged as a major power, mobilising its new economic and military might to challenge and reshape the post-Cold War order that is based on a system of rules and multilateral institutions, led by the US.

China’s rise has now preoccupied multiple US administrations as they seek to push back against Chinese actions that undermine US interests, including large-scale industrial and scientific espionage, and massive subsidies and other interventions that have distorted global markets (think solar cells, rare earths, critical minerals and now electric vehicles).

The Obama administration indicted Chinese hackers and imposed sanctions for the intellectual property theft.

Similarly, Trump’s first administration used counter-terrorism legislation and trade sanctions to in effect ban Huawei equipment from Western countries’ telecommunication networks in 2019.

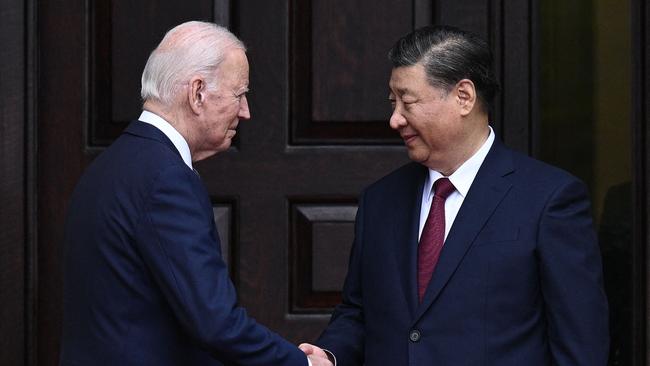

The Biden administration intensified these countermeasures in response to increasingly aggressive competition from President Xi Jinping’s China.

Against these cross-currents it’s become clear that 2025 is the start of the next phase in the struggle to shape the world order. We are witnessing a return to the naked pursuit of national interests on all sides. With this we should expect to see intensifying turbulence, economic crisis, societal and political instability, institutional change, supply-chain disruption and reshaping of global relationships.

The risks of miscalculation or deliberate conflict – and a serious global economic downturn/crisis – are real and rising.

We can’t know how interactions between China and the US – and other participants in this geopolitical drama – will play out. But the scenarios Australian businesses might have to navigate are more predictable.

They will need to put in place the response planning and investments that give them options and time to adapt in the event of a significant downturn in global GDP; a major negative demand shock domestically or globally; a significant input price shock; severe input supply chain disruptions; severe export market disruptions; significant liquidity tightening, and; a tier-one cyber attack that successfully breaches the businesses’ cyber defences.

There are preparations that can be enacted now to respond to all of these scenarios, including dual-sourcing supply chains; force majeure exposure management plans; holding spares in country; daily air-gapped full system backups; data breach response and recovery plans; forward contracting demand and supply contracts and hedging; market diversification and positioning strategies, and; liquidity crisis management plans.

Of course, it is possible that nothing will change and China and the US will manage it perfectly – but there are several global events that could lead to these scenarios for Australian businesses.

● The US trying to force Australia to curtail trade or put tariffs on China;

● A significant decrease in global growth, particularly in China, leading to decreased export values from Australia, resulting in a significant decrease in the value of the Australian dollar; leading to decreased purchasing power, leading to very significant increases in prices of consumer goods and input materials, and economic contraction. This major inflationary impact unless offset by falling growth, unemployment or oil/energy prices could result in interest rate rises putting further price pressure on mortgage holders and businesses in a negative spiral (noting that Chinese stimulus could change all this in unknowable ways);

● A significant decrease in global growth, particularly in China where the drop in growth is not accompanied by significant inflation;

● A naval quarantine of Taiwan.

We all have deep familiarity bias, informed by experiences over the past 30 years, but the world order is changing permanently, and it’s time to prepare to come out on top.

Simon Atkinson is a former deputy secretary of Treasury and a former departmental secretary. He is a strategic adviser to global investment funds and corporations.