Young borrowers at risk: RBA

The Reserve Bank has singled out younger households with lower incomes as a risk to the economic outlook.

The Reserve Bank has singled out younger households with lower incomes, less stable employment and smaller savings buffers as a risk to the economic outlook in the event of any shocks.

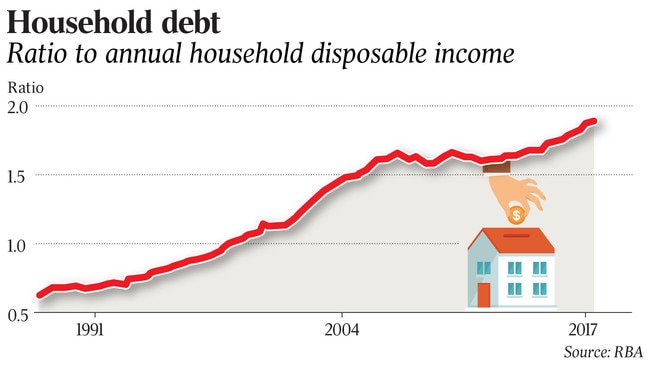

In the minutes of its July board meeting, the RBA said that after a detailed discussion of Australia’s high household debt — informed by a “special paper” prepared for the meeting — “household balance sheets continued to warrant close and careful monitoring” amid increasing risks to the global economic outlook from rising US-China trade tensions.

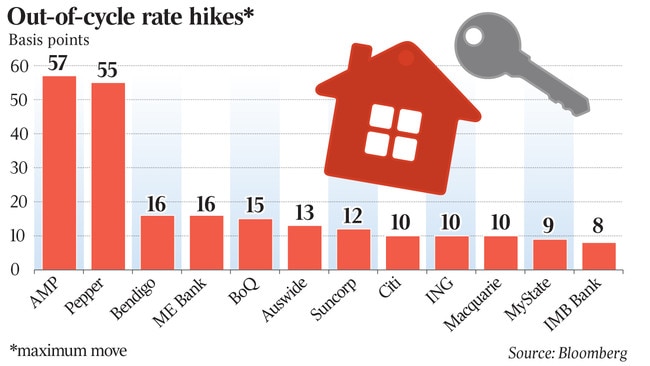

The comments come as borrowers are starting to feel the pinch from a round of out-of-cycle interest rate hikes on variable mortgages by regional lenders and credit unions in recent weeks, blaming higher funding costs.

Borrowers with a mortgage of $1 million are on average paying an additional $715 a year, or about $60 a month from the higher rates.

Interest rate comparison website RateCity estimated that mortgage holders with loans of $500,000 would be hit with a bill for an extra $358 each year if their lender increased rates by 10 basis points — the average rate rise since non-major lenders began lifting rates in March.

The big four banks have been holding out on passing on higher rates, given the intense political scrutiny on the sector, but analysts expect them to move within months.

“It’s only a matter of time before one of the big four banks hike,” said RateCity director of research Sally Tindall.

“While the threat of negative publicity has kept them at bay, eventually the pressure on their profit margins will be too great.”

The rising rates come as the RBA renewed its concerns over how debt-heavy households would respond to economic shocks. With most of the nation’s wealth tied up in illiquid assets such as property and superannuation, this could leave the economy vulnerable, particularly retail spending.

While much of Australia’s household debt is owed by higher-income and middle-aged people who tend to have more stable employment and larger savings buffers, the RBA board noted that a “material share” of household debt was held by lower-income households. This segment generally had “higher debt relative to their income”, the RBA said.

And while household assets in aggregate are valued at five times the value of household debt and total assets exceed the value of debt for most households, the RBA noted that “most household assets are housing and superannuation, and both of these are illiquid”.

With the ratio of household debt to income hitting a record high of 190.1 per cent in the March quarter, “higher levels of household debt could affect economic outcomes”, the RBA minutes said.

“For example, households with high debt levels are more vulnerable to economic shocks and therefore more likely to reduce consumption in the face of uncertainty about their future income.”

The minutes also noted that changes in interest rates have a larger effect on disposable income for households with high debt levels, but those households may be less inclined to borrow more at times when interest rates fall, suggesting interest rate cuts may be less effective from here.

“It leaves the central bank with a rather asymmetric lever — more powerful on rate hikes due to sensitive balance sheets and less powerful on the way down, as there’s no more room for households to leverage up,” said JPMorgan Australia chief economist Sally Auld.

RBA deputy governor Guy Debelle recently warned that Australia’s heavily indebted households and the likelihood of higher mortgage repayments remained a key risk to Australia’s economic outlook. He said that because wage growth — which has tumbled to a record low in recent years — has been dragging on household income, a number of borrowers “may be carrying a larger mortgage for longer than they expected when they took out the loan”.

“While they can service the mortgage, it has consumed a larger share of their income for longer than they might have intended,” Mr Debelle said in May.

The RBA has previously warned Australia’s binge on interest-only home loans could come back to haunt it over the next three years as hundreds of billions of dollars of these loans switch to normal repayment schedules, leaving borrowers scrambling to refinance or sell.

About $120 billion worth of interest-only loans — about 7 per cent of the total value outstanding — are on track to convert to normal principal-and-interest loans over each of the next three years. Interest-only borrowers are facing a jump in annual repayments of between 30 and 40 per cent, equivalent to $7000 a year for the average borrower with a $400,000, 30-year mortgage with a typical five-year interest-free period.

Although the RBA repeated its recent guidance that the next move in the cash rate was more likely to be up than down, it reiterated that because progress on reducing unemployment and increasing inflation would be gradual, there’s “no strong case for a near-term adjustment in monetary policy”.

“Rather, the Board assessed that it would be appropriate to hold the cash rate steady and for the Bank to be a source of stability and confidence while this progress unfolds.”

But while conditions in the global economy generally remained positive, the RBA cautioned that some of the downside risks to the global growth outlook had increased over the past month or so.

Capital Economics chief economist Paul Dales said the minutes confirmed that the Bank was a long way from raising interest rates and that it was worrying more about a global trade war, the slowdown in China and the high level of domestic debt at home.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout