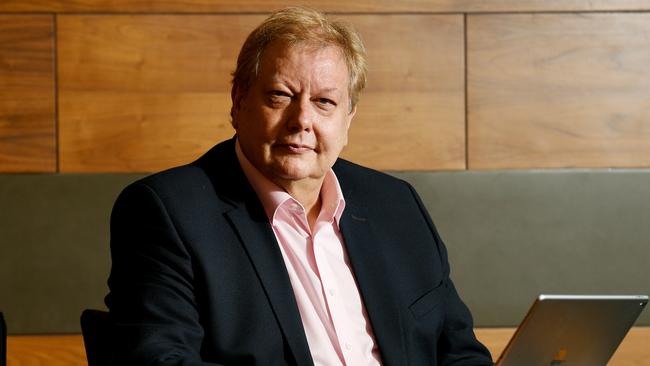

WiseTech founder Richard White $2.1bn richer after avoiding ‘silly’ wage rises and share price boom

Nearly all the staff that left WiseTech for higher wages in the tech boom have returned, vindicating founder Richard White’s strategy that led to bumper profits and share rises while others imploded.

WiseTech founder and chief executive Richard White is $2.1bn richer after the software giant’s share price soared more than 18 per cent on the back of bumper profit and revealing its next wave of growth.

Crucially, Mr White said it also avoided “the big death dive” that has plagued some of the world’s biggest tech players by not paying “silly” wages during the pandemic boom.

At WiseTech’s Sydney headquarters it was a cause for celebration for employees – 88 per cent of whom hold share equity plans – and vindication of Mr White’s strategy to hold his nerve and avoid paying sky-high salaries during the pandemic-fuelled wages boom.

“I walk around the office and everybody is smiling because they have all got shares,” Mr White told The Australian.

“That’s very attractive. When wages went nuts – and tech wages were at the extremes of this, they were the real outliers in terms of inflation – we just passively went ‘OK, we are not going to participate in that. We’re not going to pay silly prices’. We are just going to be as good as we can possibly be.

“And … the small number of staff that left us for much higher wages – all but one of them have come back because they all lost their jobs at the end of the cycle. So there is a real lesson here about consistency of employment versus the big sugar hit and then the big death dive.”

Mr White was referring to mass lay-offs at tech companies, with Microsoft, Meta, Amazon, Alphabet, Netflix and others that have sacked more than 70,000 people combined since late 2022 after embarking on recruiting binges, sparking wild share price swings.

WiseTech has been focused on controlling its costs, while still rewarding shareholders – and staff.

On Wednesday, the company – which specialises in making software for the logistics sector – hiked its full-year dividend 10 per cent to 9.2c, which it will pay on October 4.

Mr White also declared it has met its $40m a year cost savings target, which it has now lifted to $50m, while its three “breakthrough product releases” – including its new CargoWise Next platform – will present a “step change” in its capabilities, propelling the company to more growth.

WiseTech’s shares soared more than 18.4 per cent to $111.71 as a result – surpassing $100 for the first time, valuing the company at $37.4bn. It added an extra $2.1bn to Mr White’s fortune, which The Australian’s Richest 250 last estimated at $9.72bn.

“Many freight forwarders still have outdated in house legacy IT systems built 20 to 30 years ago, very inflexible, complex and expensive to maintain and are supplemented at great cost with hundreds of smaller satellite systems,” Mr White said.

“CargoWise customers replace these myriad legacy systems with a single, global, modern, efficient and fully integrated platform that dramatically reduces it costs and risks.”

Among WiseTech’s new customers is Nippon Express – one of the world’s 10 biggest freight forwarders. WiseTech secured a global rollout with Nippon Express – a process which included Mr White travelling on a “red eye” flight to Japan. “I managed to sleep on aircraft four days in a row,” he said.

Overall, WiseTech delivered a net profit of $262.8m in the year to June 30, up from $212.2m a year earlier. Revenue jumped 28 per cent to $1.04bn, slightly below analysts estimates of $1.07bn. But RBC Capital Markets analysts said while the results were largely in line with consensus estimates, free cash flow – which jumped 14 per cent to $333m -was a “standout” beating their forecasts by 108 per cent and overall market expectations by 87 per cent.

“(The free cash flow result) appears to have been driven by strong cash cost control and lower R & D capex relative to our expectations,” RBC analysts wrote in a note to investors.

During the past 12 months, the company has increased research and development investment by 41 per cent to $368.2m, representing 35 per cent of total revenue.

“This investment delivered 1,135 new product enhancements in FY24, taking total product enhancements delivered on the CargoWise application suite over the last five years to more than 5,600, from a total investment of over $1.1bn,” Mr White said.

WiseTech expects to generate revenue of $1.3bn to $1.35bn this year. It is forecasting earnings before interest, tax, depreciation and amortisation of $660m to $700m, representing growth of 33 to 41 per cent.

“We have the capability and capacity that no one else in this industry has, and we are achieving outcomes that have real impact for our customers and the industry we serve,” Mr White said.

“Through the consistent execution of our product led, 3P strategy, we are revolutionising major parts of the global logistics ecosystem as we expand our capabilities with the announcement of our three breakthrough product releases. CargoWise, our world-leading solution, is making it easier for large global players to operate more efficiently and effectively and has driven vast improvements across the industry.

“Our strategic vision is to be the operating system for global logistics, and we are accelerating our pace to achieve this vision.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout