The latter is a key national problem and one requiring federal leadership not visibly evident in Canberra since Paul Keating days.

Treasurer Jim Chalmers reportedly backs competition reform but it certainly doesn’t rank on top of his to-do list.

In an era of big data, governments have control of information which can be used to promote competition. But the Transurban consortium’s buckets of cash have proved just too tempting for the NSW and Victorian governments.

Chalmers may understand the benefit of competition, which is good and might mean he may have listened to his assistant, Minister Andrew Leigh, who constantly preaches about the dangers of Australia’s overly consolidated industry.

At a time when the government worries about inflation the benefits of competition are obvious.

This corporate reporting season has seen a conga line of companies (Boral, Amcor, Suncorp, AGL et al) from consolidated sectors confide they will continue to raise prices. And why not, when there is no real competitor to make you think twice about the move?

The government response in such cases has simply been to increase regulation, as with gas price caps and promised (not yet formally implemented) ACCC reviews of bank deposits.

Increased regulation is not the answer and in fact it is worse.

To put Transurban’s Charlton into context, he has worked his stakeholder relations superbly, delivering circa 78 per cent EBITDA margins at last count and total shareholder outperformance over his term in charge, of the same magnitude.

On any score Charlton’s performance has been superb.

He controls 90 per cent-plus of Australian toll roads, which deliver annual CPI-plus price rises each year that run 100 per cent against any move to cut inflation.

Existing competition law can’t touch him because there are alternative transport options and in any case the prices are set and regulated by state governments.

We are yet to learn what proposals ACCC boss Gina Cass-Gottlieb will push but she broadly supports the Rod Sims plan which would put the initial decision-making power in the hands of the ACCC — meaning the company bears the onus of proving a deal isn’t anti-competitive.

There will also by a Transurban-like clause which says if you have market power you can’t extend it.

Charlton’s first-rate analytics team has come up with innovative deals based on its study of what is driving traffic now and in the future, and he then packages a plan to deliver consumer benefits, with a new project done for cash upfront plus an extension of his monopoly power.

The deal is delivered while others are still thinking about it and by now the barriers to entry are sky high.

Brilliant – but that is only part of the reason for the highly strategic chief executive’s success.

There is a lot of talk and grandstanding about the benefits of more females in senior management; Charlton now has five females out of nine direct reports and has had a balanced team for five years.

This was done quietly while others have banged the drum loudly and done less.

He has a superb management style, moving people out of jobs based on their leadership ability and not technical know-how – working on the belief it’s the leadership skill that counts and the details can be filled later.

Queensland boss Sue Johnson is a case in point, working her way up from the bottom of HR to her present role. WestConnex boss Andrew Head came from IR and strategy, and Victorian chief Henry Byrne came from PR.

Many bosses leave people in their boxes without taking the time to see the potential.

Charlton is clearly highly numerate but his skill is understanding what his stakeholders want and delivering complete packages on how to achieve it while everyone else is just working out there is an issue.

The new frontier

Half the world’s economic output is dependent on nature, so if natural capital is destroyed then the global economy suffers. But right now banks and companies don’t have the information to understand the risks.

As federal parliament debates Australia’s efforts at cutting carbon emissions, the big-picture financial risks of companies trashing nature is not widely understood and is the next frontier.

Carbon emissions are simply step one and the wider issue is natural capital and how it impacts on the climate and the wider economy.

Taskforce on Nature-related Financial Disclosure (TNFD) boss Tony Goldner will be in town to promote the taskforce’s work with the aim of increasing awareness and action.

The globally backed global TNFD comes to the party with the goals of increasing transparency and setting frameworks for action.

TNFD is supported in Australia by Alasdair MacLeod’s Macdoch Foundation, which will host a dinner in Sydney this month for the Australian-trained Goldner, to promote his landmark efforts.

It is all part of the global effort to understand nature-related risks so companies know how it impacts their business and how to restore nature.

Carbon Growth Partners’ Rich Gilmore notes the EU is already placing restrictions and mandating biodiversity projects to repair nature.

This opens new potential markets but Gilmore said the fundamental problem is scaling up high-quality supply.

Environment Minister Tanya Plibersek has a consultation paper out on the Nature Repair Market, with submissions closing on February 24.

Her aim is to establish an offsets program to fund biodiversity protection and repair.

The carbon market sets a premium for biodiversity restoration but the credits will increasingly be nature capital based.

Project developer GreenCollar last November jumped ahead of government moves to award biodiversity credits by establishing its NaturePlus voluntary credits scheme aimed at attracting capital to improve overall environmental quality.

Accounting for Nature unveiled its regional study on the Burnett Mary River Regional Resource area in Queensland backed by Pollination and Andrew Forrest’s Minderoo.

The aim is to create a baseline to put a price on nature, measuring vegetation, water and farm paddocks to test the condition of assets, then remeasure 12 months later.

The International Sustainability Standards Board is also working on global standards, based in part on the work of Australia’s Accounting for Nature which has established a framework for measuring natural capital so you can measure improvements.

Macdoch boss Michelle Gortan explains the Foundation’s motives in helping farmers understand their impact on nature, understand exposure, and how best to collect the right data to ensure they can work with banks and others more easily with one set of figures.

In the process, farmers will see how improvements in natural capital will improve farm profitability.

Big companies have a team of environmental data analysts which the family farm doesn’t, and the Macdoch aim is to make it easier for farms to operate in this new normal, understanding the crucial links between agriculture and nature.

Macdoch has a long-term project, Farming for the Future, looking in part at integrating nature and the climate, with the obvious starting point establishing nature as the foundation risk.

By contrast nature-positive decisions create opportunities and underline sustainability.

The TNFD is aimed at helping companies integrate nature into decision making.

Better information will allow companies to incorporate nature-related risks and opportunities into their strategic planning, risk management and asset allocation decisions.

The TNFD principles are based on market usability, science-based nature related risks and are fundamentally agnostic.

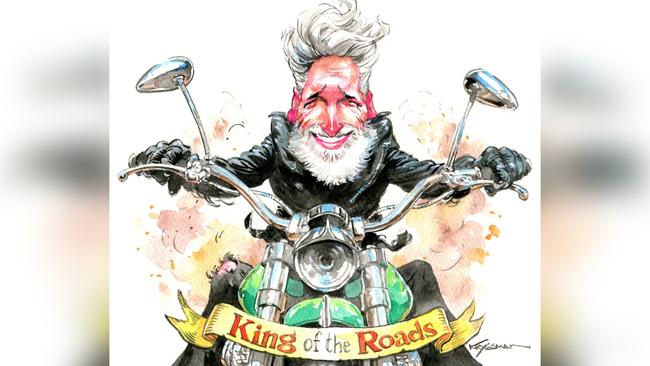

Transurban’s Scott Charlton exercised his monopoly power better than anyone in corporate Australia and in the process underlined the utter incompetence of state governments when it comes to competition policy.