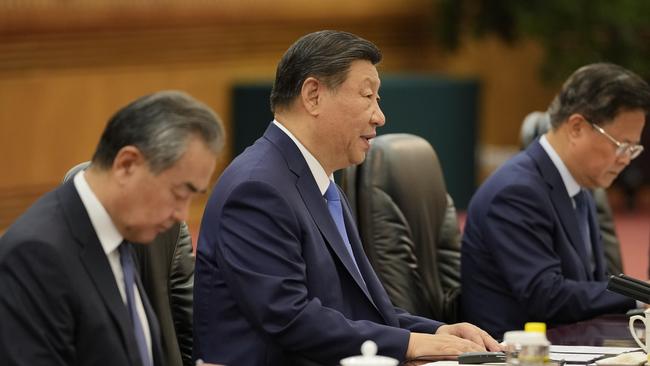

When Donald Trump was shot it was 6.11am in Beijing and about 370 Communist Party officials were waking up to start four days of meetings to review Xi Jinping’s plan to reverse the downturn in the world’s second-biggest economy.

The meeting, the so-called Third Plenum of the Central Committee, last met five years ago when the outlook was much brighter.

Over breakfast came the news Donald Trump had been shot. Delegates responded by saying how superior the Chinese system of government was when compared to the embedded violence in the US system.

But those who know US history understood such an event would increase the likelihood of Donald Trump once again becoming the President.

This must have caused many in the room in Beijing to fear (very privately) that Xi Jinping’s plan for China might be the wrong one.

But, it was too late for second thoughts, because the Third Plenum was about to start, with its aim to promote what Xi calls “high quality” growth.

Provincial and national ministries had been rushing for months to announce how they would carry out Xi’s latest economic formula, which aims to harness “new quality productive forces” to re-establish more sustainable Chinese growth.

In essence, Xi believes building more Chinese factories will generate this growth but, if Trump takes control in the US, then Xi is embracing a high-risk strategy.

China already produces almost a third of the world’s manufactured goods and Xi intends to deploy more robots and increased automation to first offset a shortage of factory workers and then to increase production.

Older industries, like steel and cement manufacturing, which are more closely tied to the real estate sector, are being replaced by the solar panel, electric car and battery industries. Investment in factories is soaring.

But, rapid expansion of manufacturing has led to a glut of goods – from chemicals to cars – and a lot of unused industrial capacity. Companies have sharply reduced prices to compete for Chinese consumers who are reluctant to spend.

Exports are needed but those at the plenum with US experience knew the shooting was likely to enhance Donald Trump’s chances to become the next US president. And with Trump would come a 60 per cent tariff on Chinese goods – and other countries might follow.

In addition, Trump vows to wind back rapid decarbonisation and return to traditional energy sources. Trump continues to promise US energy costs will be the lowest in the world. (This will change the world energy game but that’s a future comment.)

A Trump-led US means exports may not be able to boost the Chinese economy in the way they have in previous years.

And, on the Chinese domestic front, the slump in property is reducing the revenue of many local governments. They have high borrowings and are imposing taxes on consumers, which is restricting their willingness to spend.

China is no longer the favoured destination for private capital, particularly as Trump is being heralded by Wall Street as a President who will be good for business investment. Taxes will fall.

Trump’s anti-Chinese stance comes at a time when China is starting to be affected by long-range lower population trends triggered by the earlier one-child policy, which was introduced in 1980.

For decades this boosted the Chinese economy, but the substantially lowered birth rate is set to lead to a substantial ageing of the population, which in coming decades will experience a sharp fall.

In Western countries a surplus of goods and population ageing might result in substantial consumer spending incentives, but that’s not the way Xi is currently headed and there are no signs the plenum will change his direction.

For Australia’s biggest customer, China, to struggle as it uses our materials to produce vast quantities of goods which can’t be sold – except at giveaway prices – is not a good sign.

But, it does mean the world is headed for a period of deflation in goods prices.

In the US, of course, large tariffs will be imposed which will generate the revenue to lower taxes. In contrast, cost rises are coming in services but they too will be moderated over time by artificial intelligence.

It will be a different world, and that world is not exciting China, but it is exciting Wall Street.

The great danger is Xi will feel cornered and conclude the way out is to invade Taiwan. All the signs suggest that if Trump is inaugurated as president in January, a Chinese invasion of Taiwan is likely to provoke a vigorous American response, particularly if Trump settles the Ukraine war.

Wall Street is celebrating the likelihood of Donald Trump as the next US President. But, in China, it is a different story.