Now is the time for savers to review their portfolios and assess options. Often it may mean doing nothing except preparing to have a lower savings asset base.

And I also convey a plea to Reserve Bank governor Philip Lowe from a group of new home buyers with whom I was yarning over the weekend: “Please Mr Lowe bring on your planned nasties in one movement, so we can face and adapt rather than the current drip torture which is wrecking our families’ mental health.”

The RBA fears that the current 7.8 per cent inflation rate will spark a new round of wage rises (perhaps government inspired) that will embed inflation requiring interest rates to go to even higher levels to maximise pain on the mortgage belt and cause asset values to fall so people who currently believe they are well off will also slash expenditure.

The RBA forecasts do not anticipate embedded inflation, but there is clear a danger because the current drip torture takes too long to work.

At the moment, the combination of rampant government expenditure, particularly in the states, and massive savings among those not in the mortgage belt is continuing the economic boom.

But in a few months, mortgage pain will become much greater as low fixed rate mortgagees convert to current rates. The RBA’s aim is either stop enterprises giving wage rises or, for those that give significant wage rises, there will be an economic environment where they cannot lift prices but rather must reduce staff, undertake other cost reductions and/or slash profits. It is a miserable process.

In most asset classes, the higher interest rates will lower the value of assets, including shares and property. In this environment, inflation and or interest rate linked bonds offer the best safe returns. Of course, the corporations that are chosen must survive.

In the share market, the temptation is to sell out and buy back later. But very often people don’t get back, particularly if the shares they sell perform better than expected. The shares that are most vulnerable are those with a large amount of their trading is with people in the mortgage belt.

In the US, the process described above is starting to work with companies now slashing staff, but overall share prices have held. The best performers maybe those that are insulated from the trading impacts of higher interest rate.

Banks that rely on home loans will see big falls in new loans, but they are good businesses and better times will return. In the mining sector, revenues depend on individual operations and the particular commodity the mine is producing. Those short of cash are in grave danger. Share investors and their advisers need to review their portfolio along these lines.

As I discussed last week, direct property has been an excellent performer. In the current environment, direct properties that have long leases with sound tenants where there is at least a partial inflation adjustment to rent are still vulnerable to overall asset price falls but are safer. Those where tenants are reviewing their occupancy options, like some office buildings, carry clear dangers. Retail hubs will need great skill to navigate the new environment, and not all will succeed.

Sadly, listed property trusts have become gambling counters and this sector has already fallen in anticipation of tough times. The official valuations of the sector’s properties are above listed stock prices, but the gap will narrow if interest rates go high and stay high for longer than expected.

Many listed and unlisted property funds have large building development projects where building costs have gone through the roof, which will challenge the economics.

Remember, the replacement value of many well maintained properties is much higher of their market worth.

Nevertheless, the prices of many dwellings will continue to fall with the total overall decline looking set to be around 15 per cent, which throws many mortgages into the negative equity. The great risk for those with high mortgages is that couples will lose one of their incomes in the retrenchment programs.

But longer term we are going to see increased migration and there is a shortage of dwelling stock. My advice to those caught in the mortgage trap is to do everything they can, including using the gig economy for an additional income and talking with your family, banks and brokers, to hang onto the dwelling despite negative equity. If you can get through this period, you will have a dwelling which otherwise you would not have been able to buy, and you will have avoided the rental morass.

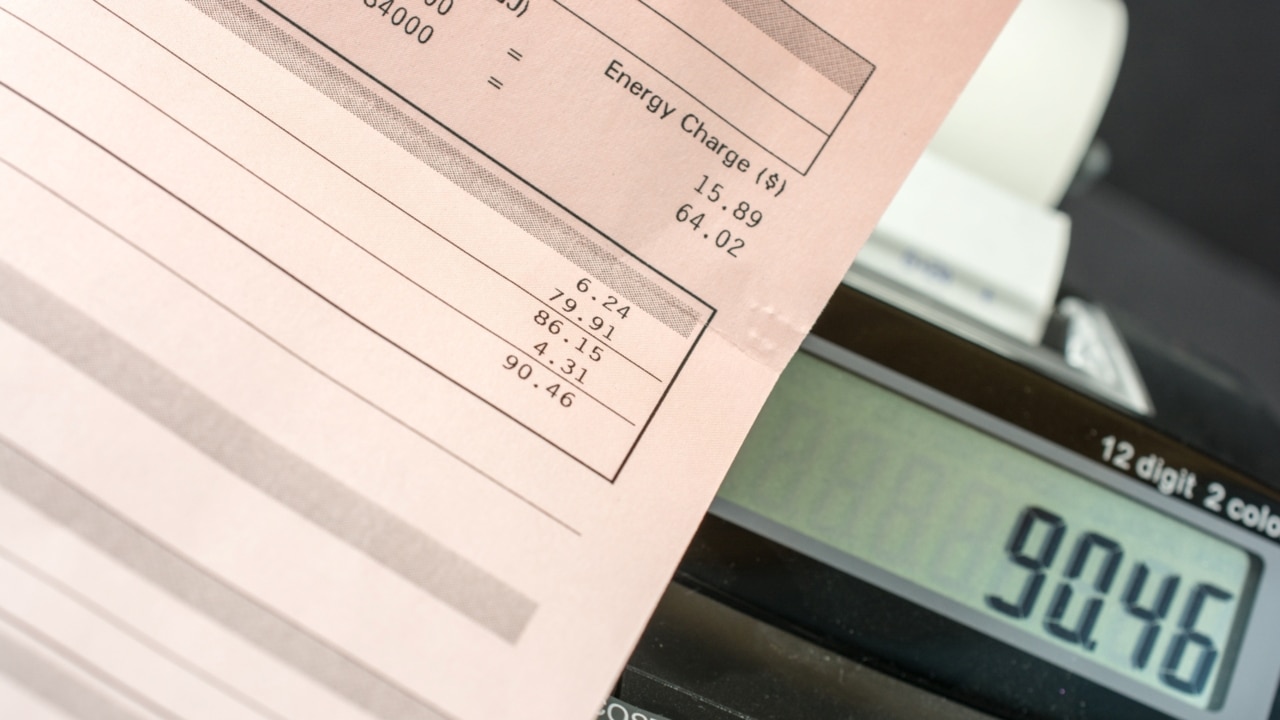

Finally, for those wanting to invest in short term bank deposits, be alert that there is a multitude of qualified offers for at call and term deposits that have traps. The simplest cash rate is the Macquarie accelerator rate, which offers 3.3 per cent for up to $2 million dollars, but even there you need an adviser to get access to the higher return.

There are a multitude of banks with one-year deposits around the 4 per cent mark, so don’t let your bank tie you up for a year at a token interest rate. Remember, rates are going to rise.

Every person with savings must realise that the prospect of higher interest rates for an extended period will reduce asset values over a wide range of categories.