Wholesale electricity contracts surge by five per cent over summer

Recent coal power outages have lifted wholesale electricity contracts which could flow through to bills, in a move that would hit households but boost AGL and Origin.

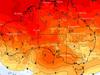

Australian wholesale electricity prices have jumped in recent weeks amid coal power outages and transmission issues, threatening to elevate the next default pricing benchmark for electricity bills.

RBC Capital Markets analyst Gordon Ramsay said recent partial outages at NSW’s two largest coal power plants, Origin Energy’s Eraring and AGL Energy’s Bayswater, were major drivers of increased wholesale electricity futures during November – stoking already elevated prices.

Since November base contracts have risen about 5 per cent across the board.

Electricity base contracts for 2024 are up across NSW (4.6 per cent), Victoria (5.6 per cent) and Queensland (7.5 per cent), Mr Ramsay said.

Year-on-year, contract prices have grown by 19 per cent in NSW, 17 per cent in Victoria, and 25 per cent in Queensland.

Any upward revision to the Default Market Offer, which is reset in July 1 each year as a benchmark for electricity bills paid by households and businesses, would be a hammer blow to households under a cost-of-living crisis and the re-election prospect of the federal Labor government.

It would, however, boost retailers such as AGL Energy and Origin Energy.

While the Default Market Offer includes a plethora of retailer costs, wholesale prices are the largest contributor to how tariffs will be set by the Australian Energy Regulator.

The watchdog includes wholesale costs over a multi-year period so even higher wholesale prices in recent months are not guaranteed to lead to higher tariffs when they are reset on July 1.

Still, the prospect alone will be a hard for the federal government as it tries to placate voter frustration amid inflation struggles – the central bank has lifted interest rates 13 times to a 13-year high, with electricity prices a major driver in inflation.

The federal Labor government has sought to highlight the impact of Russia’s invasion of Ukraine as a catalyst for the global energy crisis but, with coal prices tumbling, much of the recent jumps are driven by Australia’s precarious energy mix.

Coal remains the dominant source of Australia’s energy but a spate of power stations have shuttered in recent years as renewables make them increasingly unprofitable.

With the government struggling to accelerate the rollout of more renewables, Australia remains dependent on coal though much stations are nearing the end of their technical lifespan, which has led to unreliability.

This week, Queensland’s CS Energy’s Callide C, experienced problems.

The B1 unit was removed from service on Tuesday and was supposed to be back two days later. But CS has since revealed the unit will now not return until Sunday.

“Crews were unable to positively verify the proper functioning of a valve during regular fortnightly testing of safety systems,” the operator said.

“Our inspections of the unit have confirmed that there was not a safety issue with the valve, however some minor mechanical rectification works are required on the testing component for the valve to maintain the on-line testing and verification capability before it is returned to service.”

The outage intensifies pressure on CS Energy, which is still reeling from the disastrous 2021 explosion at the Callide C power station that left 500,000 people without power.

An independent report found CS failed to implement effective safety practices at the Central Queensland facility.

The report also revealed that senior CS Energy safety officials quit because they were worried that cost-cutting on maintenance and safety systems would eventually result in disaster. It included revelations that the company’s CEO baulked at the $2m cost of implementing new safety systems that could have prevented the Callide C explosion.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout