Wheels turning for Carbon Revolution hungry for success

Carbon Revolution has quickly become a poster child of Australian manufacturing ingenuity.

Melbourne’s Recoleta Restaurant boasts a grand staircase leading to a first-floor banquet room with weathered timber floors, faded murals and ornate stained glass, reminiscent of the leafy district of the Argentinian capital Buenos Aires bearing the same name.

In early December, over glasses of Jean-Noel Haton Brut Heritage champagne, the three founders of lightweight wheels maker Carbon Revolution gathered with their bankers from Bell Potter and Evans Dixon and lawyers from Herbert Smith Freehills to toast their $90m listing on the Australian Securities Exchange. It was the first time in many years that the three pioneers of a business that has fast become a poster child of Australian manufacturing ingenuity had dined together.

“We all went for dinner and we had never done it before other than the odd barbecue. I am never here except for some of the big events,” says the firm’s now Miami-based co-founder and chief technology officer, Brett Gass.

It was a far cry from the early days of Carbon Revolution more than a decade ago, when the vehicle dynamics expert, a former senior executive at Ford and General Motors, sold the family home in Minneapolis, quit his job and moved his wife and two young children to Frankfurt.

“You take a pretty deep breath before you go home and sell that to the wife and two kids,’’ Gass now says, sitting in the nondescript boardroom of Carbon Revolution’s Waurn Ponds headquarters outside Geelong.

“We had no customers. We sat around going, ‘Who is going to buy this stuff’, and our initial thoughts were they were going to be in Europe. But we didn’t really know.”

It was the same for Gass’s co-founders, Jake Dingle and Ashley Denmead. A former management consultant, Dingle quit his job at Goodman Fielder in 2010, sold his house and put all his money into the then fledgling company.

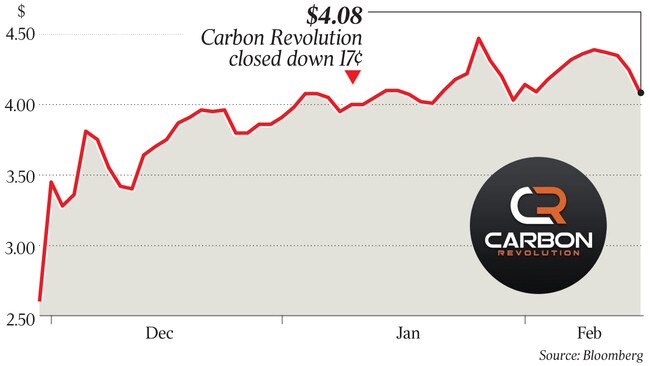

The three founders worked for nothing for four years, but six years on are smiling as the Carbon Revolution shares have performed strongly following its listing. The shares closed on Friday at $4.08, compared to their $2.60 issue price. They reached $4.47 late last month.

Dingle, the group’s chief executive, talks to Gass everyday even though Gass is on the other side of the world.

“Our goals have never diverged,” Gass says. “We were very thoughtful back more than 10 years ago when we sat around together plotting what we were going to do. We haven’t changed that plan fundamentally. It is us against the world, not us against one another in this company. Failure is not an option. It really has been all or nothing for me.”

Carbon Revolution is now lifting production output of its one-piece carbon fibre wheels substantially to fit the new vehicles being produced by global carmakers Ferrari, Ford and Renault.

The wheels are about 40 per cent lighter than conventional wheels and cut fuel consumption, reduce running costs and vehicle emissions.

In October last year, the company also secured a contract to supply wheels specifically designed for an SUV of a global automotive company, reportedly Jaguar Land Rover.

Earlier last year the firm received a $2.4m federal grant to design the world’s first carbon-fibre aircraft wheels.

In their first joint interview since the December float, Dingle, Gass and Denmead have differing reflections on the listing milestone.

Denmead, the firm’s engineering director who boasts a first class honours degree in mechanical engineering, a degree in computer science and a PhD in composite materials, says it was “more of an emotional milestone than I thought it would be”.

“I thought we had finally reached a really significant point for the business where it became more real than it has ever been. It was really significant to ring the bell and see it come up on the ASX,’’ Denmead says.

“We have been through tough times but we never thought we would not get through it. Whatever it takes, you just keep going.”

Unlike Dingle and Gass, Denmead reluctantly sold some of his shares into the float to deal with some personal affairs, but says the business is still to achieve the founders’ vision.

Dingle, whose shareholding is escrowed for two years because he is a director of the company, says he has never been driven by personal wealth.

“The value of the company is a measure of whether we are doing something well,” Dingle says. “You don’t go into something like this because you want to hit the jackpot and get rich. You go into it because you are fascinated by the challenge. It has been ridiculously challenging at times.’’

Carbon Revolution has sold more than 17,300 wheels since it began production and is on target for annualised capacity of almost 32,000 wheels by June.

Dingle says the product design and the processes that make the carbon wheel come together have been established in a co-ordinated way to allow them to be ultimately industrialised, which is the next step in the company’s evolution. The spine of the firm’s Waurn Ponds factory, which is currently largely vacant, will soon make way for the first of several mega-production lines.

“We have proven out and derisked the technology on a modular basis. Bolting that with a transport system that removes intermediate movement and labour is the next step,’’ Dingle says. It will mean more wheels produced per person, per day from the firm’s 400 staff.

“The industrialisation enables us to get to larger markets,” he says. “Which means we will continue to grow from a workforce point of view. But the input hours per wheel continues to go down pretty dramatically. It is about making smarter and smarter jobs and more and more skilled manufacturing. The global market for this technology is huge. It is price elastic but at this point in time there is a lot of demand that is beyond our capacity to provide.”

As the automotive industry has shut down in Australia in recent years, the best and brightest talent has gone offshore, but Carbon Revolution has managed to bring at least some of it back home.

The most significant is Luke Preston, an engineer who worked at Ford Australia and Holden Special Vehicles before moving to California, where he built the general assembly manufacturing team responsible for Tesla’s Model 3. Preston is Carbon Revolution’s industrialisation director.

Another five executives have returned from significant roles offshore to join the company’s production team.

“Getting people convinced you can do this in Australia has been a challenging process,” Dingle says. “To go through what we have been through and to get to a successful listing, there is an element of relief. There is an element of ‘There, we can do it’.

“Hopefully, people will think differently in the future about this stuff and how smart we can be — the fact that we can grow and commercialise things from Australia and create economic value here without going offshore.”

The listed Carbon Revolution, chaired by former UBS banker James Douglas, now has substantial backers including Alex Waislitz’s Thorney Group, the Smorgon family’s Escor Group, Acorn Capital and institutional investors Colonial, Investors Mutual, Regal Funds Management, Quest Asset Partners and Greencape.

“People can see a path for investment in something like this because they have seen the whites of our eyes,’’ Dingle says, noting several backers came in ahead of the float and others four years ago.

They will be watching with interest to see Dingle and his team achieve their stated goal of being profitable on an earnings before interest, tax, depreciation basis by the fourth quarter of 2020.

And while the founders allowed themselves a night of celebration in December, the CEO is clear: “We are nowhere near the end point, we have only just started. Selling the house and working for nothing for four years — it makes you pretty hungry.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout