Wealthy entrepreneurs who switch to real estate never look back

They might start as panelbeaters, vets or cosmetic surgeons but as Jerry Schwartz will attest, once these Richest 250 members got into property they never looked back.

They might start as panelbeaters, programmers, cosmetic surgeons, vets, miners, publicans or textile engineers, but once they’ve made their first few millions, many wealthy entrepreneurs switch gears to the even more lucrative real estate sector.

Most never look back.

The List – Richest 250 includes dozens of examples of entrepreneurs who made their money in one industry then parlayed it into property.

This article is from The List — Australia’s Richest 250, published March 15, where property is the wealthiest sector.

One of Australia’s richest men, Harry Triguboff, has rarely faltered since he dumped his chosen profession of textile engineering.

Once, he managed mills in Israel and coastal Durban, South Africa; now he develops high-rise towers in Sydney and on the Gold Coast.

Born in China, Harry Triguboff, founder of Meriton, switched from textiles because he believed it had no future in Australia.

“Our machinery was very old,” he says. “Our wages were very high compared to the wages in Japan and China and our market in Australia was very small. I knew there was no future in the industry.

“That is why I left it. I was not wrong.

“When I looked at property, it made a lot of sense to me because there were no apartments here.

“The ones developed before the war were very few. I always liked apartments because I thought that was the future.

“In due course, I understood why I was correct. I used to look out from Sydney’s Dover Heights to Bondi Beach. There were no apartments.

“In China, England, Israel we had them, but we didn’t have them in Australia, and I knew there was a big demand for them.”

Having developed more than 70,000 apartments on Australia’s eastern seaboard – and watched as the textile industry closed down – Triguboff appears to have made the right decision to jump ship, all those decades ago.

There’s also Jerry Schwartz, a cosmetic surgeon specialising in liposuction and eyelid procedures. He made an intriguing leap from wielding a scalpel at his private practice in Sydney’s suburban Matraville to owning 14 major hotels, including the towering Sofitel Darling Harbour in Sydney.

He says taking the step from dealing with patients to operating hotels was simple, confessing that he “easily” pockets more cash on property than cosmetic surgery.

“I make more money from a 10-minute phone call trying to save 10 per cent on a $100,000 invoice for buying plant and equipment for my hotels than I can in a whole day doing medical consultations,” Schwartz freely admits.

Then there’s Sam Arnaout, a panelbeater hailing from Sydney’s gritty Greenacre. He now presides over casinos in Canberra and outback Alice Springs, as well as major residential developments and a pub empire that includes Hotel Steyne in Sydney’s seaside Manly.

Paul Little is best known for turning Toll Holdings into a global transport giant. He now owns the Little Real Estate business and also develops housing subdivisions and apartment blocks.

Theo Karedis and his family made their fortune from the Theo’s Liquor chain. Now, their Arkadia property group owns retail outlets and hotels along the east coast and has a billion dollars to spend on property assets.

Shaun Bonétt is a lawyer turned property magnate, while Tony Perich and his family were dairy farmers before developing their large landholdings in Sydney’s west, around Oran Park. Nick Andrianakos ran petrol stations, but his family fortune is now mostly held in commercial buildings and shopping centres.

Even a technology billionaire such as Mike Cannon-Brookes has opted for the relative safety of Sydney prestige property, spending more than $300 million on mansions in and around the city.

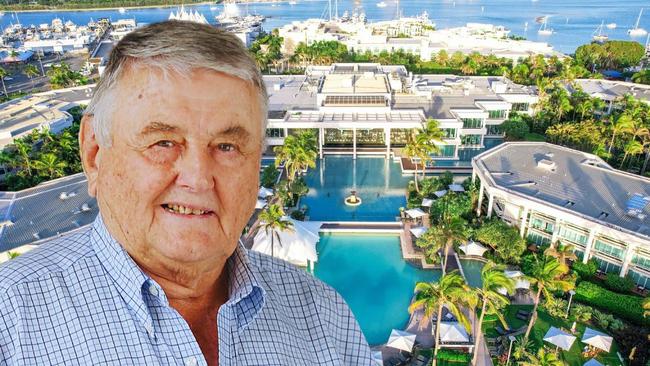

Flight Centre co-founder Graham Turner was a veterinarian for a few years before tourism became his thing, which in turn helped him jump on the property investment bandwagon.

“Travel has been good to us,” Turner says. “[It] is where we have made most of our money and it allowed us to then buy property.”

Over the years, Graham and wife Jude have amassed a major property portfolio, including Spicers Retreats, of which they recently sold 60 per cent for $130 million.

These days the Turners control a couple of eastern seaboard hotels, a rental property at First Point in Noosa, and another rental on the beach in Byron Bay’s Childe Street.

They recently purchased a $10 million designer house called Scorpia in Brisbane’s Hamilton Hill, and own several other properties in the Sunshine State capital. They are also believed to have property in the UK.

“I wasn’t a vet for that long – I only practised for the first few years,” says Turner.

“Real estate tends to be a safe haven to keep assets in over a long period of time. Real estate, unless you are lucky, will return three, four, five per cent a year. If you hold it for 40 years, that is a significant increase, and some properties, if they are in a rare good position, will appreciate very well.”

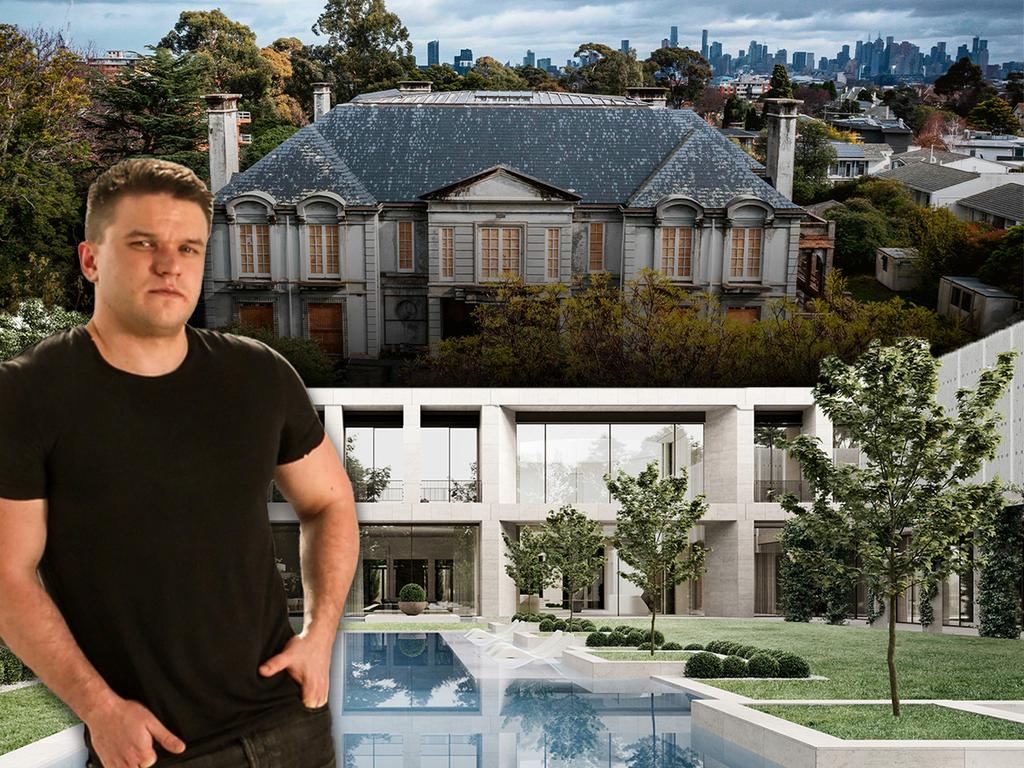

Pub mogul Arthur Laundy, who started out pulling beers in the family’s suburban Sydney hotel, is today worth $1.65 billion, having branched out from the pub trade into major hotel development and construction.

Billing himself as the nation’s “best beer puller”, Laundy went into hotel and accommodation development and investment.

This year he added to the Laundy family’s 90-plus pub portfolio by buying the $192 million Sheraton Mirage on the Gold Coast with the Karedis family.

“It’s been a two-prong attack over the past 60 years,” says the ebullient Laundy. “I’ve had the property to back up [my investment and development spree]. I enjoy work and love the hotel trade. For New Year’s, I spent the whole night at Watsons Bay Hotel with 2500 kids. I reckon I had a beer with every one of them.”

Unlike other members of the Richest 250, coal baron Brian Flannery, who turned to property in his retirement years, says his original industry was more profitable. “In the past, I have made more money out of mining,” he says, although he adds that property has always been a pretty good prospect in Australia. “Most people in property have been able to sit on it and make a lot of money. I prefer mining to real estate – I think it’s a great industry for Australia.”

He and wife Peggy have built apartment complexes and resorts at Kirra Beach on the Gold Coast on the back of the success of their resort Elements of Byron, on the NSW north coast. They have a lot of surplus land around Byron Bay, which they plan to sell, and they also own investment property in Brisbane, vacant land, and a large farm in Central Queensland. They also have a large beachfront site at Surfers Paradise.

“Right now, mining is very good,” Flannery says. “Demand for most of our commodities – iron ore, coal, gas – is supporting the federal budget.

“Right now are the good times. Every investment is a risk, but property has been pretty solid in Australia, if you buy at the right time. The 1990 property crash saw a lot of people lose money, as they did in the 2008 global financial crisis.”

Computershare co-founder Chris Morris, who started out as a programmer, retired as chairman of the share registry company to invest in property in the form of hotels and resorts.

But he appears to purchase property on a purely pragmatic basis. Either he buys it because he likes visiting it or he buys it to advance other businesses.

Morris owns two North Queensland tourism islands. He just opened Pelorus Island and says he bought nearby Orpheus Island because he loves going there.

“I bought the casino in Townsville because, due to my ownership of Orpheus, I needed a base in Townsville, and the casino came up and that was a good investment.’’ As an aside, he adds: “I buy boats because I love superyachts.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout