Would you pay half a million dollars a year for aged care? There’s a spot available

The top end of the aged-care market is expanding and clients are increasingly willing to pay up to $500,000 a year to spend their retirement years in the lap of luxury.

The term luxury is often overused.

Essential items such as a simple bar of soap can be produced and marketed as a luxury item. But when it comes to retirement, is there such a thing as luxury accommodation and luxury aged-care services?

Melbourne-based private home care provider Acquaint has embedded itself in the top end of the market. Services range from emotional support by taking an elderly family member out for a walk, through to nurses providing high-level care to enable a family member to remain in their own home for as long as possible.

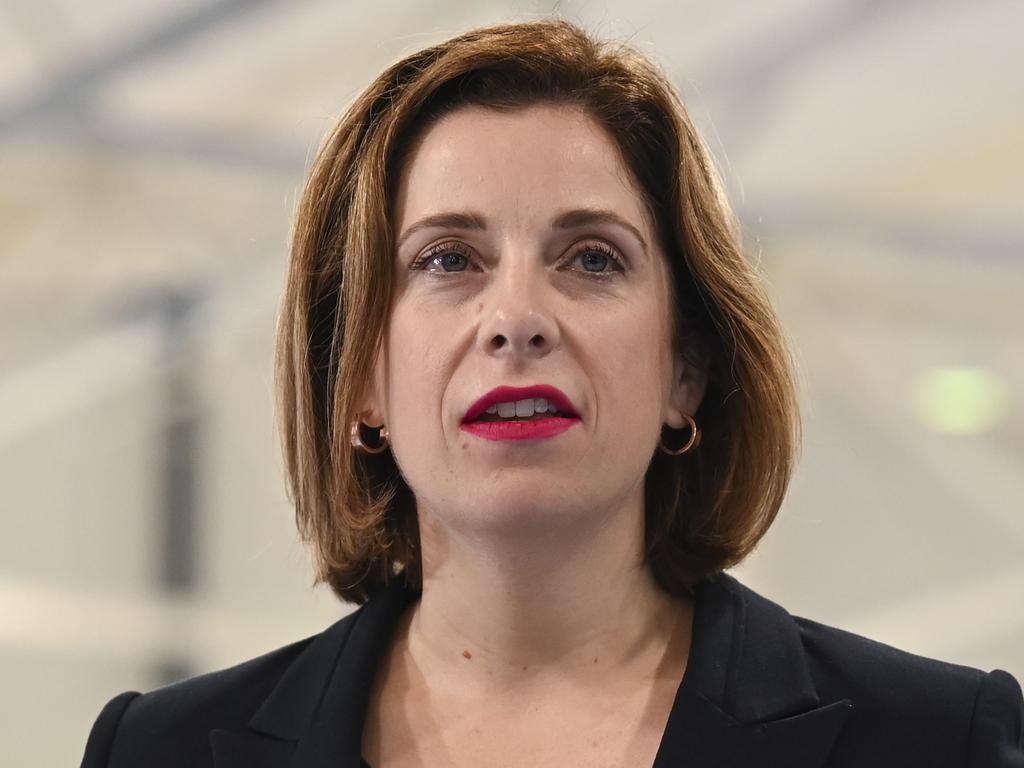

“There are government-funded home support packages available, however they are means tested, have a waiting list and require a lengthy administrative process and are subject to caps,” Managing director Fiona Somerville says.

“For people who have the funds, or do not want to fill out all the forms, or have received advice that it is not worth pursuing the government system based on their level of assets, we are there to provide a premium service to keep older Australians engaged, active and doing all the lovely things we enjoy in life.”

Somerville speaks of clients in their 90s who are taken out by her trained staff for coffee, then assisted to do the weekly shopping and finally taken home where the carer assists with cooking a meal together.

While this may not seem particularly “premium” or out of the ordinary for a home-care service provider, it is the little things that clients and their families appreciate that attracts the premium status. The consistency of care, the purposeful way carer and client are matched based on interests, and the low fuss way of getting the service organised.

“We are usually first engaged by middle-aged children worried about their mum or dad and want to provide them with a bit of help around the house,” Somerville says.

“In the matching process we look at interests such as gardening, cooking and sports.

“One of our clients is a big racing fan. We matched him with a staff member who also shares the same passion and they have quite a lot to talk about. Another client was high up in the business world so we matched him with someone who could talk about business and politics at his level.”

Overall, the difference between a government funded home-care service provider and a privately paid one comes down to convenience and quality.

“Our job is to provide another option for people,” Somerville says. “It is similar to the question of whether you send your kids to the public school or private school. If you can afford that choice, you pay for it.

“We provide a premium service for people looking for something that is cut above and I can say that the demand is absolutely there.”

But costs can add up. A 24 hour-a-day in-home care arrangement will range from provider to provider, but do not expect much change from $500,000 per year.

As such, most people transition out of the family home when their physical or mental condition reaches a point where they need regular care.

And this is where luxury seniors living and premium aged-care facilities come in.

Shane Moran who runs Provectus Care, led family owned Moran Health Care Group to become Australia’s largest private hospital and residential aged-care provider.

Since then he built a portfolio of luxury aged-care and independent living facilities. Provectus Care offers eight facilities across Sydney and Melbourne.

When it comes to aged-care accommodation there are usually two paths. The first is the independent living model for people who are over 55 years old. It is often structured on a 99 year lease model and centred around a sense of community.

The alternative is an aged-care facility for people who require more “on demand” care and support services. Residents are required to pay a refundable accommodation deposit, which can be over $1m in major capital cities, or otherwise pay a daily accommodation charge.

Under the independent living model, an upfront fee is also paid, which can range from a few hundred thousand dollars to several million dollars depending on the location and type of apartment or house.

A monthly fee is then payable to cover energy costs, water costs, maintenance and other services offered. There is also a departure fee which depends on the length of stay but can be up to 30 per cent of the resale value.

Moran says: “We love it when we hear people say that they wished they’d made the move years ago. We pride ourselves on the community that you go into and the facilities we provide.”

Depending on the location, this can include a hydrotherapy pool, chef-prepared meals with matching wine, in-house bridge club, concierge service, in-house cinema, club facilities and so on. Moran describes it as the difference between a 3 star and 5-star hotel for older Australians.

“In our new vertical village in Sydney’s south which has 37 two and three-bedroom apartments, we have facilities on the ground floor such as a cafe that is open to the public,” he says.

“Whilst our residents want to enjoy privacy and security, they also want to know who their neighbours are and not be locked away.”

If you are lucky enough to be in a strong financial position in retirement and can pay for premium support services or be in a resident in a luxury aged-care facility, they do exist and based on the popularity, retirees are increasingly adopting a “use it or lose it” approach when planning how they wish to spend their later years of life.

James Gerrard is principal and director of Sydney financial planning firm www.financialadvisor.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout