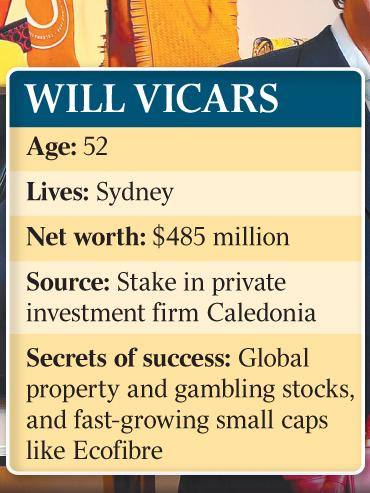

Vicars’ wealth is derived from his stake in Sydney investment company Caledonia, managing money on behalf of the wealthy Darling family and other investors, though he also has a diverse range of investments in his own name.

Caledonia (Private) Investments made a pre-tax profit of $125.9m from $139m revenue in the 2018 financial year, documents lodged with the corporate regulator earlier this year reveal.

The company, of which Vicars is chief investment officer and part-owner, paid dividends of about $73m to its owners.

Those results compared with revenue of $86m and a pre-tax profit of $70m in the previous year and come from an investment strategy concentrating on owning shares in big US property groups and food delivery services, as well as the global Formula One circuit and US building materials stocks.

According to information compiled by Bloomberg, the Caledonia portfolio is worth $9.7 billion in listed company stocks, led by real estate group Zillow — which comprises about $3.6bn across two different classes of stock for Caledonia.

Zillow has been a strong performer for Vicars this year, rising 55 per cent since January 1, and shares in the Liberty Media Formula One Series are up almost 40 per cent in the same time despite concerns about Mercedes driver Lewis Hamilton driving away at the top of year’s series and the possibility of a leading team like Ferrari breaking away from the global circuit.

Caledonia has also had a strong performance with two US building materials companies, Martin Marietta and Vulcan Materials, which have risen 30 per cent and 38 per cent respectively since January 1.

Then there is the real estate analytics company CoStar, one of the stellar performers in the Caledonia portfolio. CoStar is up 88 per cent this year, and recently announced strong profit results for the July quarter.

Another trend for Vicars is food, particular those that deliver to consumers. One in the portfolio is GrubHub, which is down about 2 per cent this year, and German-listed Delivery Hero, which is up 25 per cent since January 1 but is trading about 20 per cent less than it was in July 2018.

Vicars has less good fortune with a big holding in the Canadian-listed gambling company The Stars Group.

The owner of brands such as Australian company BetEasy, The Stars Group shares are down about 2 per cent the start of the year but are worth about half their level of 12 months ago.

London-listed Flutter Entertainment, which owns the Paddy Power and Betfair betting brands, has performed better with a 8 per cent rise but shares in car buying app TrueCar are down 41 per cent on the NASDAQ for Caledonia.

Vicars is also a substantial investor in his own right, owning a share portfolio worth at least $50m in ASX-listed stocks.

The largest is Oneview Healthcare, a health industry software company that Vicars was at one stage a non-executive director of. Unfortunately, Oneview shares have lost have their value this year.

The best stock Vicars has is industrial hemp firm Ecofibre, backed by another member of The List — Australia’s Richest 250 in Barry Lambert.

Ecofibre shares hit the ASX with a $1.00 issue price in April and have since trebled in value. They were up 25 per cent to a record high $3.69 at close of trading yesterday.

At that level, Ecofibre had a market capitalisation of more than $1bn — making it one of the best ASX floats of 2019.

Vicars also reportedly owns about $100m worth of property and last year rescued fashion label Oroton from administration in a $25m transaction. He was a large shareholder in Oroton before rescuing it.

He is also well known for brokering a deal between billionaire Gretel Packer and her brother James for her to be given her own share of the family wealth.

Sydney investor Will Vicars helped oversee an investment outfit that made a cool $125 million pre-tax profit last year, a result that could be topped in 2019 given the performance of several big stocks in his portfolio.