Why I love CSL shares ... and you should, too

Looking back, corrected for share splits, the initial opportunity to add some CSL shares to anyone’s portfolio translates to about 76.7c a share on the first day of public trading. In other words, regardless of what the immediate future holds, the investment return from owning CSL shares over the period has been nothing short of ginormous.

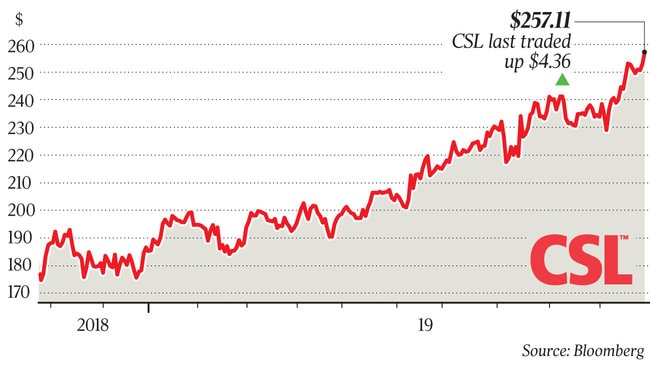

This realisation becomes even more so when one considers the share price graph over the period shows what looks like a steady, gradually rising uptrend — unlike, say, Fortescue Metals, which also reached a new all-time high in 2019.

That steady, almost unnatural-looking performance has made CSL today’s third-largest component of the S&P/ASX 200. Now also consider the fact that Commonwealth Bank shares peaked in May 2015, along with the other banks, and that BHP shares in 2014 were trading above $40, and one can only conclude that CSL’s performance has been even more impressive.

If it hadn’t been for index heavyweights such as CSL, Macquarie Group, Transurban and Goodman, it would have been near impossible for the ASX 200 to reach for a new all-time high in 2019. Yet, the sad fact remains most investors don’t own shares in CSL, though some may have owned shares at some point throughout those 25 years.

The usual explanations heard are “too expensive” and “cannot get my head around it”. This goes both for the self-managing retail crowd as for professional fund managers. The logical observation to make here is that everybody who bought shares in CSL, no matter when or at what price, is today sitting on a profit.

With the shares trading on a FX-adjusted, forward-looking estimate of about 37 times FY20 earnings per share, it will nearly always be too “expensive” for typical value-seekers, while the implied 1.2 per cent dividend yield is too low for the income-hungry.

Maybe, without owning shares in the company, there are some valuable lessons to be learned from CSL for investors of all kinds and various levels of experience.

In 2019, all three major external factors have ultimately aligned to push CSL shares to a new all-time high. This is not necessarily always the case. When bond yields rise strongly in a short time, as they did in late 2016, CSL stock temporarily faces a formidable headwind.

When the dollar strengthens against foreign currencies, this also tends to create a headache, and similar underperformance follows when investors temporarily favour cheaper-looking, beaten-down cyclicals like they did when the GFC bear market ended in 2009-2010.

Another complicating matter is the fact that CSL is now the number three index component in Australia, which makes the stock more susceptible to general market sentiment. Whereas in the past the shares were at times able to not necessarily follow general market sentiment down, such idiosyncratic behaviour is a lot more difficult when large sell orders aiming to replicate the index hit the local market.

Most importantly, however, is that 25 years from the past show that whatever external factor is holding back the stock at any given point, as long as the business continues to perform, its shares will ultimately perform, too. As such, every period of weakness or stagnation in the share price ultimately proved a profitable entry point.

This takes us to the operational reliability that has become one of the trademark characteristics of CSL. How come most businesses cannot replicate the solidity and sustainability of CSL? Never a profit warning. Seldom an operational disappointment. This company, throughout various managers, has an almost alien-like track record in a sharemarket that regularly shocks through corporate failures and mishaps.

The answer is two-fold.

● First, CSL has managed to transform itself into the highest-quality benchmark for the plasma industry globally. It operates collection centres more efficiently than anyone else, which means it can open additional centres quicker and earn its investments back in a shorter time.

● Second, in line with general industry practice, CSL invests about 10 per cent of annual revenues back into its business to expand through new centres and to constantly develop new products. It has a rich history for discovering and developing new therapies and medical solutions, which is necessary in the fast-moving and ever-evolving biotech-medical world.

In line with CSL’s high-quality operational label, the flu vaccines business sits at the forefront of new innovations in this space.

And yet, what is equally important is that the global market for plasma is growing pretty much constantly. While it could be argued plasma is a commodity, like iron ore or wheat, its market dynamics are much more favourable because supply can hardly keep up with demand — a situation not expected to change anytime soon.

In fact, the current situation whereby the US provides most of the world’s plasma supply, also because the country allows blood donors to be paid for their contribution, is not sustainable

CSL should be able to continue its path of growth and further creation of shareholder value for as long as it retains its position as best in class inside the industry, and as long as nothing fundamental changes to the underlying dynamics for the global plasma market overall.

Rudi Filapek-Vandyck is the editor at stock research publication FN Arena.

This month marks the 25th anniversary of CSL as a listed company on the ASX. In fitting fashion, shares in Australia’s highest-quality global success story surged to an all-time high of $253 in October.