Why car collectors love working from home

The pandemic has brought a new type of car collector to the market, say specialist dealers.

At the premium end of the collectible car market, prices are now running at almost double the national average property price of $550,000, with the recent sale of a 2017 HSV GTSR W1 Maloo ute for $1.05m and a 1971 Ford Falcon XY GT-HO Phase III for $1.15m.

But what has been the driver behind these record breaking prices? Is it the low interest rates and cheap money, or are there other factors at play?

Although interest rates are low, they have been low for a while. In reality, what has pushed the collectible car market to another level has been the global pandemic, where one of the more unlikely outcomes has been the surge in value of collectible cars.

Matt Stoupas, who owns ThePorschaDen Classic in Armadale, Melbourne, usually has 25 rare and collectible Porsches available for sale. However just now he only has four Porsches left in the showroom.

Stoupas says: “With COVID, we have experienced an influx of first-time Porsche buyers. Some are affluent people who have not been able to travel overseas and have an extra $75,000 to $150,000 that otherwise would have been spent on holidays.

“We might also include bored business people who experienced a slowdown with COVID, but still have cash to spend. Other customers planned to buy a Porsche at retirement, however, have brought forward their decision to buy now.”

And it is not just Porsches that have seen a surge in demand and prices.

Christophe Boribon, from Shannons Auctions and Insurance, says: “We are seeing the market pretty hot in general for all classic and sports cars. With COVID, people have been reassessing things. For some, this has included the purchase of that special classic car they have always wanted.”

In terms of who is buying, the profile of the collectible car buyer has also changed. No longer is it the exclusive domain of the cashed-up empty nester baby boomer. Younger working professionals have been entering the classic car market in force.

Boribon says: “With the work-from-home arrangement becoming popular over the past 12 months, more people are now able to drive and enjoy their collectible vehicle not only on the weekends, but also during the week as they are not stuck in a CBD office block from 9 to 5 each work day.”

And there is good news on the tax side of things for prospective investors of collectible cars.

Caxton Pang, managing director of accounting firm Linton Advisory says: “The ATO provides a capital-gains tax exemption on cars purchased in your personal name that are resold for a profit, including ones that are collectible and classic in nature”. (If you are surprised by this exemption, you will find it under sub section 108 in the ATO’s guide to CGT on “antique, veteran and vintage cars”.)

But still, some investors prefer to use a self-managed super fund to purchase collectible vehicles, presumably because it may be a more appropriate funding source and they feel the investment will achieve an appropriate level of capital growth over time in keeping with the investment strategy and objectives of their fund.

Pang says: “The ATO has strict guidelines about owning a classic car in the SMSF around insurance, leasing, selling and in particular usage. It can’t be driven for any reasons or even for maintenance or restoration purposes by members or related parties, it must also be stored away from the private residence of any related party and only unrelated parties can drive and store the vehicle for such purposes.”

So if you are a car enthusiast who would also like to drive the vehicle rather than be restricted to just looking at it, making the purchase outside of the superannuation environment seems like the logical choice. And Boribon notes that you may be opening the door to a whole new world.

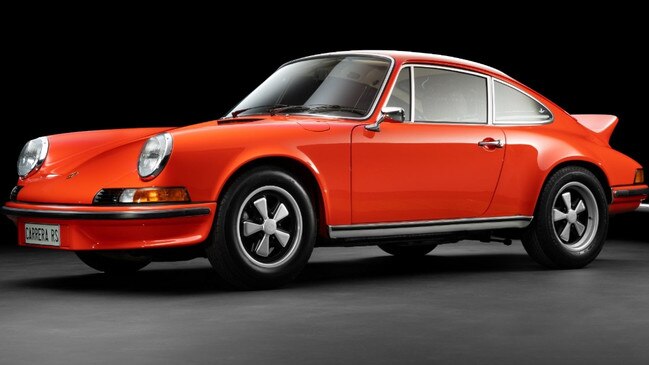

For the pure investor, classic and collectible Porsche dealer Stoupas says: “Even though the value of a 1974 Porsche 911 Carrera 2.7 has increased from $150,000 a few years ago to $400,000, I believe this iconic vehicle will have the greatest growth out of any Porsche over the next five years and will join the $1m club. And for those with a lower budget, any modern 911 with a global production run of less than 1500 is almost guaranteed to be a future collectible.”

According to the most recent Knight Frank Luxury Investment Index 2021, classic cars gained 190 per cent over the last decade.

James Gerrard is principal and director of Sydney financial planning firm financialadvisor.com.au