Why Australian investment experts believe the money will be made on overseas markets

Wall Street and China are the top targets for sharemarket investors as small-cap stocks move up to take first place among this year’s favourite sectors.

Some of the best investment minds in the wealth-management industry came together this month at the Portfolio Construction Forum strategies forum in Sydney to debate what the next 12 months is likely to look like.

Led by Graham Rich, the delegates were offered a range of economic scenarios, from good to bad, and each was voted on by delegates, to determine the probability of each alternative.

From there, predictions were made on what investments people should be making and what they should be selling.

The experts agreed that the AI boom would continue to drive investment returns across property and sharemarkets. Stage one of the boom resulted in the rapid rise of companies directly in the sector such as Nvidia, which is up almost 3000 per cent over five years.

Stage two is now approaching. The experts believe businesses that embrace AI and shift to new AI-enhanced processes will rise to the top of their fields.

And we are not only talking about large tech businesses. The experts believe the opportunity is greatest for small, nimble companies that can adjust quickly.

AI tools are highly accessible and cost-effective. Your local restaurant owner can build an AI algorithm in a couple of hours to forecast customer patronage by collating inputs such as weather, tourist arrival numbers and economic conditions.

The experts, including investment research firm Zenith Investment Partners founder David Wright and Platinum Asset Management chief executive Andrew Clifford, debated what settings were needed to capitalise on the AI boom in your investment portfolio.

There was a strong view that US shares offered more upside potential than Australian shares.

Of the delegates, 60 per cent voted to hold a larger-than-normal US share exposure, compared to only 7 per cent who voted to allocate more money to Australian shares.

Evergreen Consultants founder Angela Ashton said the top 10 stocks on the ASX were expensive.

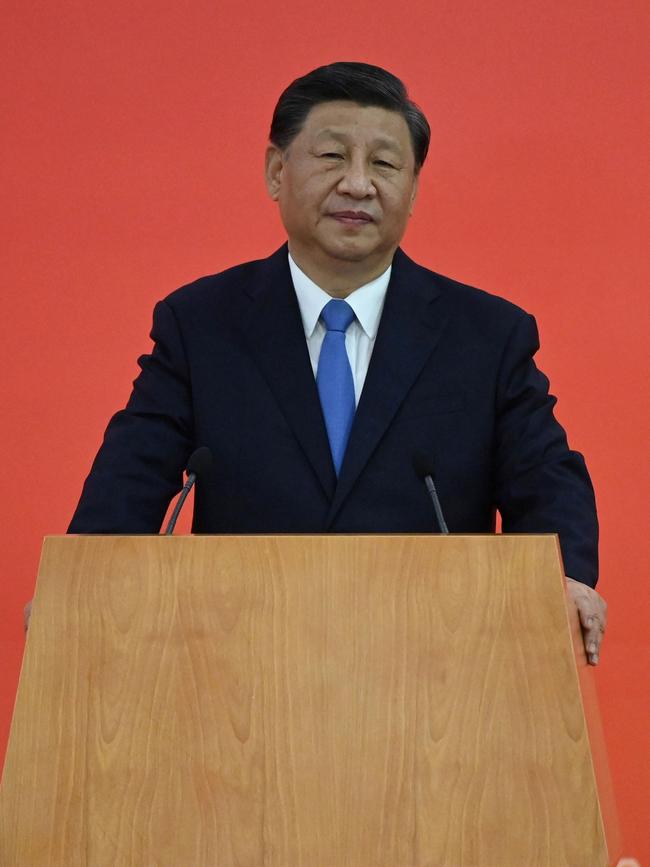

Mr Clifford discussed the potential headwinds faced by the Australian economy resulting from poor Chinese economic conditions, but also said that some of the best buying opportunities were in China rather than the US.

He said you could find “rock bottom prices” in the Chinese sharemarket. His argument was that US companies that were very exposed to China – such as Nike, which trades on a price-to-earnings ratio of 22 times – do not represent good value when compared with Chinese companies that trade on an average sharemarket P/E of 10 times.

Scott Welch, the chief investment officer of US wealth management firm, said: “There is a valuation discrepancy between small cap versus large cap and I am leaning more towards small cap.”

Mr Wright from Zenith agreed and said that that peak interest rates had been reached. As interest rates fell, this was likely to be good for smaller companies which were sensitive to interest rate changes. The experts also tended to favour global small company investments rather than Australian small company stocks.

Ms Ashton said: “The non-large-cap trade is the play of the next 12 months. Small companies will be able to leverage AI quicker than larger companies.”

On the topic of bonds, views were mixed. Some experts preferred longer-dated government bonds while others preferred shorter-dated corporate bonds.

Mr Clifford, who was in favour of longer-dated bonds, said: “I want as much duration as possible. I do not like credit (corporate bonds) due to the potential for bad economic scenarios and the loss of duration.

“Credit funds may be getting 8 per cent now, but this will go down to 3 per cent as interest rates come down.”

And when it came to the vote the delegates generally agreed; 40 per cent preferred longer-dated bonds while only 15 per cent wanted shorter-dated bonds.

In addition to small-cap stocks and emerging markets such as China, the experts favoured data centre and infrastructure investments such as energy transmission lines to cash in on the AI boom.

Mr Wright said: “Data centres are hot assets due to the AI boom so I would be overweight in their exposure.”

But given that Goodman Group makes up almost 40 per cent of the listed property sector in Australia, the experts preferred to look abroad and target GREITS – global real estate investment trusts that are available in both ETF and managed fund formats. When discussing currency, only 7 per cent of delegates voted to hedge currency exposure, whereas 45 per cent of delegates voted to leave their currency exposure largely unhedged. In other words, the experts predict that the Australian dollar is more likely to fall from its current level of US68c than it is to rise and break above the US70c barrier.

While stage two of the AI boom was the most likely economic scenario to play out, there were plenty of twists and turns in the process as delegates voted for the “optimal” portfolio mix.

US shares, smaller companies, infrastructure investments and long-term bonds were all expected to be winners, but that was under the assumption that we avoid an inflation-induced recession, which would derail expected returns and flip things upside down.

James Gerrard is principal and director of Sydney planning firm www.financialadivser.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout