The measurement system for comparing low-cost MySuper products launched on Tuesday is not perfect, but it offers a comparison that is backed by the prudential regulator of Australia and that will be good enough for the vast majority of people.

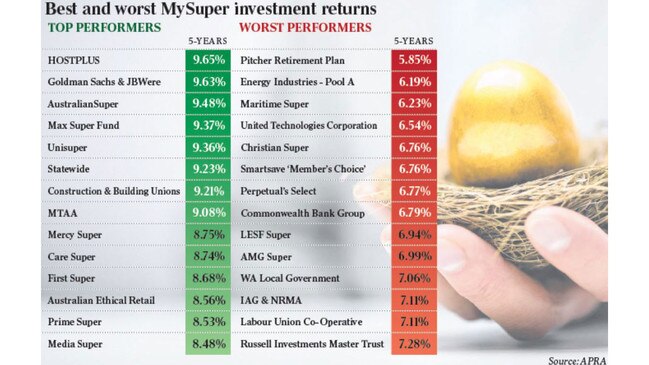

Even Industry insiders might be surprised to see “big names” such as Westpac or Christian Super doing so poorly.

READ MORE: APRA heatmaps identify worst super performers | Super funds face new pressure on short selling | APRA tells super funds to shape up or merge

In reality, almost any big super fund can make itself sound relatively successful to the wider public by highlighting what it might define as important for savers.

However, in the end, if a fund is consistently behind the market or behind its key rivals then the arguments for the defence will fall flat.

The outstanding benefit of the new APRA heatmap measure is that it will lead to a better informed public and it will scare the daylights out of sleepy boards that had lagged their peers.

Whether this in turn should lead to the idea of a “best in show”, where the top performing funds get preferred treatment, is another point entirely.

The big problem with this idea is that funds will push the envelope to make the top league. As they do so, risks inside the super system might very well rise in tandem.

Across financial services, comparison services on all aspects of personal finance have generally improved in recent years.

In contrast, superannuation is more complex and until now, the average saver had no idea whether one fund was any better than another, apart from occasional and obscure reports from industry players.

One of the biggest problems inside super is the thorny notion of definition: one fund’s definition of “balanced” might not be the same as a rival’s.

Until this outstanding issue is resolved, you can’t really compare perfectly, but comparing imperfectly will do for the moment.

Industry groups that exist to represent the entire super industry seem only capable of unconvincing remarks at times like this.

Warnings from various lobby leaders that the new APRA league tables are simplistic and possibly misleading show a lack of leadership in the sector.

Sally Loane, CEO of the Financial Services Council, suggests that first-time readers of the tables ask: “What do they want from their fund?”

I expect most people want their fund to be close to the top ranks most of the time.

That’s mathematically impossible, of course, but every fund should still be trying.

The next objective for APRA should be to make this exercise definitive and to become the de facto benchmark for super.

To do this, it will have to somehow “weigh” how funds invest their money so that we might measure, say, an infrastructure-heavy industry fund against a retail fund that has more liquidity demands and has, by definition, more exposure to listed markets.

APRA has measured the portion of MySuper funds that are concentrated on growth assets which is a start, but this will not be granular enough to satisfy those who feel hard done by in the survey.

Certainly, you can bet the funds at the bottom of the pile will scream about how they should not be there, but the great thing is, we now know which funds they are — whatever their excuses.

First things first: Comparing super funds and highlighting the weaker performers is a very useful and welcome exercise.