Three ASX-listed small caps that could create useful disruption

I’ve had fun with Afterpay. Now I’m looking for small caps with that kind of potential for the future.

Due to Afterpay’s disruption, two well-known businesses failed to lift off in the Australian market in the past two months.

In September, “buy now, pay later” forces caused ME Bank to discontinue its investment in credit cards and the company’s chief executive, Jamie McPhee, proclaimed: “I don’t think my daughters will ever own a credit card. They will have a debit card and a buy now, pay later account.”

Then last month, there was Ahmed Fahour’s Latitude IPO fail. His company offers a more traditional credit business, which generates fees from consumers racking up increasing amounts of debt.

Investors and, more to the point, consumers of credit services are voting with their feet, favouring low-value, high-turnover solutions that don’t involve onerous conditions if they can’t make payments.

Afterpay is still a disruptor, and even after recent share price falls it still has a market cap of more than $7.5bn. This could climb a lot higher (according to Morgan Stanley), but it is also vulnerable to regulation and to increasing competition (according to UBS). More to the point, I’ve had some fun (I wish I had more) with Afterpay as an investment and now I’m looking for ASX-listed small caps with that kind of potential for the future.

Hazer Group (HZR)

One that I particularly like is early stage but it has a great deal of potential, owning a technology that turns human waste into clean energy, which puts the company in a prime position to disrupt conventional producers of hydrogen as well as graphite miners. Hazer Group is in the process of building a demonstration plant in its home state of Western Australia, which should be a big positive for its prospects of eventually supplying the giant Japanese market.

After all, the hydrogen revolution isn’t happening in the future, it’s happening now. As Australia’s chief scientist Alan Finkel said this time last year: Japan has declared its intention to use hydrogen as a mainstream fuel. Underlining this point, the nation’s ambition is to have the 2020 Tokyo Olympics run on hydrogen (a goal set a number of years ago).

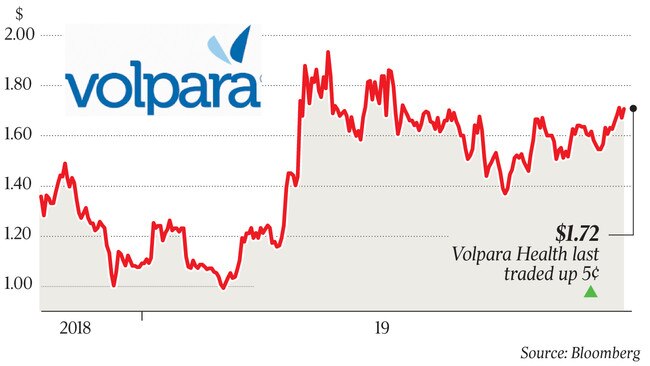

Volpara Health Technology (VHT)

Then there is New Zealand-based med-tech Volpara Health Technology, which has developed (in my opinion) a game-changing proprietary technology using artificial intelligence to transform early detection of breast cancer. Currently, the main breast cancer screening technology is mammography, or breast X-ray. An estimated 75 million women are scanned annually in this “one size fits all” approach, which does not take into account varying risk profiles of patients.

Volpara’s technology focuses on transforming the digital mammogram into standardised information about the breast using its AI algorithms.

LBT Innovations (LBT)

Next cab off the rank is Adelaide-based LBT Innovations, which has developed an automated machine that uses AI to work in pathology laboratories. Its Automated Plate Assessment System platform technology automates culture-plate screening and interpretation, speeding up the process by at least three times that of a manual reading. The technology was developed by LBT in collaboration with the University of Adelaide’s Australian Institute of Machine Learning. In May, the company’s shares spiked after it announced that its 50 per cent-owned joint venture Clever Culture Systems received US FDA approval for LBT’s platform, but it still has a long way to go.

The biggest disruptors some could argue in our lifetime are the so-called FAANGs — Facebook, Amazon, Apple, Netflix and Google owner Alphabet. These are now worth $US3.5 trillion ($5.1 trillion) and are all heavily based on accessing huge amounts of data from consumers.

This is the investment area in which ex-All Black captain David Kirk’s team at ASX-listed Bailador Technology Investments (BTI) hunts. Bailador provides access to private information technology companies that otherwise would not be available to individual investors.

I thought his former team were a better bet in the Rugby World Cup than any of these stocks, but it just goes to show these disrupters can really disrupt your portfolio in the right way.

Richard Hemming is an independent analyst who edits undertheradarreport.com.au

r.hemming@undertheradar report.com.au

Forget for a second about the noise in valuing Afterpay Touch. The fact is this company has changed the face of lending not only in Australia as a “buy now, pay later” pioneer, but increasingly in huge offshore markets, including the US.