The lessons and questions for regulators from the Keystone financial web

Keystone Asset Management, which is the trustee of Shield Master Fund, raised more than $480m from over 5800 investors since February 2022. But after an ASIC investigation and subsequent enforcement action the fund, which is insolvent and currently in administration, is in the process of being wound up and significant investor losses are expected.

ASIC’s investigation indicated that potential investors were cold called by lead generators. They were referred to personal financial advice providers who advised investors to roll their superannuation assets into retail superannuation funds through which the trustees were Macquarie Investment Management Limited and Equity Trustees Superannuation Limited.

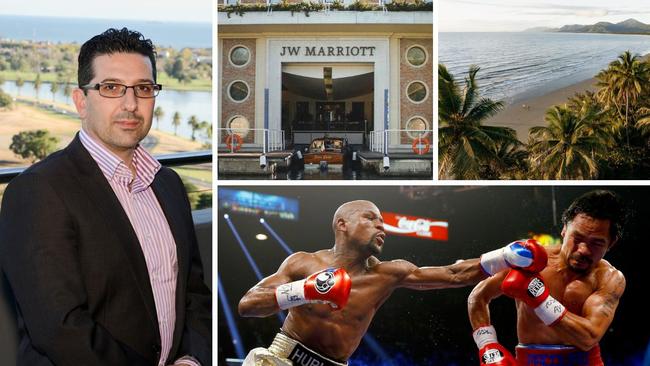

ASIC alleges that a large amount of the money invested in the Shield Master Fund was then invested in a wholesale managed fund called the Advantage Diversified Property Fund – which is associated with Paul Chiodo, the former director of Keystone Asset Management, which ran the Shield Master Fund.

The property fund then made loans to various companies associated with Chiodo to fund property development projects in Fiji, Italy, Port Douglas and Melbourne.

Substantial funds appear to have been spent on property developments without written contracts and, in the case of a Port Douglas development, without the required development approvals to proceed.

Overall, ASIC believes that there is likely to be a substantial shortfall when the assets are liquidated, compared with the original investor capital.

ASIC also has concerns that investor funds may have been misapplied. Of the money transferred to Advantage Diversified Property Fund, ASIC told the Federal Court that $302,000 was used to pay for an appearance by celebrity boxer Floyd Mayweather and $110,000 was allegedly paid to Tyson Fury Corporate Events.

Deloitte was initially appointed by the Federal Court in September as receiver and subsequently as administrator of Keystone Asset Management and conducted an extensive forensic accounting investigation into what happened. Of the $531m (excluding redemptions) invested in the Shield Master Fund, about $305m was transferred to the Advantage Diversified Property Fund. Deloitte now values the net assets in this fund to be somewhere between $25.3m to $58.3m as at May 31.

Advantage Diversified Property Fund transferred $265m to Chiodo Corporation, controlled by Chiodo, and Deloitte identified about $16.9m as having been paid to entities controlled by Chiodo where it could not link costs to specific projects. Separately, Chiodo Corporation transferred $160m into a company called City Built whose director, Robert Filippini, did not hold a building licence until May 2024 – which is after ASIC stepped in and banned the fund from accepting new investors, in February 2024.

Speaking at the Financial Advice Association of Australia’s annual congress in Brisbane recently, ASIC commissioner Alan Kirkland said: “Potential investors were called by telemarketers, who then referred them to financial advisers. They were advised to roll over from their existing superannuation funds and to put part or all of their superannuation into the Shield Master Fund.

“While our work on this matter continues and it involves a broad range of entities and individuals, it’s important to note that some advisers appear to have played a really crucial role in advising consumers to invest in Shield.”

Some of the financial advisers involved come from a well-known financial planning group called InterPrac Financial Planning as well as other firms such as MWL Financial Services, Financial Services Group Australia and Next Generation Advice.

Louie Kortesis, a former director of Keystone Asset Management, is noted on the MWL Financial Services website as the partner in the accounting division. Deloitte found that $4.9m was received by 24Calibre, an entity controlled by Kortesis “apparently for celebrity appearance fees, agent fees, travel costs and operating costs” paid from Chiodo Corporation.

At this stage ASIC has not made any allegation of financial misconduct against any of the financial advisers involved who recommended the Shield Master Fund. “I wish I could say that this is an isolated example, but it’s sadly similar to a pattern of conduct that we are seeing far too often, where telemarketers recruit people and hand them over to advisers,” Kirkland said.

“Those advisers then encourage them to move their super from a relatively well-performing fund into a platform product or SMSF with their savings then invested in high-risk property or crypto investment schemes that are highly unlikely to align with the best interests of the consumers involved.”

Reading through the product disclosure statement for the various Shield sub investments – which is up to 80 pages long and full of jargon – it becomes clear that the average retail investor is ill-equipped to understand what the investment does and the risks than might be taken.

For instance, ASIC found that the PDS gave the impression that investors could make weekly withdrawals from the fund when redemptions were actually at the absolute discretion of Keystone Asset Management and could be subject to a two-year redemption lockup period.

The whole system of investor disclosures and documentation needs to be reviewed by ASIC and questions need to be asked about whether it was reasonable to expect the everyday investor to wade through copious amounts of fine print contained in product disclosure statements to determine whether they should invest in a retail managed fund.

The introduction of investors to financial advisers should also be looked at closely as the referral has the potential to affect the impartiality of the advice provided by the financial adviser. In other words, is the adviser more likely to recommend an investment linked to a property developer or fund management firm that introduces the client to the adviser?

ASIC should also look into whether it is a loophole for fund managers to attract retail money, but then transfer it to a wholesale managed fund that has far less regulatory requirements and recourse for investors. The Shield Fund, which was a retail managed fund, used retail investor money to then invest in the Advantage Diversified Property Fund, which is a wholesale managed fund.

The key takeaway from this situation is that if you are wanting to invest, do the research yourself.

Do not engage with cold callers when it comes to financial products as the vast majority of reputable firms don’t rely on cold calling to attract new customers. And also be wary of the potential conflicts of interest when getting financial advice.

Question the basis for any advice provided and ask for justification as to why the recommendations are in your best interest.

James Gerrard is principal and director of planning firm www.financialadvisor.com.au

Thousands of people are likely to go to Christmas not knowing how much of their life savings will be lost in the latest failed investment scheme.