Superannuation funds show signs of recovery

SuperRatings says super balances recovered some lost ground in April after the COVID-19 battering, but remain well down.

Superannuation account balances are beginning to stabilise but remain well down following the battering from the coronavirus pandemi c, says SuperRatings.

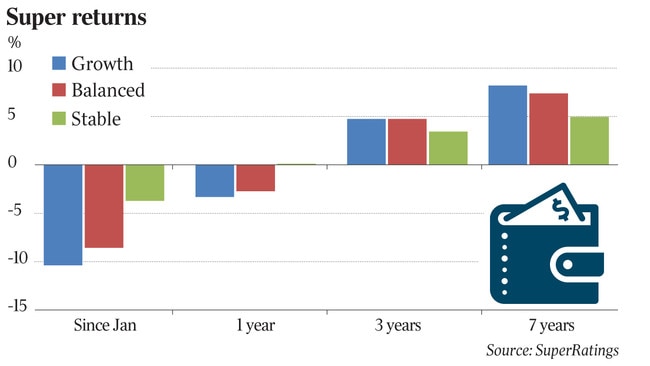

Latest figures released by the research house reveal the average Australian super fund balance is down 8.1 per cent since the beginning of the calendar year.

However, the median balanced option — which make up the bulk of super accounts — rose by 2.7 per cent over April, as super funds recovered some of the value lost in the March market meltdown.

SuperRatings executive director Kirby Rappell said it was “pleasing” that signs of an upturn were beginning to appear, but flagged super funds remained on standby for further financial fallout.

“April saw some of March’s losses reversed, and it has been pleasing to see how most funds' portfolios have responded to this challenging period,” Mr Rappell said.

“However, we’re having more conversations with funds to determine their level of preparedness should the situation deteriorate.”

The research house says while it is expecting returns for this current financial year to be broadly negative, they will be “milder” than the impacts experienced during the 2007-08 global downturn, assuming the situation does not rapidly deteriorate through May and June.

Median growth option, which is more exposed to shares and riskier asset classes, is estimated to be down 9.7 per cent since the beginning of the 2020 calendar year.

The capital stable option, which has less exposure to equity market movements, is down 3.5 per cent over the same period.

One-year returns on median balanced option fell by 2.5 per cent. Growth accounts over the same period dropped 3.2 per cent and capital stable remained unchanged.

Pension accounts have been worse off, with a balanced pension account estimated to be down 8.5 per cent since the start of the year.

Median growth pension accounts fell in the same period by 10.3 per cent, while capital stable accounts decreased by just 3.7 per cent.

The negative market swings had been driven by global markets digesting the impact of COVID-19, but massive stimulus program led by the federal government and billions of dollars injected into the financial system by the Reserve Bank has helped markets recover.

“Markets appeared to show an eerie sense of calm, thanks in part to the fiscal and monetary response from the government and RBA, but also due to the success of social distancing and other measures in containing the virus,” Mr Rappell said.

Despite members feeling the financial pinch, SuperRatings said the biggest mistake was often when people cashed out and missed the recovery period.

“When we look back as far as the global financial crisis, the recent fall in super fund balances appears stark, rivalling the GFC for the depth and speed of the decline,” SuperRatings said.

“However, what is also apparent is the strength of the recovery following the GFC and the period of largely uninterrupted growth that members enjoyed over the subsequent decade.”

Overall, SuperRatings said “funds have performed well against long-term objective targets”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout