Superannuation for housing ‘to hit homebuyers’

Coalition proposals to allow people to withdraw superannuation for a home deposit will worsen the housing affordability crisis, a report by economist Saul Eslake says.

Proposals to allow people to withdraw superannuation for a home deposit will worsen the housing affordability crisis, a report by economist Saul Eslake says.

It says six decades of housing history suggest the Coalition plans to let people use up to $50,000 of their super for a deposit would lead to “more expensive housing and not more homeowners”.

“The ongoing decline in home ownership among Australians aged between 25 and 55 is leading to increasing inequality in the distribution of wealth across generations,” the report says.

“Allowing prospective homebuyers to access some proportion of their accumulated superannuation savings, as proposed by the Liberal and National parties during the 2022 election and subsequently, will result in residential property prices rising at a faster rate than they would otherwise.”

The independent report, commissioned by the Super Members Council, comes as a separate study by comparison website Mozo.com.au found more than half of Australians think they should be able to access their superannuation early.

Many people dipped into their super in 2020 when the Morrison government allowed up to $20,000 to be withdrawn during the pandemic, resulting in three million people taking out a total of almost $38bn.

The Corinna Economic Advisory report, written by Mr Eslake, says the Coalition’s Super Home Buyer Scheme “would likely hinder home ownership aspirations for younger Australians”.

It examined a similar New Zealand scheme that had been running for 17 years and found that home ownership rates for under-40s there had fallen by more than 5 per cent during its operation.

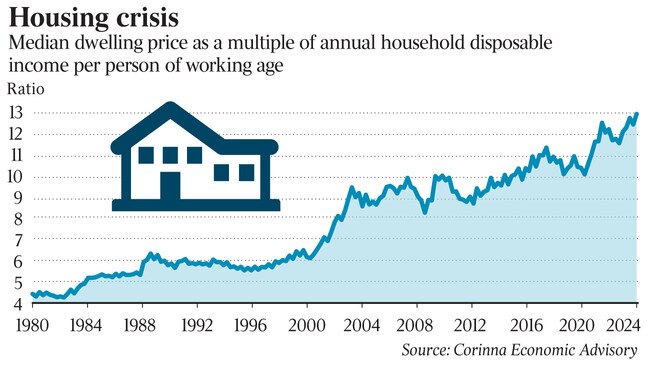

Mr Eslake said 60 years of evidence showed that all schemes enabling people to spend more on housing – including first homeowner grants, mortgage deposit guarantee schemes and shared equity schemes – led to more expensive housing and a smaller proportion of people owning it.

“In some ways, super for housing is just an enormous first homeowners grant,” he said.

“Super for housing will not help, very much, the people who are most disadvantaged by the fact that house prices have been going up faster than incomes for the last 30 or more years, because typically they don’t have much in super to take out. Super for housing is mainly going to help people who would have been able to buy a house anyway.”

The median super balance for people aged 25-24 is $20,300, the report says.

So why do political parties push first-homebuyer policies?

Mr Eslake said while it might sound cynical, all politicians shed “crocodile tears” about aspiring first homeowners’ difficulties, because there were millions more voters who were homeowners and liked rising house prices than there were potential first-home buyers.

And second, “the Coalition hates super”, he said. “They hate super – and there’s some justification for this – because they think that compulsory superannuation gives unions a bigger say in the running of the economy than their declining membership warrants.”

Mozo’s research spanning more than 2100 people found 56 per cent think they should be able to withdraw their super at any time, with housing by far the most popular target of the money.

Mozo spokeswoman Rachel Wastell said there was a broader desire among people to get on the property ladder and clear rising debt, and sentiment towards early super access was growing.

“This debate is particularly pressing when it comes to major expenses, such as buying a house,” she said.

“Many view superannuation as a potential resource for addressing financial stress, but the purpose of super is to provide a much-needed safety net in retirement.”

Under the Coalition’s plan, people would be able to withdraw up to 40 per cent of their super savings, but would later be required to return the withdrawn amount along with a pro rata share of the capital gain.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout