Starbucks still losing money in Australia for billionaire Russell Withers of 7-Eleven

Australians haven’t shown much love for the big American coffee chain, but the financial situation for the local arm is finally improving.

It looks like Australian coffee snobs still don’t have a huge appreciation for one of the biggest sellers of lattes and cappuccinos in the world.

Starbucks is seemingly ubiquitous across North America and is growing rapidly in China, but has found Australia a much tougher market to crack.

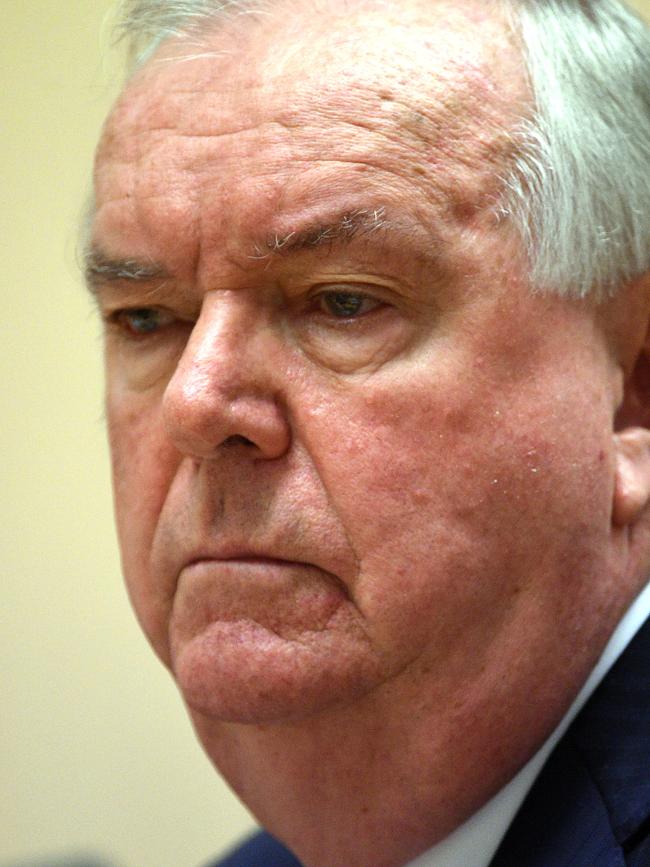

The local arm of Starbucks is owned by Australian billionaire Russell Withers, who has stepped in over recent years to operate the business under a trademark and technology licence agreement with the chain’s US managers.

According to the Starbucks Coffee Australia financial accounts recently lodged with the Australian Securities & Investments Commission, the business made an operating loss of about $7m in 2020.

Revenue rose from $86m in 2019 to about $92m, but the loss widened from $5m, though a $1.95m tax benefit helped the business record a $5.1m statutory net loss for the 2020 financial year.

That result compared with a $3.6m loss in the previous year.

In earnings before interest and tax, depreciation and amortisation terms though, the business was profitable given a large $17m depreciation expense.

Starbucks Australia’s accounts show a $12m depreciation expense for right-of-use assets contributed to the result. On an EBITDA basis, the group made an impressive $13.3m profit.

The result shows that, in financial terms at least, the Starbucks business in Australia has started to finally turn the corner.

The US giant itself entered the Australian market in 2000, but within eight years racked up about $143m in losses and had received about $72m in loans from its US parent, which was needed for the Australian arm to survive financially.

By 2008 there were reportedly 84 Starbucks stores across Australia, but with the business having made a loss of $27.6m the previous year management decided to cut back its exposure to the market drastically by shutting 61 stores and sacking 685 staff.

Withers is also the owner of the 7-Eleven chain of convenience stores, which he and his family introduced to Australia in 1977 with the first outlet in Melbourne’s Oakleigh. It has since overseen its growth into what is now claimed to be the biggest convenience and independent fuel retailer on the country’s eastern seaboard.

He seems to have taken a more cautious approach with Starbucks, even if business is still not profitable on a statutory basis and its balance sheet reveals a net liability of almost $15m and $36m owing to related parties.

The group’s 2020 accounts show the business opened six new stores during the 2020 financial year and closed one, giving it 50 stores in total.

But 7-Eleven is the jewel in the Withers family crown, even if there has been controversy associated with it for several years.

The last accounts for the business lodged with the corporate regulator revealed 7-Eleven’s pre-tax profit for the 2018 financial year surged to $119.6m, compared with $37.4m the previous year. The $3.4bn revenue was up from $2.8bn in 2017 and, after paying $36m in tax, net profit was about $84m, compared with $28m in 2017.

Since then the business has kept growing and growing, though the accounts also revealed 7-Eleven has paid more than $100m under its wages claim and repayment programs, introduced after the company was hit by a scandal in 2015 for systematically underpaying staff.

The company paid out about $15m in 2018 and the scandal saw Mr Withers leave the board, but he maintains his ownership stake.

In the past 12 months, 7-Eleven has opened five new stores in NSW and the ACT and now has more than 700 outlets across Victoria, NSW, the ACT, Queensland and Western Australia.

The group employs about 8800 people, either directly by 7-Eleven or indirectly through franchised stores, and 7-Eleven claims to serve an average of seven customers per second.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout