RBA

What if the RBA were to drop its commitment to holding rates at current low levels?

Every month the Reserve Bank of Australia tells us that it plans to hold rates at current super low levels for the next three years: But the rebound in the local economy is stronger than almost anyone expected. Economists are already concerned over whether central banks have been too quick to splash cash during the crisis: Or, as economists might put it ‘calibrating the withdrawal of stimulus’ in the months ahead could be very difficult.

Next year even a gentle acceleration of the economic activity we witnessed in the final quarter this year would make the RBA’s three year promise even more of a stretch than it is today: Don’t be surprised if our central bank ‘changes the language’ around keeping rates at current levels in 2021.

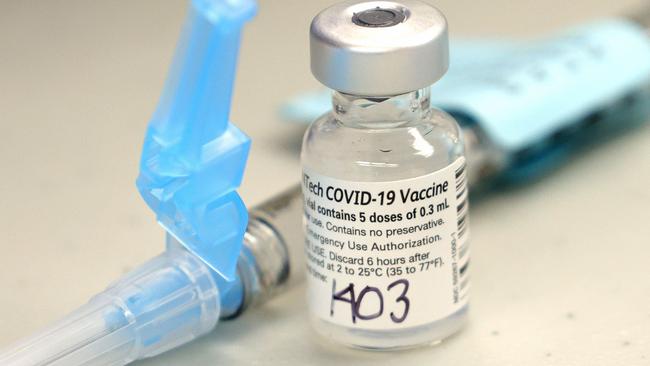

Vaccine makers fail to fix the problem

What if the current crop of Covid vaccines are tested by new strains of the virus - or delivery programs are dogged by fights over who gets a jab first - or significant elements of the population refuse to be vaccinated?

Any failures or disappointments around the expected success of the global Covid vaccination effort will weigh heavily on investor confidence. Success around a global vaccine rollout is already built into asset prices, but we have yet to see if the global vaccine makers can pull off the great public health challenge of our times.

China kicks back on iron ore

The price of iron ore more than doubled in 2020, but China has no choice except to pay the spot price for imports.

Under current conditions, the majority of those imports must be from Australia.

The China Iron and Steel Association is already pressuring Australian miners to improve the situation - China will ultimately find alternatives.

Long term it will be iron ore imports from Africa, short term it might include a drive to optimise scrap metal.

Not that long ago iron ore price contracts were fixed following annual formalised negotiations.

Next year China just might find a way to escape its bind on Australian iron ore.

If it does, the price of our most important export commodity will fall.

Superannuation early release becomes permanent

The success of the government’s superannuation early release scheme has upturned a sacred cow.

Super was never meant to be touched except in cases of extreme hardship. Now a new generation have become accustomed to using super for purposes other than retirement savings.

Next year the government is due to introduce a much debated lift in the Superannuation Guarantee Charge from 9.5 per cent to 10 per cent.

With even more money flowing in the front door to super, there will be pressure to continue allowing money to leave through the back door with proposed schemes such as early release super for housing deposits.

Politically, the government just might see that as a trade-off worth making.

A nasty sharemarket sell-off takes hold

Yes, the conditions are very good for the sharemarket - low rates combined with a rebound in earnings should propel the wider markets across 2021.

But the volatility of 2020 is also expected to extend in the year ahead.

Sharemarkets overheated in the last quarter - witness the Tesla phenomenon on Wall Street or the IPO boom on the ASX.

Forecasts suggest we should see 10 per cent plus returns on share markets by this time next year, but that does not rule out a scary sell-off at any time in the near term.

Inflation shocks

The shock would not be a breakout of inflation but rather the reappearance of it in any convincing manner after two decades of less than 2 per cent annual growth in prices.

Printing money has not (yet) caused inflation but a return to growth and a decline in globalisation could spark a resurgence.

A genuine threat of an inflation rebound will threaten the low rates underpinning of our current economy and reprice all asset classes.

Will 2021 be the year it finally returns?

If we get what many believe will be the best global GDP growth readings in 50 years it has to be possible.

The Also Rans - Six more potential surprises

Gold prices go nowhere over 2021 as the strong returns from sharemarket put investor focus firmly on greed over fear.

House prices sag mid-2021 following the withdrawal of stimulus payments combined with demand weakness created by 700,000 less immigrants coming into the local market between 2021 and the middle of 2023.

The conservative Exchange Traded Fund sector has a sudden burst of competition over who launches the first crypto-based ETF on the ASX.

Self managed super funds get a post-crisis revival in commencements as more investors want to manage their own money - this is exactly what happened in the wake of the GFC.

Physical shopping makes a comeback as the limits of online ordering become obvious spurring interest in beaten-up retail stocks.

A bond bear market kicks into gear. As inflation appears, bond prices drop sharply, blindsiding retail investors stuck in bonds that are not inflation-linked.

If 2020 is any guide, the year ahead should be full of unexpected twists for investors. Here’s what might surprise.