Rally makes Afterpay’s Nick Molnar and Anthony Eisen billionaires

So much has the market surged in the past two months that there were two new entrants to the billionaire ranks this week.

So much has the market surged in the past two months that there were two new entrants to the billionaire ranks this week: Afterpay co-founders Nick Molnar and Anthony Eisen.

At 28, Molnar has quietly become the youngest billionaire in Australia as shares in the “buy now, pay later” company he helped start only six years ago keep hitting record highs.

Investors are piling into Afterpay after a $300m investment by Chinese giant Tencent early this month, but Molnar and Eisen’s company is not the only one to emerge stronger than ever during the COVID-19 pandemic.

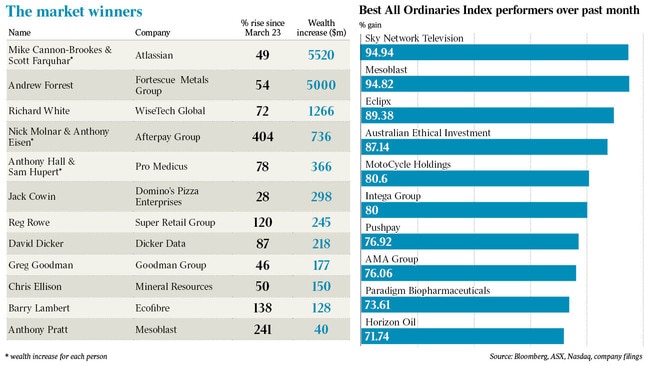

Several companies headed by Australia’s most successful and wealthiest individuals and wealthy families have enjoyed their best ever trading runs since the ASX 200 hit a low on March 23, and others have quickly bounced back in recent weeks and given investors who bought in at the time huge returns in a little more than two months.

Among those is Andrew Forrest’s Fortescue Metals, which has hit a series of record highs and pushed Forrest’s wealth beyond $15bn for the first time.

An analysis by The Weekend Australian has found several stocks headed by members of The List have hit all-time record highs since markets plunged seemingly everywhere in mid-March as the coronavirus swept the world.

Some stocks have benefited from the new economic reality of working from home, with software stocks and food delivery companies performing well. Other usually well-regarded stocks that fell sharply during early to mid March have since bounced back and either regained lost ground or increased even more in value.

The best performer in dollar terms during the pandemic has been software company Atlassian, headed by 40-year-old billionaires Mike Cannon-Brookes and Scott Farquhar.

Atlassian shares hit a fresh record of $US190.21 on the Nasdaq last Friday, giving the pair paper wealth of about $17.5bn each just for the stock holdings.

That figure put them above the $16.95bn wealth recorded by Australia’s wealthiest person Anthony Pratt when The Australian published the 2020 edition of The List – Australia’s Richest 250 on March 21, and Gina Rinehart’s $16.25bn fortune in second position (both of their wealth is held privately, and may have also increased since March).

In percentage terms though, the best performer by far has been Afterpay, headed by Molnar and Eisen. The company’s share price was already rising sharply — trebling from a low of $8.90 on March 23 — before Tencent’s $319m purchase of its stock was revealed at the start of May. An announcement this week that Afterpay has 5 million customers in the US was also well received by the market, and the shares are up more than 400 per cent in two months.

Both Molnar and Eisen’s stake in Afterpay passed the $900m mark midweek and, with other property assets and cash holdings, both are now estimated to be billionaires only six years after Molnar started the company after selling jewellery on eBay.

But the question remains whether the share price surges are a temporary bounce after a big fall earlier in the year and are sustainable in the longer term, or whether they are now fully priced for an optimistic comeback for the global economy and therefore could be headed downwards should financial results later this year and in 2021 prove disappointing.

Morgan Stanley has a $36 12-month price target on Afterpay, which was trading at more than $44 on Friday. In contrast, Bell Potter has a target of $50. At that price, both Molnar and Eisen would have more than $1bn in shares alone.

Atlassian duo Cannon-Brookes and Farquhar have also had a big run, with investors marking up the company, best known for its Jira and Confluence collaboration software products, as it has benefited from the rising demand for tools and programs to work from home during the pandemic.

Atlassian shares were trading between $US180 and $190 during the week, but the consensus 12-month price target among analysts in the US covering the stock is about $US160.

Chris Ellison’s mining services company Mineral Resources has mostly “buy” recommendations from analysts covering the stock, which has approached the record highs it traded at in March and back in late 2017.

Similarly, radiologist software firm Pro Medicus has performed well for founders Anthony Hall and Sam Hupert, while exceeding the 12-month price target of analysts, even though they all have “buy” or “hold” ratings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout