Today’s issue is Josh Frydenberg’s idea to let people take $20,000 from their super fund to help survive during the virus-led downturn, which not only robs the person of $79,000 in retirement savings it also has a potentially huge impact on super funds.

The obvious losers being corporate Australia given the industry funds are meant to be the cash cows for industry.

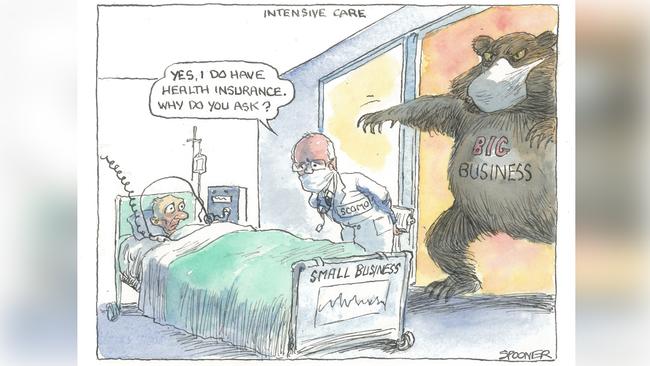

This comes at a time when executives are starting to scratch their heads at the intent of government policy that understandably has so far been directed at helping the people who lose their jobs.

No complaints on that score, but business leaders wonder when some of the support comes their way.

They look at the UK and US, which have directly funded industry, the latter with a $US50bn ($84bn) line of credit for the aviation industry. Delta alone picked up a $US10bn line of credit.

This is money aimed to support the airline to help it maintain staff and recover quickly after the health impacts peak.

The business complaints do forget such benefits as $125bon in cheap funding available via the RBA and federal government and other support benefits for the banking industry.

Directors have been spared the impact of the insolvency laws, which declare trading when insolvent illegal and both APRA and ASIC have ditched other reform measures to focus their efforts on the impact of the virus. They have both pledged flexibility in the right circumstances.

ASX boss Dominic Stevens will play a slightly different tune by underlining some of the key disclosure rules and the importance of shareholder protection in other areas like promoter-based fundraising to help bail out smaller companies.

The government is backing its coronavirus loan package with 50 per cent guarantees that rightly splits the burden so the professionals, the big banks, can determine who best to fund with the new loans.

More big job losses are coming down the line, with Virgin boss Paul Scurrah due to unveil his response shortly to the government-imposed closing of domestic air travel.

Industry funds have thrived in a world in which the likes of AustralianSuper collects a net $1bn-plus a month from the mandated guarantee and withdrawals are easily managed, but if all its 2.2 million members wanted the cash today, that money has to come from somewhere.

Just to provide some context, if everyone of those members grabbed their $20,000, that would cost AustralianSuper boss Ian Silk $42bn, or 25 per cent of funds under management.

For starters, most people would be told that now is not a great time to raid the super fund, so they wouldn’t, but some, of course, have no other options.

Those with a home loan can raise cash by just paying the minimum mortgage required rather than doing what they have been and paying down their principal quicker.

CBA’s Matt Comyn said if every one of his mortgage customers did that, there would be an extra $3.6bn in cash available.

This works out at $400 a month for its 730,000 mortgage customers, or $5000 a year.

Silk’s fund can probably cope with the withdrawals he gets, but it’s the behemoth in the industry and a host of smaller funds might struggle.

More to the point, in theory industry funds are meant to be the cash cows to keep corporate Australia afloat or to refloat post-virus, but if they have paid out all the cash to members their pie is reduced.

This comes as the impact of the crisis was made clear on Tuesday when AustralianSuper for the first time in its 14-year existence made an unscheduled revaluation of its roughly $40bn unlisted assets, cutting the valuation by 7.5 per cent, or 2.2 per cent for a balanced fund. The fund now has about $170bn in assets under management, down 8 per cent in the last month and 9.5 per cent in the financial year to date.

So far this year, the ASX 200 index has fallen 35 per cent.

AustralianSuper has about 53 per cent in equities, 23 per cent in unlisted assets and the rest in fixed income and cash.

The revaluation of unlisted funds like its ports, roads and airports, normally happens each quarter and is generally increased, but the downgrade follows that of other funds such as UniSuper and Hesta.

The hit to super from the government intervention affects the financial system of the country at a time when the Treasurer is doing everything he can to keep it going.

The arguments are admittedly a little self-serving in favour of the super funds, but the point remains that the government policy has severe ramifications elsewhere.

This is magnified by the fact that the government has mandated the tax office to serve the respective funds with a demand for money if they receive a request for assets without much by way of proof of their financial position.

Bare essentials

JB Hi-Fi’s Richard Murray would probably argue that as 60 per cent of his Good Guys store sales are to replace broken goods, and JB Hi-Fi is tooling Australia for the shift to home working, his retailers are essential.

Wesfarmers’ Rob Scott would argue Bunnings supplies the building and construction industry, Officeworks the home office and Target winter clothes for the family, all of which make them essential. As the lockdown increases, the definition of an essential retailer will take on real value for those lucky enough to be declared as such.

The industry is working overtime to establish its credentials, looking at little things like increasing the threshold on when a PIN number is required for card transactions to minimise contact, limiting people in the store to allow for social distancing, more click-and-collect options at the local market and increasing online sales.

The ACCC did its bit by allowing the big supermarkets more freedom to co-ordinate logistics to attempt to meet demand.

This may include arranging who will supply what supermarket chain and dividing service into geographic markets.

This week the ACCC will also probably also clear Coles’s takeover of Jewel Fine Foods, which together with Woolworths’ 23 per cent of industry leader B&J Kitchens means the supermarket giants will control the $600m prepared meals industry. Coles is buying Jewell from administration after the company overextended last year with a $70m expansion, but given the lockdowns now is a perfect time for the supermarkets to own the meal suppliers.

When your industry was created by government policy, the risk is you are subject to the whims of politicians, a fact that the superannuation industry lives with.