The move by the $30bn Equip Super, which covers employees from engineering, manufacturing, healthcare and teaching, shows how big funds with international exposure are becoming increasingly concerned about risks building in the global economy, which it expects will soon be felt here.

In particular, Equip’s chief investment officer Andrew Howard has declared the end of the near-decade-long run in the bull market, with interest rates still having a long way to go to contain inflation.

“We believe it’s not a matter of if there will be a recession, but when,” Howard says.

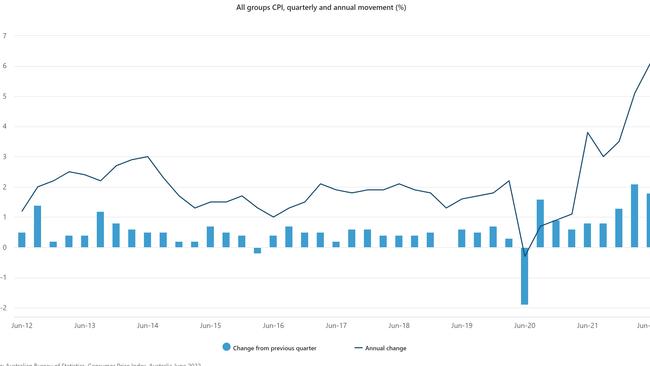

The Reserve Bank is expected to push through another 50 basis point interest rate rise when its board meets on Tuesday. This will take the cash rate to 2.85 per cent, the highest level in nine years, with more rises expected to follow. In recent weeks RBA governor Philip Lowe has taken a tougher view on stamping out inflation, which will see more rate increases through into the new financial year.

At the same time, global markets have taken a bearish bent, with the US Federal Reserve declaring its battle against inflation ‘‘unconditional’’ as it pushes interest rates there to the highest level in 15 years.

With Australia’s quarterly inflation expected to hit 8 per cent and money markets tipping a cash rate to peak above 4 per cent over the next year, Howard says it is “difficult to envisage how (Australia’s) economic outlook remains in the positive’’ with these projections. “While we might be more insulated here, we’re not completely immune from what’s going on in the rest of the world, particularly on energy and supply side issues,” he said in an interview.

Tough quarter

His comments come on the back of another tough quarter for global sharemarkets. Australian equities fell 1 per cent in the three months to end-September and were off 5.2 per cent on the month. US shares were down 9.3 per cent in September and global shares 8.5 per cent.

In recent weeks global bond yields have been surging, with the British currency crisis adding to pressure for fixed income markets.

“Even after five interest rate rises over the last five months by the RBA, sitting at 2.35 per cent today, our view is that we’ve got a lot higher to go from here in terms of where interest rates will arguably go, or where the RBA feels that interest rates need to get to, in order to bring inflation under control,” Howard says.

In recent months the super fund has added three senior fund managers to its team, with the three sharing five decades of experience. Key to this is a new role which sees former Australia Post Super Scheme head of investments Alister Wong take on the role of defensive assets and alternatives. Manish Utreja from Insignia will oversee real assets including renewables, commodities and property. Equip is pushing deeper into green investing, with the former BT Funds’ head of ESG to roll out a similar strategy at the super fund.

Equip is one of the nation’s oldest industry-investing style super funds, emerging out of several former Victorian state-owned utilities, including the State Electricity Commission more than 90 years ago and later the state’s Gas and Fuel Corporation. More recently it has built a membership base across mining and manufacturing. Through its merger three years ago with Catholic Super, it also counts thousands of teachers and healthcare workers as members. The fund currently has a goal to double its membership base to 300,000 and lift assets under management to $50bn within the next three years.

Given its power industry heritage, Howard says the fund strongly supports the move to net zero emissions through backing renewable energy strategies. However, he says large funds need to be mindful of how Australia makes the energy transition: by engaging with companies rather than outright divestment of high carbon emitting companies.

Howard has previously held top investment roles at industry fund Hostplus and VicSuper.

He says Equip has been adjusting its settings for several months, rather than reacting to current conditions on global markets.

The appointments complement his current team, and he points out that it’s important to have experience in a rising rate environment. The last time rates started increasing in Australia was in late 2009, he notes, and many new super fund members haven’t experienced negative returns.

As global markets slid last during the financial year, Equip’s flagship balanced growth fund returned minus 3.71 per cent for the year to end June, following 16.6 per cent a year earlier. Over 10 years Equip has delivered 8.4 per cent in annualised returns.

“What we’re experiencing at the moment is effectively a bear market after a very prolonged bull market,” Howard says.

“It’s been a great ride. So we need experience in not only managing in strong markets, but also the expertise to be able to manage through very volatile markets”.

China worries

During the most recent synchronised downturn – the Global Financial Crisis – Australia was insulated because of its exposure to a fast-growing Chinese economy.

This time Europe and the US are each facing the real risk of falling into a recession, just as China is slowing sharply.

China’s hardline policy of zero Covid cases is shutting down pockets of its economy and cutting off global supply chains.

Russia’s move to double down on its war with Ukraine will only add pressure to the global economy, although most of the impact will be felt in Europe.

“You can build a pretty strong argument to say that those supply side issues are going to continue for some time, which probably leads us to a situation where central banks feel like they have to overshoot in terms of tightening,” Howard says.

At a recent Bloomberg forum, Reserve Bank deputy governor Michele Bullock said the outlook for the global economy was “looking quite uncertain and quite worrying”. And that has implications for Australia because of the potential to flow through on commodity prices.

The troubled property market in China, which represents as much as a third of that economy, was a key vulnerability, particularly when it came to demand for iron ore, she said.

In terms of strategy, Equip’s Howard says diversification is the key for all investors. But through the current cycle this includes increasing exposure to infrastructure assets, including ports and airports, which have in-built protection against inflation.

The fund is currently looking at several offshore renewable energy investments.

And for equities there is a move to a more “defensive” position, including a focus on companies with low levels of debt, high levels of cash and those that have pricing power. Howard is also making sure the fund has ample levels of liquidity – or cash – so it can move when valuations come into the frame. However, he expects choppy markets to continue for now.

“The key message there is that being a long-term investor, you can afford to be patient. So we’re certainly not chasing the market at the moment – as much as valuations might look pretty attractive right now.”

“We could see this volatility continuing for quite some time until the market has conviction in terms of just what the actions by central banks are going to be and for how long interest rate rises need to increase and be maintained at increased levels,” Howard says.

johnstone@theaustralian.com.au

One of the nation’s oldest industry super funds is making some major changes behind the scenes to protect investments as it prepares for the real prospect of Australia slipping into a recession.