Asked about the film industry’s notorious record in trying to second guess what might flop or succeed in the future, Goldman famously quipped “nobody knows anything”.

Sometimes you might say the same thing about investment markets. Who would have thought share prices and house prices would be rising by December?

IN BUSINESS: PICTURES FROM 2020

When Afterpay was $8 in March who said it would be $116 by Christmas? It’s a similar story at Tesla, which was the most shorted stock in the US at one point. Not to mention Bitcoin, considered by many to be a flash in the pan, but then it just hit a new record high.

Alternatively, you might challenge Goldman’s denunciation and suggest investors actually do know one thing: so-called “black swan” events will appear each year up-ending even the most modest attempts to see into the future.

Still, we long for a glimpse of what might be coming down the line.

Here’s a random list. It’s not a forecast, just a sample menu of what I’m watching out for in the year ahead.

1. A better sharemarket

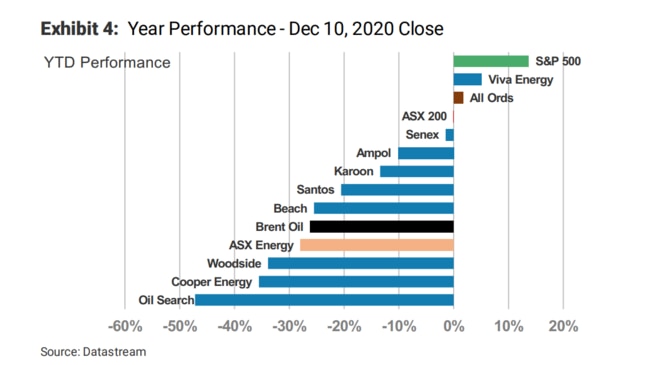

With a flat year in terms of final returns in 2020, history suggests we could reasonably expect a strong rebound on the ASX in 2021. Forecasts of 10 per cent more are common.

Can we really expect a strong sharemarket next year with the vaccine challenge, China trade tensions et al? The short answer is yes, because three things push shares higher: low rates, confidence and stronger earnings. We’ve witnessed the first two, the third is yet to come.

2. Inflation Protection

Can central banks really print money for years without triggering inflation? Can we take the Reserve Bank of Australia seriously when it says rates will stay this low for three years? Ever so slowly the world’s most influential economists are starting to talk about the return of inflation. It’s a long time since anyone had to hunt for inflation-linked investments. A new generation of investors like to think the solution might just be Bitcoin, but for the majority of investors the answer will always be gold.

3. Recovering residential property

For most investors, property investing is local and share investing is global. And that means the effective long term control of Covid in Australia through vaccines is actually the single most important issue in residential property. With the end of lockdowns, property prices had a convincing recovery in every city on a short-term basis, prices were often stronger again in regional centres.

For investors the issue in residential property is rental income, which remains very weak and is even going backwards in some pockets of the market. In 2021 fortune should favour the brave in residential property, especially those who can buy without having to get a mortgage.

4. New opportunities in super

Every year brings changes in super, and from July 1, 2021 several of the planned changes might actually be useful. Thanks to indexation (adjusting for inflation) the maximum amount you can contribute per annum pre tax (concessional) should go from $25,000 to $27,500 and the maximum amount you can put in post tax (non concessional) should rise from $100,000 to $110,000.

Separately, the total amount that can be transferred on retirement to super underpinning a tax-free retirement is currently $1.6m per individual. That number is set to rise to $1.7m for those who “start their first retirement phase income stream on or after indexation”.

It also seems likely that the Superannuation Guarantee Charge - the amount of your salary that goes into super on a mandatory basis - will rise from 9.5 per cent to 10 per cent, so keep that in mind when doing any calculations for voluntary contributions.

5. The true cost of work from home

When we look at post-covid themes, working from home, and its close relation, online shopping, will surely emerge as an enduring legacy. We already know this has meant a boom for online commerce players such as Kogan. What we have yet to see is the price online success extracts from traditional commerce. Some CBD office vacancy rates are already near 10 per cent. For investors it’s a glum outlook for property companies with any exposure to CBD office towers or run of the mill suburban shopping centres.

6. Feasible alternative energy

Coal and oil are fading as investment options. The road ahead is all about new forms of energy, including uranium-fuelled nuclear power and hydrogen.

This year with rising demand and tightening supply uranium prices have finally moved on from the 2011 Fukushima disaster - they are up nearly 30 per cent and stocks such as Paladin are up 200 per cent even outpacing the knock out returns from iron ore leaders like Fortescue (which is up 100 per cent over 52 weeks).

No surprise then that Fortescue founder Andrew Forrest is at the forefront of pushing hydrogen, another energy source which has been something of an unfulfilled promise for years. A new variation - green hydrogen - may go a long way toward satisfying environmental concerns in some regions.

7. A bounce for banks

The “big four” are back on the gravy train after the regulator dropped all dividend payout restraints earlier this month. Meanwhile the promise of fresh competition from digital-only competitors has received a serious setback with the shutdown of neobank Xinja.

Top brokers believe the major banks should be offering a 5 per cent yield again by mid-2021. As for bank share prices, they are already improving and in the case of the laggards such as NAB and Westpac they still could have a long way to go.

8. Charging up electric cars

The price of electric cars is coming down, while the value of electric car stocks is going up. The most commonly held overseas stock by Australians this year was Tesla and did they get rewarded or what? The stock is up more than 600 per cent since January.

As celebrity car enthusiast Jay Leno says: “I don’t know any Tesla person who’s gone back to petrol car”.

For Australian investors the local play is battery metals, especially lithium.

We have a very lively small cap lithium sector with Galaxy Minerals, Orocobre, Pilbara Minerals and the action in this sector is really only at the beginning.

9. Vertigo for buy now, pay later valuations

If Tesla is the phenomenon of global markets, Afterpay is the phenomenon of our market. It coasted above $100 and is now in the ASX top 20, edging out insurance giant ING. The superlatives keep coming for what is essentially a fresh idea in consumer finance. It’s a great business story, but an outlandishly priced stock. Investing at these levels when it has gained nearly 300 per cent over the year is playing a game of pass the parcel.

10. Re-entering emerging markets

If you take on board the theory that the less developed markets will next year get the upswing that Wall Street got this year, that makes a very strong case for EM investments. Better still, if the US dollar continues to decline then these markets will have strong tailwinds. The way into this space for most investors is exchange traded funds or specialist managed funds.

As the year ends with your investments most likely a little ahead of where they were at the start of 2020, I’m reminded of the quote from Hollywood screenwriter William Goldman on the ability of forecasters.