Is your super fund a dud?

If your superannuation fund is persistently failing to match the performance of its peers, it’s time to get out.

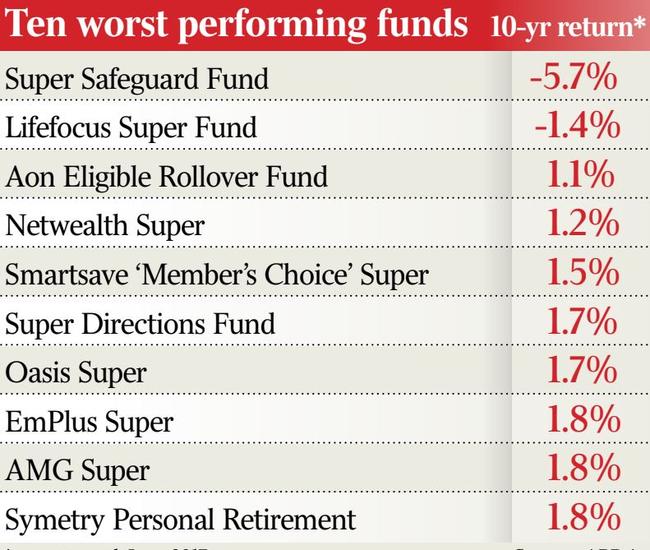

In one of the more alarming observation in the report, the Commission suggests that up to one in four funds ‘persistently underperform’. The crucial term here is ‘persistently’ … different funds with different management styles may have varying performance quarter to quarter but ultimately show little variation over the long run. However, if a fund fails to match its peers for years on end, it is time to get out.

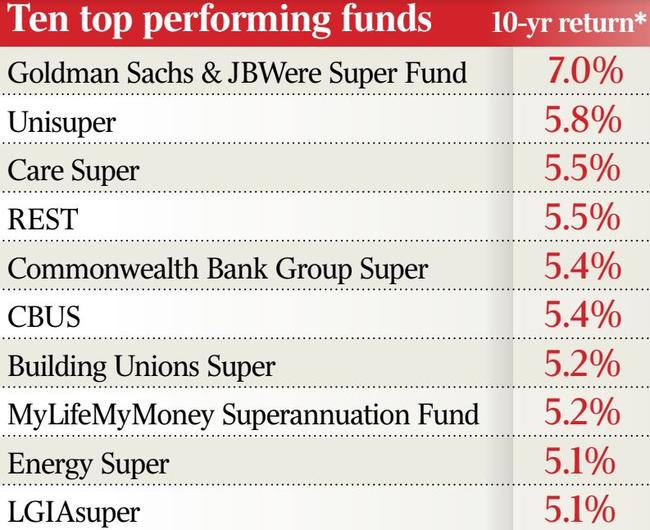

The key performance number is 5.6 per cent per year — this is the average annual return from larger funds used by the Commission. If your fund has consistently failed to reach this figure you are losing out.

The Commission estimates that over an average member’s working life being stuck in a poor-performing default fund can leave them with almost 40 per cent less to spend in retirement. In a case study put forward in the report for a 55-year old today, the difference could be

up to $600,000 by the time they retire. With even the Commission itself consistently criticising the poor quality and transparency of data on superannuation, comparing performance is not easy.

One of the few windows into the area are the statistical reports from the regulator Australian Prudential Regulation Authority. If you look at the most recent APRA numbers, in the year to June last year among the worst performing funds — with a one-year return of less than 1 per cent — were the State Bank Supersafe Approved Deposit fund, the Stateplus fixed-term pension plan, the CommInsure Corporate Insurance Superannuation Trust, The Super Safeguard fund, The Future Super fund, and the Crown Employees (NSW Fire Brigades Firefighting Staff Death and Disability) fund.

At the other end of the spectrum, the top performing funds included Hostplus, CBUS and AustraliaSuper which were all in the top five in a very good year (the 12 months to June 30 2017) when the average fund brought in 9 per cent.

Financial advisers suggest although there is considerable paperwork in switching super funds, it can be worth the effort.

Doug Turek of Professional Wealth Ltd suggests: “There does seem to be some consistently poor performers, if you are sure that they have let you down over a long period of time … there are better options.”

For those with SMSF funds. the Commission has made the provocative assessment that those with over $1m in assets have generally performed as well as larger funds, but those below the $1m mark can struggle.

Worse still, very small SMSFs are virtually written off by the report.

So how small is too small?

The answer is an SMSF under $100,000 and most certainly under $50,000.

However, John Maroney, CEO of the SMSF Association, explains that most funds in the sub-$100,000 level are ‘either building up, or winding down, the average SMSF is now comfortably above $1m.”

Is your super fund a dud? It’s the number one question facing every worker in Australia after this week’s benchmark Productivity Commission report into super which showed the losers in the system were either ‘defaulted’ into poorly performing funds or struggling in self-managed funds that were too small.