iFlix an expensive operation for Patrick Grove

iFlix’s Patrick Grove is finding that building a new technology business across an entire continent or two isn’t cheap.

Building the Asian version of Netflix is proving to be an expensive business for Patrick Grove.

The Australian entrepreneur is the co-founder of iFlix, which has attracted big amounts of funding from investors and is growing at a breakneck pace as it constantly opens in new markets around Asia and Africa.

But financial accounts recently lodged with the Australian Securities & Investments Commission shed light on the cost of building a new technology business across an entire continent or two.

The iFlix accounts for the year ending December 31 last year, lodged with ASIC late last week, have Grove’s business recording a paper loss $US159.74m ($232m) in 2018, up from a $US124m loss for the previous year.

While those figures mean iFlix has racked up more than $400m in losses in two years, much of the losses are due to amortisation or impairment of intangible assets related to content rights and provisions for onerous contracts.

The business, which is spending heavily to develop its own series of movies, has at least 700,000 paying subscribers and tens of millions of consumers via their phone or internet contracts.

Net outflows for the year in cash terms were about $US25m.

A note in the accounts says the group, of which Grove’s Catcha Group owns 44 per cent, has raised $US50m from investors during 2019 via convertible notes and a Series C funding and $US15.5m in lieu of content and marketing payments to an Indonesian investor.

The accounts say iFlix has cash reserves of $US12.7m.

“As the group needs to raise money, the directors are looking at fundraising options and strategies,” the accounts say.

The convertible notes have a redemption right if a stockmarket listing has not occurred by July 31 next year.

Grove has reportedly engaged UBS and Macquarie to explore an IPO “at some point in the future”, though he has claimed publicly that a float is just one of the options for the business.

In July, iFlix said it had raised more than $50m in a new funding round led by Fidelity Capital and also including existing investors such as Catcha, Hearst Group and Sky, as well as new shareholders including JTBC from Indonesia and Japan’s Yoshimoto Kogyo.

There have long been rumours the business was headed for a $1bn IPO at some time this year or early to mid-2020.

It has already raised more than $400m from investors over the past four years.

If Grove pushes ahead with a listing, it will be yet another big and successful transaction for the serial entrepreneur who was once an accountant with Arthur Andersen before leaving the firm in 1999 to embark on a corporate career. His biggest success has been iProperty, sold to REA Group in a $751m deal in 2016.

He now moves mostly between Kuala Lumpur and Singapore.

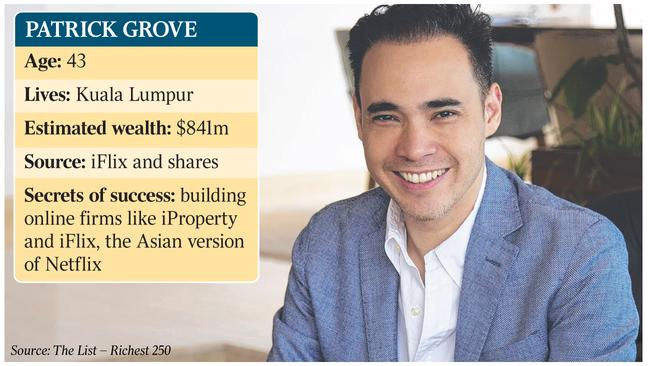

Grove’s wealth was estimated at $841m in The List — Australia’s Richest 250, published by The Australian in late March, much of it from his stake in iFlix, though he does have shareholdings in several ASX-listed companies and owns a house in Sydney’s Darling Point, for which he paid $28m in August 2017.

Shares in iCar Asia, which has online car sale portals in markets such as Malaysia and Thailand, are up about 25 per cent this year.

Groves also has a stake in Frontier Digital Ventures, which has taken shareholdings in a range of online classified companies in emerging markets, from a general classifieds company in Central American countries to property and car search firms in countries such as Angola, Myanmar and Ghana.

Its Pakistani online property portal, Zameen, has become profitable.

Frontier Digital Ventures shares have risen about 42 per cent since January 1.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout