Hamish Douglass of Magellan banks on China coffee addicts

Stock picker Hamish Douglass likes to joke how good a thing it is that coffee is addictive.

Name: Hamish Douglass

Age: 50

Lives: Sydney

Estimated wealth: $617m

Source: Shares in Magellan Financial Group

Secrets of success: Global stock picks like Starbucks and Alphabet

Stock picker Hamish Douglass likes to joke how good a thing it is that coffee is addictive.

Douglass, co-founder and now chairman of Magellan Financial Group, is talking in the context of US coffee giant Starbucks.

The seemingly ubiquitous Starbucks is huge in the US and though it has never really broken into the market in a big way in Australia, Douglass is betting China is going to become a nation of coffee connoisseurs.

Recently appointed Magellan’s chairman, Douglass remains the firm’s chief investment officer and is lead portfolio manager of the fund’s global equities strategies — and he is clearly a coffee fan.

So much so that Starbucks has recently become Magellan’s biggest position, according to data available on Bloomberg.

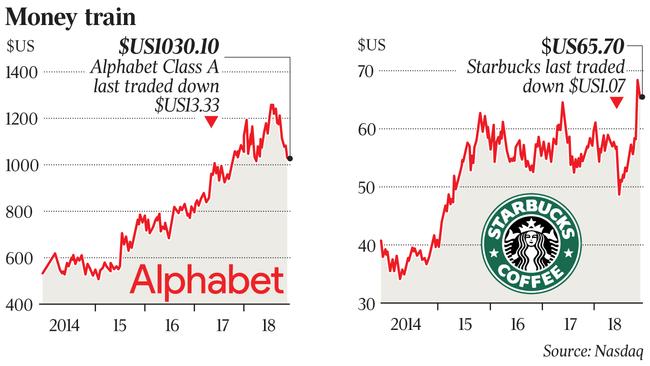

Magellan (MFG) has almost $US2.6 billion ($3.6bn) of Starbucks Corporation stock, which has risen about 16 per cent in value since the beginning of the year to overtake the firm’s second-biggest holding, in Google, which has declined about 3 per cent in the same time but has fallen about 16 per cent in three months.

Magellan has about $US2.1bn in Google stock.

Starbucks shares are up almost 15 per cent in the past month alone, thanks mostly to stronger than expected quarterly sales.

Its China business rebounded due to a delivery deal with online retail giant Alibaba.

Douglass told the Magellan national adviser roadshow last month: “What are we doing investing in what looks like a large, mature take-out coffee business? Where is the tailwind behind the business? It is all about China.

“It is relatively a small business at the moment, about 12 per cent of the business. But it is a massive opportunity.

“We can see the rise of the consumer class there and in China the average coffee consumption per day is one cup.

“The great thing about coffee is it’s addictive. So once you get these people trialling this product, it is something they keep consuming.”

He said Starbucks’ profit results should benefit from its plans to roll out 600 stores a year in China and he thinks the company can grow profits by about 14-17 per cent a year there, “with ridiculous returns on capital”.

He is still a fan of Google, too, and declares it the world’s best advertising company. He says that while market sentiment will drive its share price in the next three to six months, its long-term outlook is also strong.

Douglass himself has wealth estimated at about $617 million, comprised mostly of shares in Magellan, which he co-founded with fellow rich-lister Chris Mackay. Like much of the ASX, Magellan shares have had a rollercoaster ride of sorts this year. They are down about 4 per cent since January 1, still less than the 6.5 per cent fall for the ASX 200 and the All Ordinaries Index.

Douglass is still a believer in US stocks, saying that while it is not necessarily cheap, even with recent falls of the big tech stocks, companies in technology, consumer staples, healthcare and banking around the world are not necessarily better value than their US equivalents.

Magellan holds big stocks like Facebook, Apple, Oracle and Microsoft, but has found good performance in HCA Healthcare, on the New York Stock Exchange.

The US hospital chain is now the sixth biggest in the Magellan portfolio and, although Douglass’s firm sold some HCA stock earlier in the year, it still has a position worth about $US1.72bn, according to Bloomberg, and is the fifth-biggest shareholder (Magellan is also the fifth-biggest shareholder in Starbucks). HCA shares have risen by about 52 per cent since January 1.

Another strong performer in the Magellan portfolio has been Atmos Energy, which is up about 15 per cent this year. Atmos is one of the US’s largest natural gas distributors.

Other US energy stocks Magellan holds have also outperformed the wider market, including Sempra Energy, WEC Energy, Eversource Energy and Xcel Energy, all of which have risen by between 5 per cent and 7 per cent since January 1.

The firm also holds shares in infrastructure companies such as Aeroports de Paris, up about 8 per cent this year, and American Tower Corporation, which owns wireless and broadcast real estate.

ATC shares are up about 12 per cent this year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout