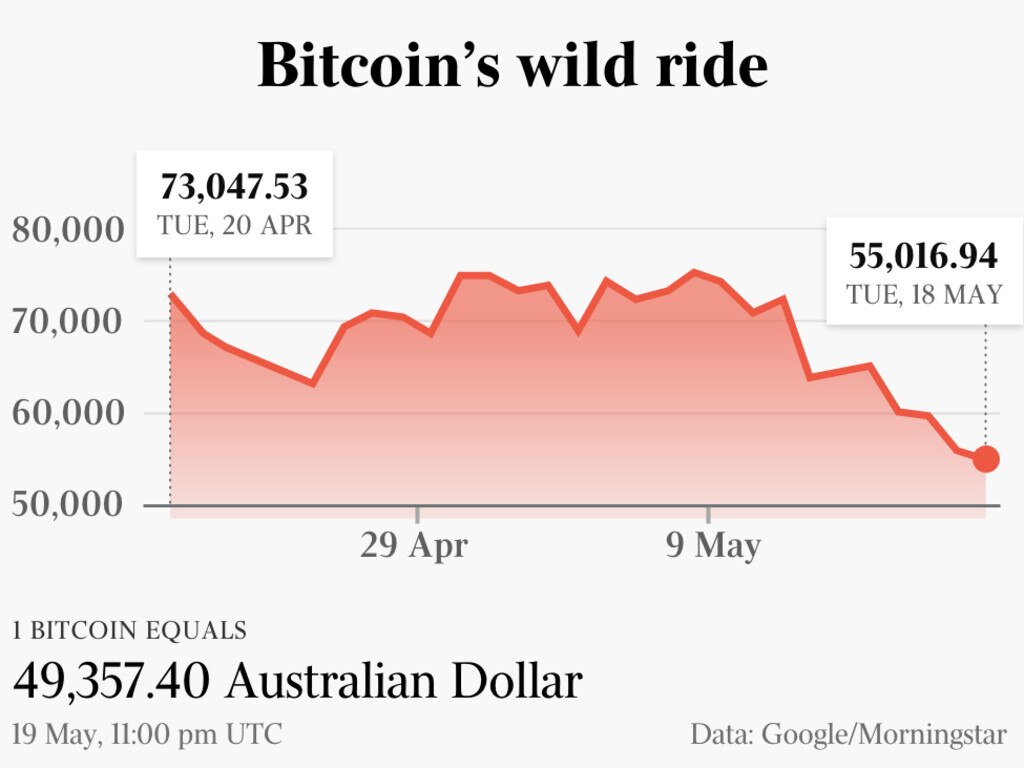

It’s not just the plunge in cryptocurrency valuations, estimated to be a $US1 trillion ($1.3 trillion) wipe-out in the past 12 days – such nosedives are routine in this new asset class.

Rather, it is the yellow metal itself that is leading a fightback as the “store of value” based on two powerful factors.

The first is a traditional defence: gold continues to prove its merit as a defensive asset, as the value of gold broadly rises when the sharemarket turns down. Bitcoin and its peers cannot claim this aspect.

In other words, gold is “non-correlated” to the sharemarket, which means it is a genuinely “alternative” asset.

As the cryptocurrency rout extends, gold prices have been energised by rising inflation fears. Gold bullion is up on just about every time period from one month (5 per cent) to one year (9 per cent) to 10 years (53 per cent).

But it is a fresh factor for gold that is tantalising traders – it’s the potential of new-era gold mining to reframe itself in terms of environmental reputation and, in doing so, to regain ground recently lost to the cryptocurrencies.

It is the enormous energy consumption behind the data mining of bitcoin that ultimately turned Tesla CEO Elon Musk against the cryptocurrency. Musk’s delayed, but dramatic, response to news that crypto data miners were using more energy each year than Argentina accelerated the latest sell-off. (Tesla will no longer accept bitcoin.)

To seasoned gold watchers, the “greening” of the gold industry might sound unlikely.

The sector includes the notorious area of “dirty gold” among unregulated miners, along with the metal’s history of environmental degradation.

But more recently a new breed of gold miners are moving to overcome past issues while stretching to score points with the ESG (environmental, social and governance) regime that now dominates institutional investing teams.

On the ASX, the moment to push for a greener gold is not being lost on local players such as Bellevue Gold, which is pressing its claim as being “among the most environmentally acceptable stocks”. Bellevue managing director Steve Parsons says: “At its simplest, it is about minimising the carbon footprint of a gold mine and if you seek the highest grade gold you keep it small.”

Bellevue – still classified as an explorer – has already managed a market capitalisation of $800 million, though it is yet to produce gold. Among the group’s attractions is a stated plan to “become one of the most profitable green and gold miners in Australia – with low-emission, low-energy-intensity gold”.

In fact, Bellevue (up 24 per cent over the past year) claims that when its West Australian mine comes into production at Christmas next year, it will be the “second-lowest greenhouse emitter” among the locally listed gold miners (on emissions per ounce of gold produced.)

Bellevue’s low emissions score will only be beaten by the Fosterville gold deposit in Victoria owned by Kirkland Lake, the Canadian-based miner that is a key player in green gold.

“We are going to see sustainability become a key criteria for investors in all commodities,” Parsons says. “The big low-grade gold mines could become marginal because increasingly investors are asking the same question: what is your record in this area – what are you doing to mitigate risks?”

Of course, the cryptocurrency set will not stand aside and let the ship sink on ESG issues.

As my colleague Ticky Fullerton reported recently, a group of former Macquarie executives are leading the unlisted Iress Energy group working on a sustainable solution to the bitcoin network. The group recently hired Jason Conroy, former CEO of TransGrid, to lead the operation.

Iris Energy has announced ambitious plans to become one of the world’s leading green bitcoin miners: it currently owns and manages its own sustainable data infrastructure underpinned by Canadian hydropower.

For now though, with the cryptocurrencies struggling on every front, it is the greener gold miners that look like having a more sustainable future.

In the heavyweight bout between gold and bitcoin for the wallets of the inflation-wary – gold has just won the first round.