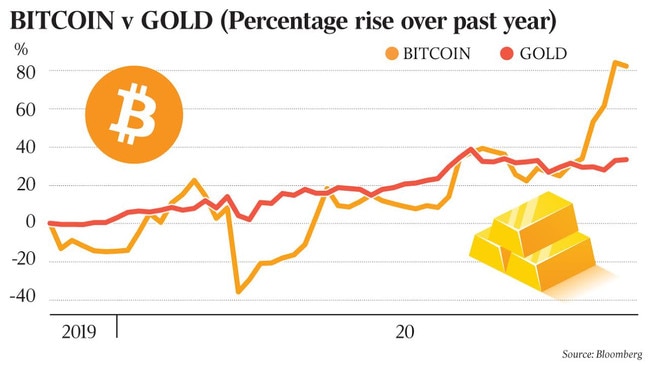

Gold, the traditional safe haven alternative when markets enter periods of exceptional uncertainty is nudging a key milestone of $US2000 - an event that is more than enough to trigger calls the yellow metal could soon breakout and rise to $US3000 or beyond.

But global concerns over stability in US markets has also spiked renewed interest in Bitcoin.

The alternative digital currency has bounced back from a dramatic price decline to lift 30 per cent since the US election was announced.

It is currently trading near $US15,400.

As both Bitcoin and gold garner new interest - gold often favoured among older investors and Bitcoin among Millennials - institutional investors are steadily accepting the leading cryptocurrency.

“Bitcoin is being used as a store of wealth so to call it a digital version of gold is a fair assessment,” says Arian Neiron, the managing director of the Van Eck investment group which offers the local market’s Gold Miners ETF.

Bitcoin’s potentially enlarged role in post-US election investment markets follows a string of key developments in recent months triggered initially by what looked like a change of heart among global banks to the digital currency.

Three years ago, New York investment bank JPMorgan led the charge against Bitcoin when its CEO Jamie Dimon tagged it as a “fraud”, but earlier this year a research note from the investment bank said Bitcoin could double in value.

In recent weeks the institutional acceptance has also accelerated after both PayPal and Square Payments said they would accept Bitcoin on their payment platforms.

Bitcoin’s rebound has come about with improved regulatory scrutiny - which is nowhere near that of gold - but a lot better than when the world last paid attention three years ago. (In Christmas 2017 Bitcoin hit $20,000, it then fell as low as $3000 before climbing back to current levels).

Bitcoin is often on the radar to some of the same investors as gold, but the yellow metal trounces cryptocurrency when it comes to a regulatory safety net. (That’s not to say gold does not have regular controversies and difficulties in recent months there has been quality issues at the Perth mint and a major upset at the Australian Taxation Office relating to the taxing of gold refiners).

Kanish Chugh, head of distribution at ETF Securities - which runs Australia’s oldest gold ETF worth around $2bn - says: “We can’t rule out an Australian ETF based on Bitcoin coming along sooner or later.

Neiron - of Van Eck - agrees. “It’s not a matter of ‘if’ but when,” he suggests.

The rush to gold as an alternative asset is shown in the total value of the ETF Securities GOLD ETF which took 15 years to get to a value of $1bn and then increased to $2bn over the past year.

“Investors are more and more seeing gold as a long-term strategic allocation rather than some tactical hedge in their portfolio,” says Chugh.

On global markets, the value of listed ETFs based on gold and Bitcoin are broadly similar.

But the figures are misleading since the vast bulk of gold is represented by bullion, coins and jewellery.

In total, investment capital terms the value of gold is roughly 10 times that of Bitcoin (approximately $US2.6 trillion in gold versus $US240bn for Bitcoin).

As share markets lift this week off the back of the Joe Biden victory, gold investors may be concerned the conditions are changing, but Van Eck’s Neiron says: “It’s wrong to assume that gold, as a safe haven, should have a negative correlation with the stock market. In fact, gold’s longer-term correlation with the S&P 500 is essentially zero.”

Indeed, if the rush to find alternative assets continues against a background of non-existent income for cash deposits, the rivalry between Bitcoin and gold can only intensify.

But for now at least, institutional investors such as Chugh at ETF Securities are not biting.

“We like gold’s regulatory structure and the acceptance at all levels,” he says, “not to mention its thousands of years of history.”

Extended speculation over the nature of post-US election investment markets has fired up trading in gold while offering a potential second life to its much hyped digital counterpart, Bitcoin.