Donations and tax deductions: how to improve your ATO refund

It’s the busiest time of the year for tax-deductible donations to charities, and here’s how you can enhance your generosity.

Peak period for donations is here, but many generous Australians make mistakes that reduce the impact of their generosity.

As charities run campaigns to attract more cash before June 30, tax specialists say there are ways to get the biggest back for your donation buck – and it often starts with understanding the rules.

Making a donation in the wrong partner’s name can effectively mean delivering only half the potential financial benefit, while some people make donations that are not really donations.

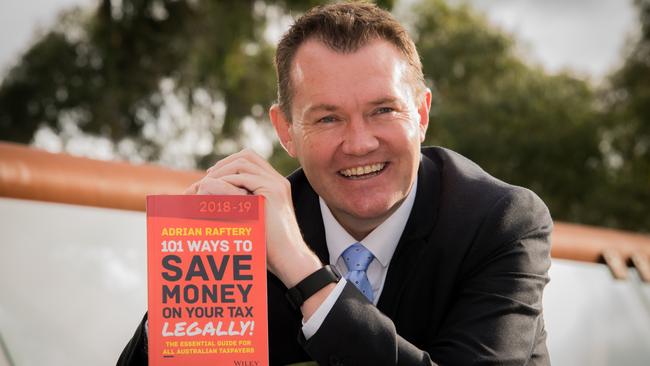

Mr Taxman founder Adrian Raftery says people can use the tax rules to enhance their generosity, with June the busiest time of the year for donations because it delivers donors a quick cashflow turnaround.

“You pay in June and get the benefit in your tax refund in July or August,” he says.

“It’s an easy last-minute tax planning tool. Especially in this day and age with donations being online, you can make a donation on the night of June 30, and before exiting the website there’s a tax-deductible receipt in your inbox.”

Dr Raftery has been involved with the Bears of Hope charity, which supports families who experience the loss of their baby, for 14 years and says “Australians are incredibly generous”.

IS IT DEDUCTIBLE?

But there are areas where generosity may not deliver the biggest possible benefit.

Dr Raftery says donations to GoFundMe pages are generally not deductible, although it depends on how the request for help is set up. The Australian Taxation Office only allows tax deductions for donations to deductible gift recipients.

“A lot of people call themselves charities but are not deductible gift recipients,” Raftery says.

The Australian Charities and Not-for-profits Commission has details about deductible gift recipients, and a register where people can search for their charity to check its tax-deductibility status.

Raftery says some people think they will not claim a deduction because it’s for charity anyway. But, he says, isn’t it better to give more, claim the tax deduction in line with your marginal tax rate, and end up paying the same net amount?

H&R Block director of tax communications Mark Chapman says many people do not understand the tax rules around donations.

“When it come to tax time, we often ask people if they made donations and they say yes, but when we ask if they can prove it, the answer’s no,” he says.

“People don’t realise they can claim a tax deduction, but you have to have the receipt to provide evidence. That’s a major area where taxpayers fall down.”

SPOUSE STRATEGIES

Chapman says most charities will be deductible gift recipients “but there may be occasions where it won’t.”

“You can’t claim donations to an organisation that gives you some sort of personal benefit, for example buying raffle tickets or donating in exchange for chocolates or a pen,” he says.

Donations should be made by the highest-income earner in the family.

“If you are two spouses and one earns $10,000 and the other earns $200,000, it makes far more sense for the person earning $200,000 to make the donation because they get tax relief at 45c in the dollar,” Chapman says.

“The spouse earning $10,000 doesn’t get anything back – that sounds like a no-brainer, but there is not always a great deal of communication between people,” he says.

Guide Dogs SA/NT CEO Aaron Chia says the organisation’s tax time appeal is its largest annual fundraising campaign.

“People make their donations to ensure they receive a tax receipt before the end of the financial year,” he says.

However, donations have declined about 10 per cent in the past 12 months, Chia says.

“This has been particularly noticed in our appeal campaigns, which indicates to us that many people are struggling with cost-of-living pressures,” he says.

ATO’S TAX DEDUCTION RULES

The Australian Taxation Office says a donation must meet the following four conditions for people to be able to claim a deduction:

• It must be to a deductible gift recipient.

• It must truly be a donation where “you are voluntarily transferring money or property without receiving, or expecting to receive, any material benefit or advantage in return”.

• It must be money or property, including financial assets such as shares.

• It must comply with relevant conditions, as some charities have rules around the types of deductible gifts they can receive.

Source: ato.gov.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout