Cooper opens global fund to investors

Peter Cooper says his global fund is suitable for retirees and charities and foundations.

Stock picker Peter Cooper has opened his first fund to external investors for five years, buying global stocks in companies he claims will be relatively less volatile for clients who are retirees, charities and foundations.

The Cooper Investors Global Endowment Fund was opened to investors on July 1 after being run by Cooper’s global funds team with their own capital since the beginning of 2017.

Cooper says the team has achieved an absolute gross return of 16.2 per cent since inception and a 14.3 per cent return in the past 12 months, buying stocks he says should outperform in periods of market weakness.

“This endowment mindset way of investing is one of the biggest investment trends we’ve seen in the market place,” he said.

“Investing in a lower risk portfolio that aims to protect capital yet still experiencing market or above-market returns over the longer term is highly desirable for those investors in pensions phase or for charities and foundations.”

Cooper’s global endowment fund wants to invest in what he calls sustainable businesses with sound governance practices, which excludes companies “whose primary business is the production of tobacco, controversial weapons or gambling”.

The fund’s holdings include the Swiss Exchange-listed maker of cosmetics ingredients Givaudan, which is up 17 per cent since January 1, and IDEX Corporation, a manufacturer of a variety of fluid, metering, health and science technologies which has had a 30 per cent rise in the value of its shares on the New York Stock Exchange so far this year.

Another investment is public utility company American Water Works, which has assets in the US and Canada and is up 26 per cent in 2019 on the NYSE.

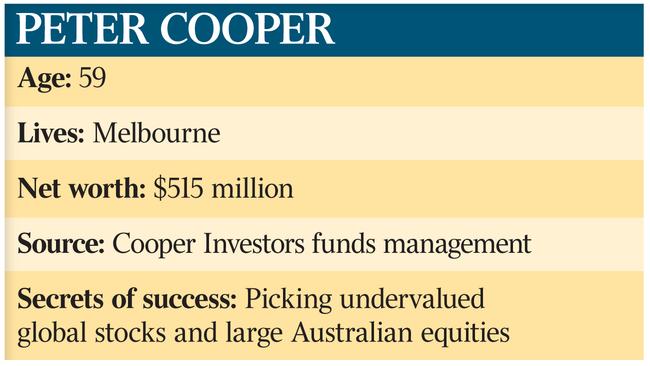

Cooper has about $13.5 billion funds under management at his boutique firm, which has a majority stake in that accounts for the bulk of estimated $515 million fortune as a member of The List — Australia’s Richest 250.

Cooper started Cooper Investors in 2001 after running the Australian equities portfolio for BNP and later Merrill Lynch Investment Managers.

He and his team manage money for a range of clients which include pension and super funds, government agencies, schools, religious institutions and wealthy families.

The business made a net profit of $25m from $75m revenue in 2018 according to documents lodged with the corporate regulator, and paid a $26.2m dividend to Cooper and his staff.

Cooper is best known for his Australian equities fund, which have had a mixed performance in the past 12 months.

The flagship CI Australian Equities Fund returned 7.8 per cent in the 2019 financial year to June 30, which was under the 11.55 per cent of its benchmark S&P ASX 200 Accumulation Index.

In a recent note to clients, Cooper blamed the poor performance of three stocks in the fund’s portfolio — Link Administration Holdings, Boral and Clydesdale Bank — which have since been sold, and the decision not to hold Telstra shares, which increased by 52 per cent in the year.

The fund’s managers are still keen on registry services firm Computershare, which is down almost 4 per cent since January 1, after attending a recent investor day in London due to its ability to add new work for existing registry clients.

Cooper is more cautious on China, however.

“There is little doubt the Chinese economy is going through a managed slow down (and) China looks to be a stable, rather than growing, influence on commodities in the near future,” the client note said, while adding that iron ore prices have been strong other commodities have not increased in value to the same extent.

It is maintaining its holdings in mining companies BHP, which his up 26 per cent this year, and OZ Minerals, which has risen 26 per cent.

One Cooper fund that has performed particularly well is the CI Asian Tiger Fund, which rose 11.97 per cent in the 2019 financial year against its MSCI AC Asia ex Japan benchmark of 4.79 per cent.

Much of the fund’s outperformance was from Hong Kong Stock Exchange-listed stocks. The Asian Tiger fund has even bought the HKSE-owner Hong Kong Exchanges & Clearing, which is up 19 per cent since January 1.

It has got an even better performance from sportswear company Li Ning, which high a 12-month trading high on Monday and has risen 138 per cent this year.